Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 20, 2015

Russian bonds hold firm during latest oil rout

Oil prices and the rouble are once again in freefall, but the latest episode is having little effect on Russia's bond market.

- Markit iBoxx USD Russian Federation Sovereigns index yield is 89bps tighter than the last time oil dipped below $44

- Markit iBoxx USD Corporates Russian Federation Index yield has nearly halved since December

- The negative correlation between oil prices and Russian bond yields has weakened over the past six months

After enjoying a recovery in the first half of 2015, oil prices have started to decline again to the detriment of oil exporting nations. Lower expected demand from China and global oversupply has put renewed price pressure on the commodity. At the same time, fears of a global slowdown have seen investors flee emerging markets, crushing their currencies along the way.

The Russian rouble has not been spared, with latest levels against the US dollar approaching the record highs seen in January this year. It has lost 26% of its value against the US dollar in the last three months alone. Yesterday also saw the price of WTI crude oil hit a new six year low as its price dipped below $40 per barrel. Just a few months ago, Russia surpassed Saudi Arabia as China's biggest oil trade partner.

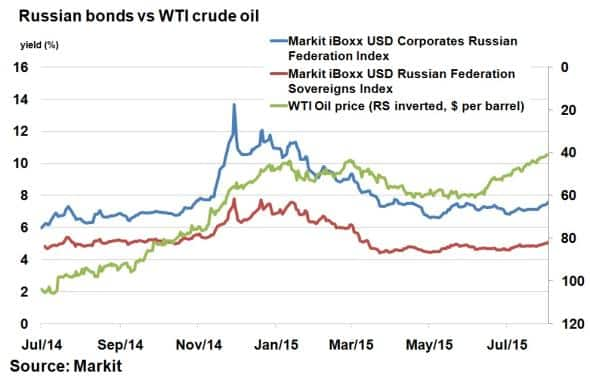

But these levels for crude oil and the rouble have been seen before; last December-January. Back then credit markets reacted very negatively, with Russian eurodollar bond yields spiking to record levels. The Markit iBoxx USD Corporates Russian Federation Index hit a record 13.64% last December when Russia's central bank decided to hike interest rates 6.5% to halt capital flight amid a tumbling oil price. Likewise, the Markit iBoxx USD Russian Federation Sovereigns Index also hit a record yield of 7.78% on the same day.

As the price of oil started to stabilise in January, so did investors' outlook on Russia. Yields for both corporates and sovereigns started to decline.

Bonds holding up better

The relationship between the price of oil, the rouble and Russian bond yield was evident. From July 2014 to January 2015, the correlation between bond yields and the price of WTI oil was -0.93 for sovereign and corporates; a strong negative relationship.

Since January this relationship continued to weaken, with one year correlations between oil and sovereigns now -0.33 and with corporates -0.54.

This weakening relationship is demonstrated by the fact that bond yields are nowhere near historical highs, despite oil prices seeing another dip over the past two months. The Markit iBoxx USD Corporates Russian Federation Index and the Markit iBoxx USD Russian Federation Sovereigns index currently yield 7.57% and 5.07% respectively, 1.57% and 0.89% lower than the last oil price trough in March.

Clearly bond investors are a lot more confident that Russia can weather the storm better this time around. The shock factor, which may have led to fear selling, is not as pronounced this time around. Uncertainty around the economic impact of geopolitical sanctions has also waned as Russia has adapted, but risks remain. If oil prices and the rouble fall further, Russian bonds could be entering unchartered territory.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Credit-Russian-bonds-hold-firm-during-latest-oil-rout.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Credit-Russian-bonds-hold-firm-during-latest-oil-rout.html&text=Russian+bonds+hold+firm+during+latest+oil+rout","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Credit-Russian-bonds-hold-firm-during-latest-oil-rout.html","enabled":true},{"name":"email","url":"?subject=Russian bonds hold firm during latest oil rout&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Credit-Russian-bonds-hold-firm-during-latest-oil-rout.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+bonds+hold+firm+during+latest+oil+rout http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20082015-Credit-Russian-bonds-hold-firm-during-latest-oil-rout.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}