Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 21, 2016

Low beta bulls vindicated

High beta shares have felt the brunt of the recent market slump, driving investors to embrace low beta ETFs with renewed vigour.

- Highest beta US shares have underperformed the market by 28% since January 2015

- Low beta ETFs have attracted $960m of net inflows year to date after solid 2015

- PowerShares S&P 500 low volatility ETF is 3% ahead of its conventional peers ytd

While painful for some, the recent market volatility has not hit every share equally as market forces benefit some stocks more than others. One area that has felt this trend most acutely is the highly volatile "high beta" shares.

These stocks, whose historical returns are the least correlated with that of the market, enjoyed a strong run in the wake of the financial crisis. However this trend turned 18 months ago and these former high flyers have since trailed the rest of the market, according to the Markit Research Signal 60 Month Beta factor.

The highest beta 10% of US shares were 50% ahead of the rest of the market from the start of 2009, but the uncertain market seen since has seen these shares give up most of their advance as investors headed to the safety of the shallow end of the volatility pool.

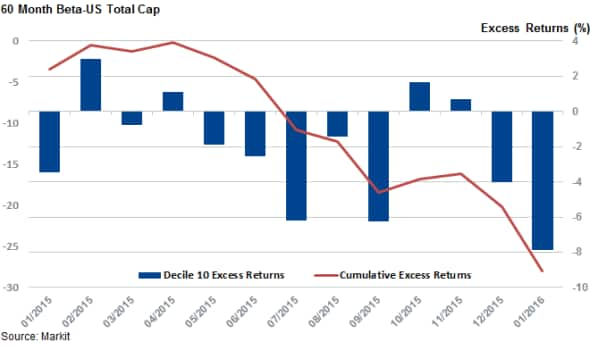

This trend has been most evident over the last 12 months when the constituents of Markit US Total Cap universe, which ranks the highest beta decile of the 60 Month Active Beta factor, have underperformed the rest of the market by a cumulative 28%. This pattern was remarkably consistent over this timeframe, as the most highly volatile shares failed to match the market's returns for a full eight of last year's months.

2016 has shown no signs of the trend slowing as high beta names have underperformed by 7.8% in the opening two weeks of the year.

Investors hop on low volatility bandwagon

The underperformance of highly volatile shares in the recent market does not seem to have escaped investors as they have been flocking to low volatility, "low beta" ETFs since these shares started to lose momentum.

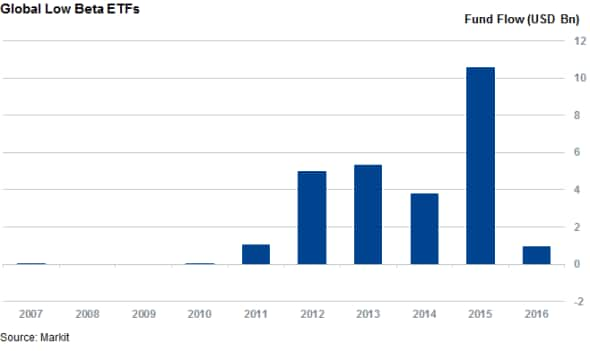

The 60 or so such products which aim to minimize stock volatility by maximising their exposure to low volatility shares saw a record net inflow of $10.6bn in 2015; the most on record.

2016 is shaping up to be another strong year as these funds have already attracted over $960m in the first two, highly volatile trading weeks of the year. These inflows contrast with an exodus out equity funds overall as global equity ETFs have seen $9.8bn of outflows over the same timeframe.

The faith in low volatility products looks to have paid off as the PowerShares S&P 500 Low Volatility Portfolio ETF has managed to outperform the SPRD S&P 500 ETF by 3% since the start of the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-low-beta-bulls-vindicated.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-low-beta-bulls-vindicated.html&text=Low+beta+bulls+vindicated","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-low-beta-bulls-vindicated.html","enabled":true},{"name":"email","url":"?subject=Low beta bulls vindicated&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-low-beta-bulls-vindicated.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Low+beta+bulls+vindicated http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21012016-equities-low-beta-bulls-vindicated.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}