Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 20, 2016

ETF investors pile in to treasuries despite Fed noise

Last week saw the probability of a Federal Reserve June interest hike surge ahead, but investors' appetite for treasuries remains steady despite the losses incurred by spiking yields.

- Markit iBoxx $ Treasuries index has seen the largest one day yield spike of the year so far

- Investors targeted treasuries ETFs in the last two weeks, snapping a ten week outflow streak

- Emerging market funds saw their first weekly outflows since February as investors cashed out

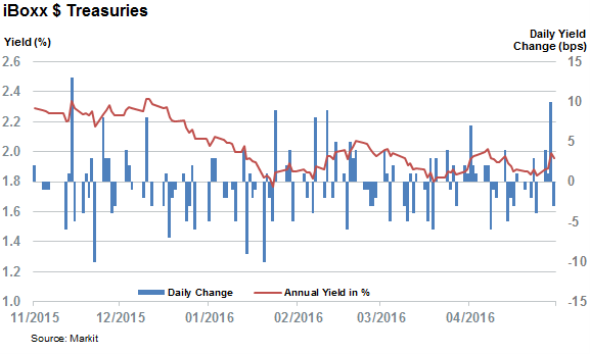

The bond market was rocked by hawkish US Federal Reserve (Fed) minutes and a higher than expected inflation reading this week which sent yields in US treasuries up sharply. The Markit iBoxx $ Treasuries index which tracks the asset class saw its yield jump by 10bps on Wednesday in the largest jump since December 3rd of last year, a move that preceded the first Fed rate hike since the financial crisis.

Despite the fact that investors are now pricing in a 30% chance that the Fed will hike interest rates in its June meeting, treasuries yields are still down sharply for the year so far - which goes to show that investors are still to be fully convinced about the Fed's newly found hawkish stance.

ETF investors still like treasuries

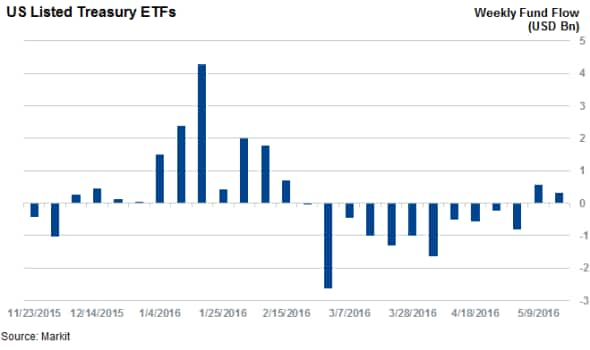

This scepticism has been evidenced as US ETF investors have taken advantage of the recent spike in yields to buy into US treasuries. Treasury ETFs, which saw their first inflows since mid-February last week, have continued to see inflows this week with over $330m flowing into the 52 US treasuries ETFs in the Markit ETP database.

Emerging markets fall out of favour

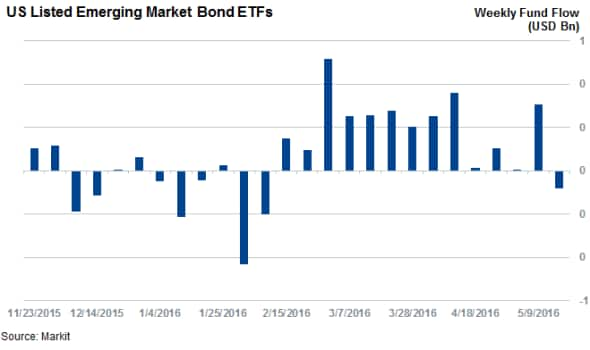

Emerging market sovereign bonds, which stand to lose out from a hawkish Fed, also proved relatively immune to this week's event as the extra yield required by investors to hold dollar denominated emerging market sovereign bonds, as tracked by the Markit iBoxx USD Emerging Markets Sovereign benchmark spread, was flat on the week.

Unlike in the treasuries market however, ETF investors have not shown the same willingness to stick to emerging market debt exposure. In fact the 15 US listed emerging market debt ETFs are on track for their first weekly outflow in over three months after investors withdrew $146m of assets from these funds on Thursday as the market reacted to this weeks' movements.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-Credit-ETF-investors-pile-in-to-treasuries-despite-Fed-noise.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-Credit-ETF-investors-pile-in-to-treasuries-despite-Fed-noise.html&text=ETF+investors+pile+in+to+treasuries+despite+Fed+noise","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-Credit-ETF-investors-pile-in-to-treasuries-despite-Fed-noise.html","enabled":true},{"name":"email","url":"?subject=ETF investors pile in to treasuries despite Fed noise&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-Credit-ETF-investors-pile-in-to-treasuries-despite-Fed-noise.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETF+investors+pile+in+to+treasuries+despite+Fed+noise http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-Credit-ETF-investors-pile-in-to-treasuries-despite-Fed-noise.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}