Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 20, 2015

Investors flock to Swiss assets

Last week’s surprise currency move to unpeg the Swiss franc from the euro has prompted both domestic and foreign investors to target Swiss assets.

- Swiss exposed funds experienced $705m of ETF inflows following the franc’s unpegging

- Commodity funds led a retreat, though currency hedged funds cushioned the blow

- The franc’s fall could benefit European dividend investors as the stronger Swiss franc will boost payments in pan European indexes

As Russia discovered last year, currency pegs are hard to enforce. In the second week of January, the Swiss National Bank (SNB) dropped its self-imposed peg against the euro; an unexpected move that shocked the market and sent the franc up strongly against the euro, which the SNB had actively been purchasing in order to keep its currency artificially low against its regional peer.

The move had wide ranging ramifications in the country’s asset markets, with the benchmark SMI index falling by nearly 9%, its largest one day fall in a genration, as investors weighed in the prospects of Swiss companies losing their competitive edge to eurozone countries which account for over 45% of Swiss exports. These fears were echoed by Swatch Group ceo Nick Hayek, who equated the move by the SNB to a “tsunami; for the export industry and for tourism, and finally for the entire country”.

These implications saw the value of Swiss ETFs denominated in Swiss francs fall by over CHF 1.1bn on Thursday 15th January owing to a combination of falling asset prices, mainly domestic equities and foreign exchange shifts for assets benchmarked in foreign currencies. Despite the recent sharp fall, investors seem to be returning to Swiss assets, as Swiss ETFs have since seen a rise in inflows.

ETF investors flock to Swiss equities

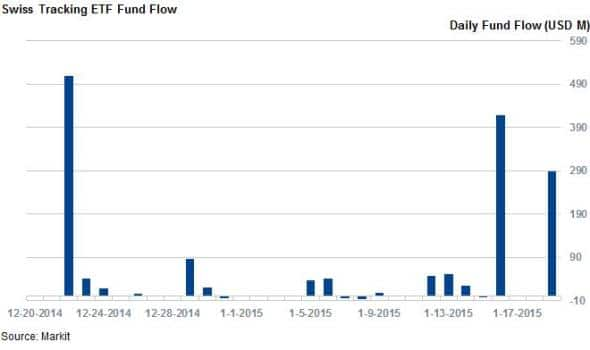

Despite the dramatic fall in Swiss equity values, investors have actively added to their Swiss exposure in the last few days, adding $705m to the 73 Swiss tracking ETFs in the two days following the SNB’s move.

The majority of these inflows were from funds which solely trade on the Swiss exchange, so it is safe to assume that these inflows are from Swiss investors seeing buying opportunities in the recent market dip.

Two SMI funds driving this trend are the iShares SMI and UBS ETF (CH) - SMI® (CHF) A-dis which saw over $190m of inflows on Monday.

The funds which do not have a Swiss listing but track Swiss assets have also seen inflows in the last couple of trading days, suggesting international investors are also keen to increase their Swiss exposure.

This trend is led by the UBS ETF - MSCI Switzerland 20/35 UCITS ETF (CHF) A-acc which trades in Italy and saw over $10m of inflows on Monday 19th January.

Currency hedged funds prove their worth

Interestingly, Swiss investors had been some of the largest purchasers of currency hedged products, especially commodity products. These funds, which manage CHF 4.36bn, proved their worth on Thurdsday as they outperformed their unhedged peers by quite a wide margin.

The largest such funds, the ZKB Gold ETF hedged (CHF) outperformed its larger unhedged peer by over 11% on Thursday 15th, saving its investors around CHF 80m.

Ironically, one such fund popular fund, the iShares MSCI Japan CHF Hedged UCITS ETF, had become popular for investors looking to hedge away yen devaluation in Japan, as opposed to a sharp increase in the value of the Swiss franc.

Boost for dividend investors

The recent dip could also prove beneficial for dividend investors as the currency’s recent appreciation against the euro means that Swiss companies, which are largely expected to stick to their absolute CHF payments, will pay higher dividends in euro terms. Markit’s dividend team expect this forex shift to translate into €5.8bn of additional payments for constituents of the FTSE Eurofirst 300 (The full analysis can be found in this report).

This trend is apparent even among firms whose dividend is expected to be negatively impacted by the Franc recent movements. For example, Richemont’s dividend growth forecast has been trimmed to 7% from 10%, in CHF terms. However, this still translates into a 13% boost in euro terms.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Equities-Investors-flock-to-Swiss-assets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Equities-Investors-flock-to-Swiss-assets.html&text=Investors+flock+to+Swiss+assets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Equities-Investors-flock-to-Swiss-assets.html","enabled":true},{"name":"email","url":"?subject=Investors flock to Swiss assets&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Equities-Investors-flock-to-Swiss-assets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+flock+to+Swiss+assets http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012015-Equities-Investors-flock-to-Swiss-assets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}