Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 21, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week, plus names identified at risk of experiencing a short squeeze.

- Short sellers continue relentless campaigns targeting Zoe's Kitchen and Gamestop

- Energy firms remain under pressure and Mattress Firm at risk of a short squeeze

- Markit Dividend Forecasting expecting a 53% dividend cut for Australian Worleyparsons

North America

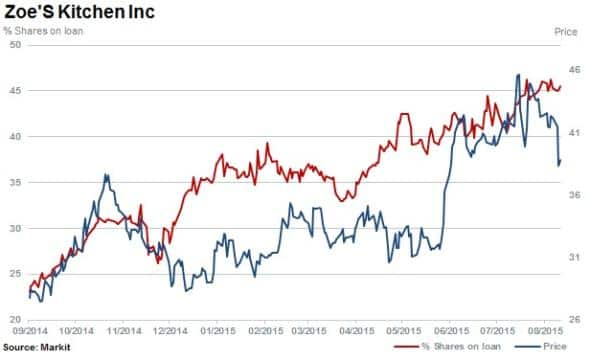

Short seller's resilience in targeting Zoe's Kitchen has been rewarded in past few weeks with the stock falling 11% since the beginning of August.

Since its IPO in 2014, leveraging off other names such as Chipotle, short sellers have consistently tracked the fast casual diner. Currently 45.7% of shares are outstanding on loan.

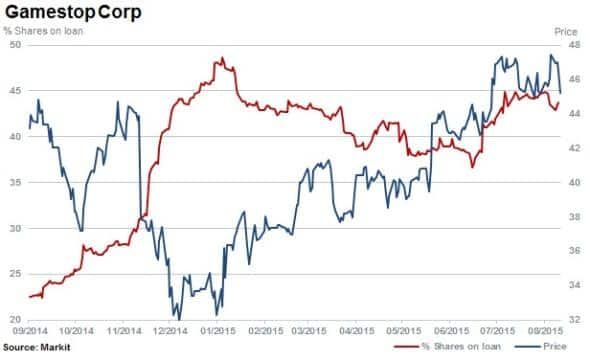

Another regular name featuring among the most shorted ahead of earnings is Gamestop with 43.7% of shares outstanding on loan. Short sellers have bumped up positions by 15% in the last three months with the stock rising 11%.

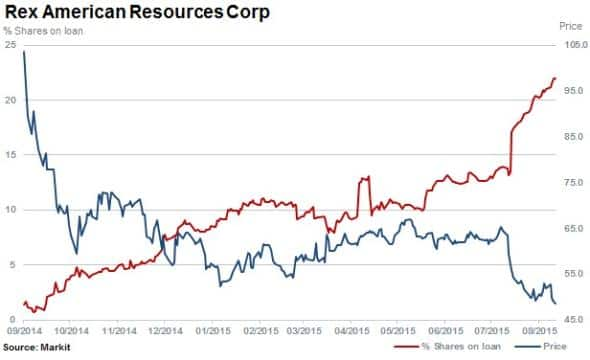

Alternative energy producer Rex American Resources has seen short interest spike by 60% in the last month. Shares outstanding on loan have increased to 22% as the company's stock plummeted by a 25% in the last three months.

Other notable shorts in North America include out of favour fashion retailers Abercrombie & Fitch and Guess, with 26.7% and 13.5% of shares outstanding on loan respectively.

Short Squeeze

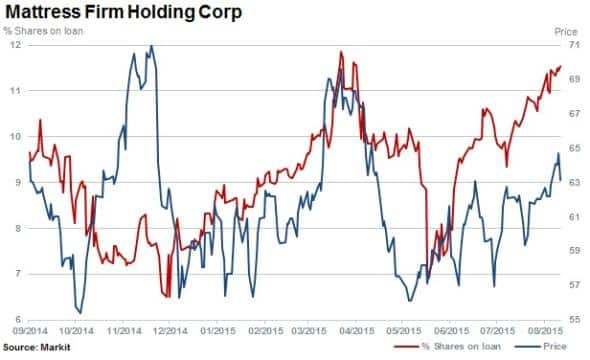

Research Signal's Short Squeeze model* identifies companies highly likely to suffer a squeeze under current trading conditions. One such company currently identified is bedding retailer Mattress Firm.

In the last three months, shares outstanding on loan have increased by a third to 11.5% and the stock is up 10%. The company is expected to release earnings on the September 2nd 2015.

Europe

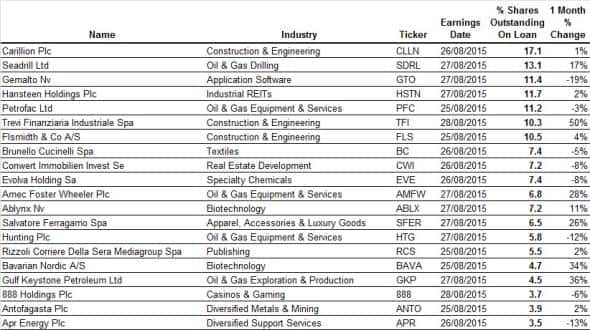

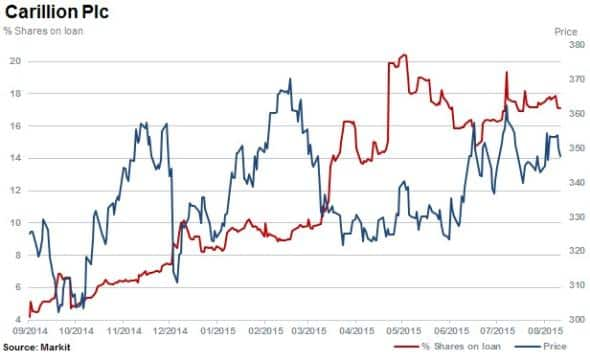

UK based building and infrastructure services provider Carillion is the most shorted ahead of earnings in Europe this week with 17.1% of shares outstanding on loan.

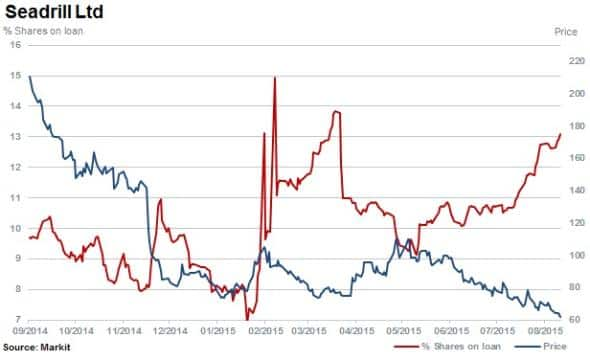

Second most shorted is Seadrill which has continued to come under immense pressure as oil prices hit fresh six year lows. Short sellers have increased their positions by 20% since May 2015 while the stock has fallen by a further 40%.

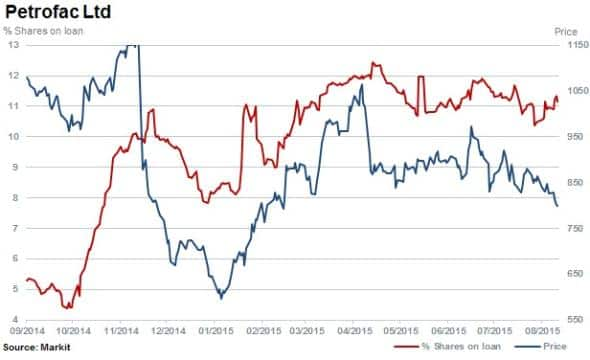

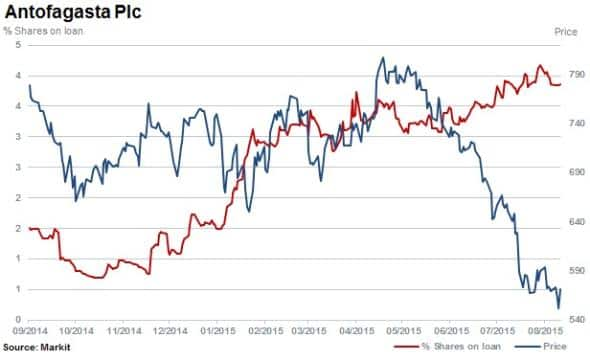

Petrofac and Antofagasta make the top twenty most shorted ahead of earnings and are expected by Markit Dividend Forecastingto cut dividends.

A 43% dividend reduction is expected for Petrofac, an oilfield services company. A June trading update indicated net debt for the firm rose to $1.2bn as of May 31st 2015, compared to $0.7bn a year earlier. In April the company issued its third profit warning in a year, announcing it would book a second write down of "130m, following a previous "154m hit.

A larger cut of 57% to the dividend is expected for Chile-based copper mining group Antofagasta. This is following lower production numbers and higher costs reported for Q1. On a full year basis, Markit's dividend forecast is broadly in line with the target payout ratio, using the current earnings consensus estimates.

Apac

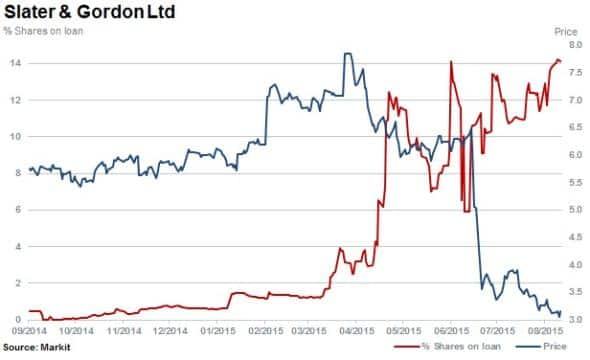

Most short sold in Apac ahead of earnings this week is dominated by engineering, energy and commodities exposed firms; particularly in Australia. However, Legal services provider Slater & Gordon leads the pack with 14.1% of shares outstanding on loan.

Slater & Gordon acquired beleaguered Quindell, a previous target of short sellers in the UK. Slater & Gordon recently announced to the market that it has lost a longstanding commercial agreement with a UK insurer. 14% of shares are currently outstanding on loan.

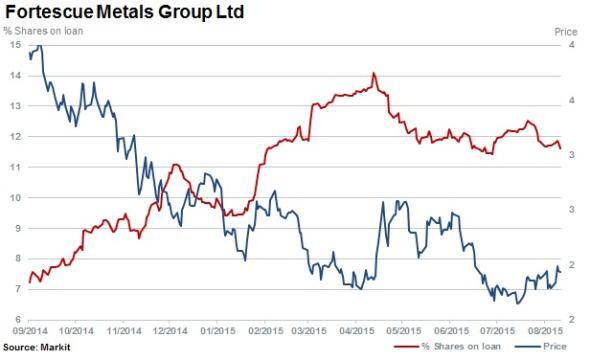

Short sellers have continued to hold positions in iron ore miner Fortescue Metals with shares outstanding on loan currently at 11.9%. The stock has lost more than half its value over the last 12 months.

Dividend cut expected at WorleyParsons

Markit Dividend Forecastingis expecting a dramatic 53% cut in the final dividend from WorleyParsons Limited. Currently there are 9.6% of shares outstanding on loan with the stock falling by a third in the last three months.

WorleyParsons delivers large scale engineering projects in the resource and energy sector and therefore has a large exposure to industry capital expenditure.

The company announced another major restructuring plan on May 4th 2015, with AUD 125m pretax costs estimated for redundancies, onerous leases and general provisions due to weaker market conditions.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}