Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 19, 2016

Lithium rush fails to spark investor confidence

Lithium, a key component of electric cars, has sparked its own "gold rush" with firms exposed to the metal seeing their shares surge as the electric car industry ramps up, but the recent rush has also attracted plenty of doubters in the form of short sellers.

- Lithium shares which make up the Global X Lithium ETF have returned 12.8% in 2016

- Short sellers have doubled their positions in global lithium firms which make up the ETF

- Electric car OEMs see the most shorting activity, but mining firms experience the largest jump

Last month's hugely successful Tesla Model 3 launch heralded what many hope will be the start of the mass market electric car movement. While enthusiasm is high, so is scepticism around Tesla's and it peer's ability to deliver a reliable product at a price cheap enough for mass market appeal. One of the deciding factors will be whether the industry will be able to source enough batteries at a price point which doesn't tip the electric car's bill of materials out of the mass market category.

The battery sector has attracted huge investment in recent years with lithium, a key component of the lithium ion batteries in electric cars grabbing the most attention. However this element could prove to be a limiting factor, creating bottle necks in the electric car component supply chain.

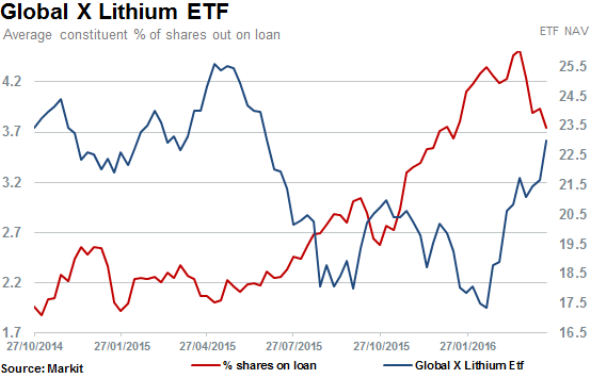

Investors have been eager to take positions on the story in the last few weeks as the lithium related shares which make up the Global X Lithium ETF(LIT), have returned nearly 13% since the start of the year, largely outperforming the rest of the global market.

This strong performance has however attracted short sellers, with a surge in short interest seen in the past year. Average short interest of LIT constituents has increased over 80% in the past 12 months.

While most of the lithium shorts are concentrated towards the two carmakers which make up the ETF's constituents (Tesla and BYD), short interest has been building up the fastest in the eight chemical and mining firms, with average short interest increasing over 160% to reach 3.2%. There has been some covering as of late however but driving the overall increase are two lithium miners below.

In the last three months shares have surged by 35% in Albemarle, a supplier of a number of lithium based products. With short interest at negligible levels 12 months ago, shares outstanding on loan have increased over four fold, rising to 8.2%.

Also seeing a large increase in shorting activity rising over threefold in the past 12 months is FMC Lithium with 7.7% of shares outstanding on loan currently. FMC, reportedly one of the leading suppliers of lithium, has seen its shares slide 34% over the past year.

While short sellers have increased positions in the supply chain of electric vehicles, covering in Tesla short positions has been seen as shares continue to rally at close to 12 month highs.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Equities-Lithium-rush-fails-to-spark-investor-confidence.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Equities-Lithium-rush-fails-to-spark-investor-confidence.html&text=Lithium+rush+fails+to+spark+investor+confidence+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Equities-Lithium-rush-fails-to-spark-investor-confidence.html","enabled":true},{"name":"email","url":"?subject=Lithium rush fails to spark investor confidence | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Equities-Lithium-rush-fails-to-spark-investor-confidence.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Lithium+rush+fails+to+spark+investor+confidence+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Equities-Lithium-rush-fails-to-spark-investor-confidence.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}