Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 20, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

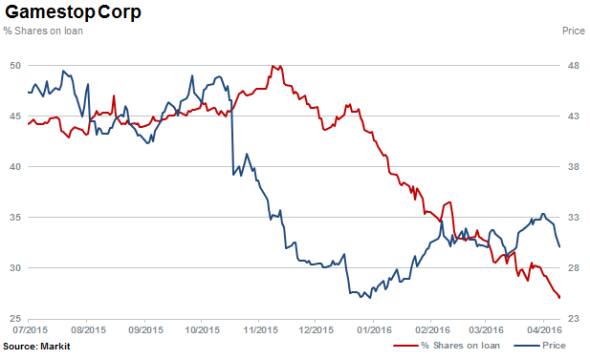

- Short sellers continue to cover positions in Gamestop as shares find some support in 2016

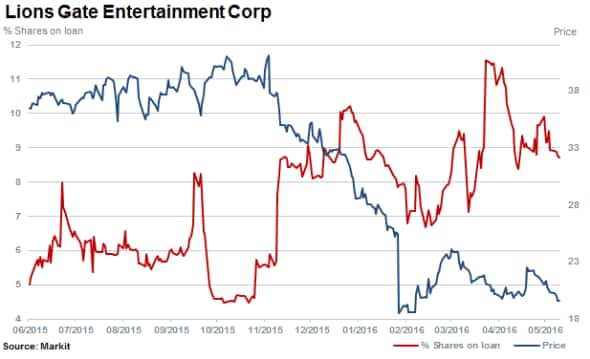

- Hunger Games disappointment at the box office sees shorts add to Lions Gate positions

- Australian Agriculture, the country's oldest company attracts short sellers ahead of earnings

North America

About to report its first quarter results and no stranger to being the most shorted ahead of earnings in North America is Gamestop. Shares in the video game retailer, previously the most shorted constituent of the S&P500 (now cut from index) shares have found support in 2016 and rallied 13% since January lows. This come as the company continues to diversify away from declining physical video game sales. The recent rise however, is after shares have plummeted 46% since the beginning of November 2015.

Gamestop still has significant short interest (shares currently outstanding on loan) having rallied 13% since January lows at 27%. Currently however, short sellers have covered 40% of overall positions.

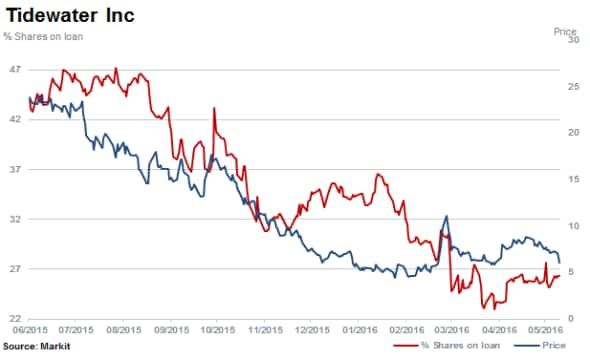

Second most shorted is Tidewater with short interest of 26% currently. The company provides large service vessels to the offshore oil industry and has seen its shares dive by almost 80% in the last 12 months with short sellers taking profits and covering a third of positions.

Unfazed by a recent 15% spike in share price over the last three months, short sellers have increased positions in discount American retailer Big Lots with short interest rising by a fifth to 17.4%.

Lastly, despite shares plummeting over 50% since November 2015 after reporting disappointing takings from the final instalment to the Hunger Games franchise, short sellers have continued to target Lions Gate Entertainment.

Short sellers have increased positions in the firm with short interest rising to 8.2% marking a four year high. Rating agencies S&P has meanwhile upgraded their outlook for the company to 'Positive' based on stable revenue and cash generation emanating from increased production of content destined for the streaming television business.

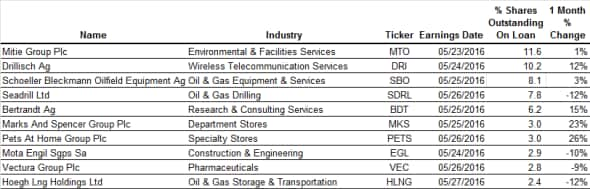

Europe

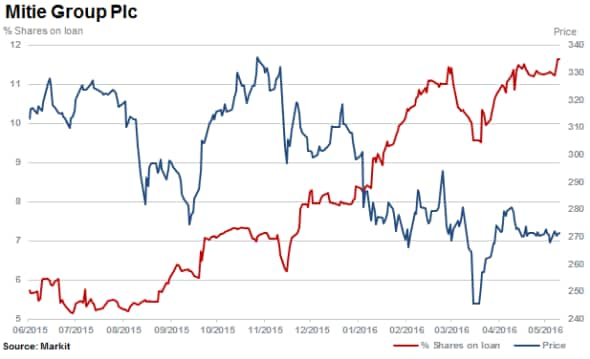

Most shorted ahead of earnings in Europe this week is outsourcing group Mitie with 11.6% of shares outstanding on loan. After taking profits as shares fell sharply in April, short sellers have now increased positions by 22%, following an 11% rally in shares with short interest reaching 11.6%.

Second most shorted in Europe is Germany's largest wireless and virtual network operator Drillish. The company currently has 10.2% of shares outstanding on loan.

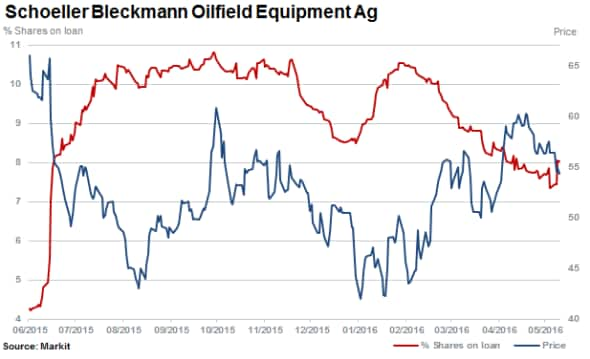

The third most shorted stock ahead of earnings this week in Europe is Schoeller Bleckman Oilfield Equipment. The company provides high-precision components for directional drilling and short sellers have covered just over a fifth of positions in the last three months, while shares have rallied by 18%.

Apac

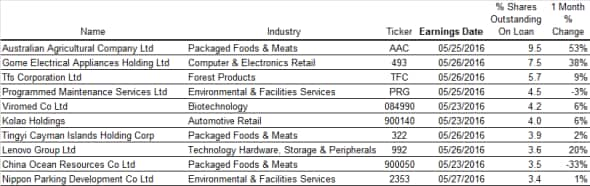

Most shorted ahead of earnings in Apac is Australian Agricultural (AA) with 9.5% of shares outstanding on loan. The company provides beef and agricultural products globally and is the oldest continually operating company in Australia.

Short interest in AA has spiked higher, up over six fold in the past 12 months, while volatile shares have remained fairly stagnant.

Short interest in Gome Electrical Appliances has more than doubled since the beginning of April, reaching 7.5% currently. Shares in the Asian based appliance retailer have slid by almost 60% over the past 12 months.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20052016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}