Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 20, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to the companies due to announce earnings in the week to come.

- Homebuilders Lennar and Kb Home see high short interest

- In Europe, Imagination Technologies sees the highest short interest in the lead up to earnings

- Retailers make up three of the four Asian firms seeing significant short interest in the run up to earnings

North American earnings

This week sees first quarter earnings announcements tail off in the lead up to the second quarter earnings season. On the short interest side, there are only 21 companies with 3% or more of their shares out on loan ahead of earnings.

Irrigation company Lindsay comes in as the most shorted company ahead of earnings this week after having seen the number of shares out on loan climb by a quarter in the last four weeks. The current demand to borrow represents 26% of its shares outstanding, and is just 10% off the all-time high demand to borrow seen at the tail end of last year. As to what is driving this demand to borrow, we’ve seen analysts trim their forecasts in the months leading up to results after the firm missed its revenue and profits expectations last earnings round. The high demand to borrow could indicate further bearishness on the company’s weakened earnings expectations.

While Lindsay did see a significant jump in short interest in the run-up to earnings, the honours of the largest jump in short interest goes to RV manufacturer Winnebago Industries which has seen demand to borrow jump by 62% in the month leading up to earnings. While Winnebago has generally has a good results track record of late, short seller have been looking at the recent surging gas prices which may be crimping demand for the large gas guzzlers produced by the company.

On a sector basis, we see two homebuilders feature on this week’s list of heavily shorted firms. Both KB Home and Lennar have seen their price fall in recent months as the weather, surging prices and rising mortgage rates dole out a damper on US house sales.

European earnings

Europe also sees low earnings activity with just three firms seeing over 3% of shares out on loan ahead of imminent results.

UK semiconductor company Imagination Technologies is the most shorted company out of this week’s crop of earnings with 9.4% of its shares out on loan. The firm which develops and licences consumer electronic IP saw its shares take a battering over the last 18 months as the demand for cell phone and other bits of consumer tech market cooled globally. Short sellers have been keen to play the price fall, but have covered in recent months as Imagination shares rallied from their lows.

Also seeing recent low short interest is Carpetright which has seen shorts stay at their recent lows despite the fact that its shares are down by 15% in the last three months.

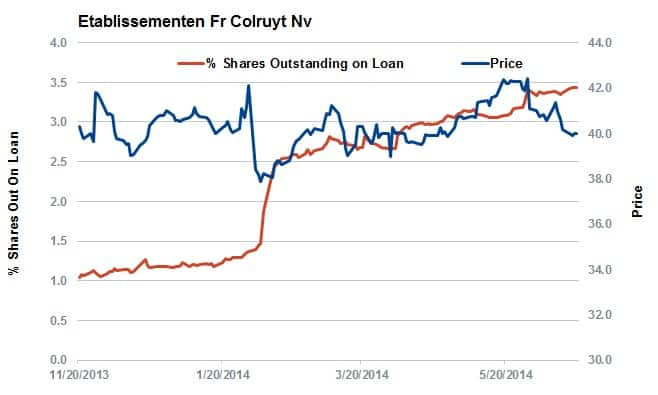

The same can’t be said for Belgian firm Colruyt which has seen short interest more than triple since the start of the year to a new annual high.

Asian earnings

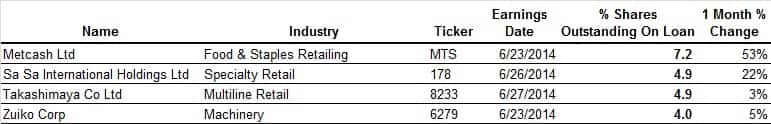

Asia also sees light reporting flow, with four firms with more than 3% of shares out on loan ahead of earnings.

Retailers again make up the majority of heavily shorted names led by Australian grocer Metcash which has over 7% of its shares out on loan. That number has climbed by 50% in the last four weeks as analysts trimmed their profit expectations for the coming results as the firm continues to see pressure from larger rivals Woolworths and Westfarmer.

The other two retailers to see high demand to borrow are Sa Sa International in Hong Kong and Takashimaya in Japan.

The only non-retail firm to make this week’s list is diaper manufacturer Zuiko which has 4% of its shares out on loan.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062014120000most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20062014120000most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}