Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 21, 2014

Calm returns to Portugal

The recent sudden implosion of the Espirito Santo group looks to have been contained in the wake of the government sponsored restructure, which has seen a brightening of investor sentiment across both fixed income and equity assets.

- CDS spreads have tightened from their recent highs

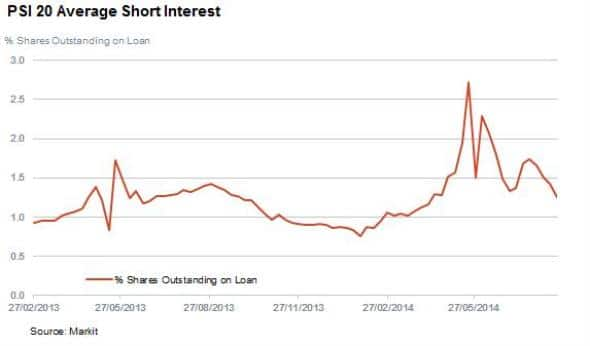

- PSI average short interest has fallen by 15% since the start of July

- ETF investors have continued to add to their exposure to Portugal in recent weeks

The sudden and somewhat unexpected implosion of the Espirito Santo group was arguably the largest financial scandal to hit the European banking system this year. Yet already the €5bn cash injection from the Portuguese government looks to have stabilised the situation, prompting a reversal in investor sentiment. In light of these recent developments, we gauge investor mood in the country.

CDS spreads tightening

Despite surging as the Espirito Santo story broke, Portugal's sovereign CDS spread looks to have stabilised over the last couple of weeks and has recently resumed its downward trend which it saw at the beginning of the year. Current CDS spread stands at 166bps,63bps tighter than in the days immediately following Banco Espirito Santo's (BES) bailout.

While the current CDS spread is still higher than in the weeks immediately preceding the BES scandal, the current spread is less than half the level seen at the start of the year. This speaks volumes about the implicit support provided by the European Central Bank, which recently praised Portugal for its swift action in containing the crisis.

Short staying away

While the BES story did see a jump in shorting activity, the current average demand to borrow shares in Portugal's PSI index is roughly 15% lower than at the start of July, showing that investors are in no mood to bet on further deterioration in the country's equity value.

This looks to have been well placed as the PSI 20 index has rebounded strongly in the wake of the Espirito Santo restructuring, with the index posting a 5% rise in the last two weeks.

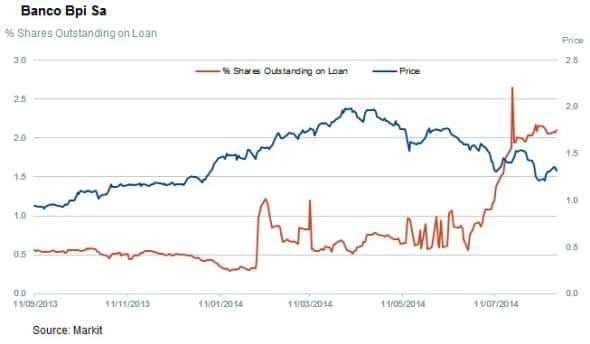

Despite this, we still see pocket of increased short selling, mainly in Banco Bpi which has seen short interest quadruple to 2% of shares outstanding and supermarket firm Jeronimo Martins which has seen shorts steadily increase their positions to an all-time high in recent weeks.

However it's worth noting that the recent surge in shorting activity has been driven by poor operating results and does not look to be tied to the country's banking struggles.

Dividends expected to stay roughly flat

The struggles of the banking sector will not impact the dividend situation significantly, as the four banks in the PSI were not expected to pay a dividend in the near future according to Markit Dividend Forecast.

Dividends paid by the other 16 constituents are also not expected to be significant with only €1.6nn of total payments forecasted for the current fiscal year. The only company expected to make a significant increase in payments is energy firm GALP which is expected to lift its aggregate payment by a fifth to €267m.

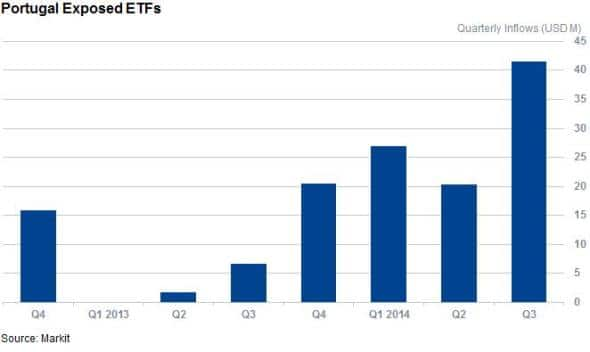

ETF investors doubling down

ETF investors seem to be on the same page as short sellers, with the three Portugal tracking products managing to keep attracting new assets despite the steep fall in the PSI index which they track. This trend has only accelerated in the wake of the BES bailout as these funds have attracted over $30m of new assets in the last three weeks. This takes their AUM to an all-time high.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014calm-returns-to-portugal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014calm-returns-to-portugal.html&text=Calm+returns+to+Portugal","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014calm-returns-to-portugal.html","enabled":true},{"name":"email","url":"?subject=Calm returns to Portugal&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014calm-returns-to-portugal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Calm+returns+to+Portugal http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014calm-returns-to-portugal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}