Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 21, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

- Lannett targeted by short seller looking to play the generics slump

- Short sellers stay the course with Carillion heading into earnings

- Australian companies make up the majority of Asian short targets

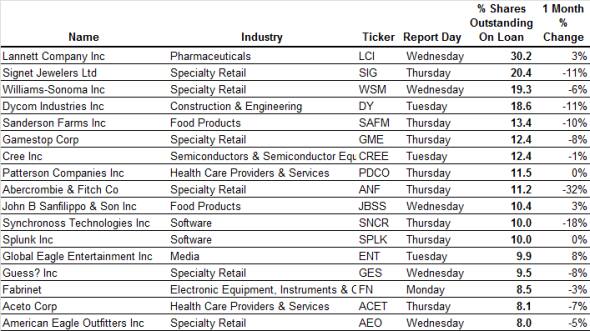

North America

With just under a third of its shares out on loan to short sellers, generic pharmaceutical company Lannett is this week's high conviction short play among companies announcing earnings. Lannett's high short interest reflects the ongoing headwind in generics pricing, which drove the company's shares down by 18% in its last earnings update. Short sellers have taken some profits off the table following the earnings setback, but bearish sentiment in Lannett is still evident.

Short sellers playing the generics slowdown have also targeted Aceto, which draws more than 40% of its business by packaging drugs for human consumption. Aceto shares have halved from their peak after a string of disappointing earnings. This significant slump hasn't satiated short sellers, as the proportion of the company's shares out on loan continues to remain high.

The final healthcare short plays of the week include dental supplier Patterson Companies, which has seen demand to borrow its shares more than double in the last 12 months to 11% of all shares outstanding.

Poultry producer Sanderson Farms, a former favorite short target, also makes this week's list of firms with high short interest - it currently has 13.4% of shares out on loan. Shorts are by and large starting to lose their appetite though; the demand to borrow shares nearly halved since January, as the value climbed by more than 50%.

This week will also see plenty of heavily shorted retailers. The firms to watch out for are jeweler Signet, homeware firm Williams-Sonoma and game retailer Gamestop. Fashion retailers are also in short sellers' crosshairs: Abercrombie & Fitch, Guess? and American Eagle are on the list of the firms to watch.

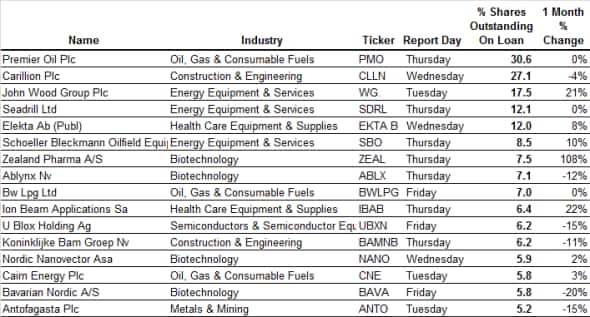

Europe

The big short plays among European firms are from the energy sector, which is still trying to recover from last year's volatility. While energy firms still attract plenty of directional short selling, the sector's ongoing consolidation and recapitalization have made it a fertile ground for arbitragers.

Premier Oil, the company with the highest level of short interest, falls into the latter of the two categories. Premier recently issued a large amount of convertible bonds, which has driven the demand to borrow above 30% of shares outstanding, ten times the levels experienced 12 months ago.

John Wood group, the second most shorted energy stock announcing earnings this week, also lands on the arbitrage list.

The demand to borrow Seadrill, Bw Lpg and Cairn Energy is most likely directional. None of these firms engaged in any corporate action that would make their shares targets for arbitrageurs.

The other key directional short target is Carillion, which has more than a quarter of its shares out on loan. Carillion shorts are largely staying the course, despite the firm's disastrous profit warnings that wiped nearly three quarter off of the firm's share price.

Asia

Australia will be the epicentre of short activity, as the country is home to all but three of the most heavily shorted companies announcing earnings.

The list of Australian short targets is led by mining firm Western Area, which has over 24% of its shares out on loan. Western's share price has mirrored the vagrancies of the nickel market over the last few years, and short sellers have targeted the firm since the price of the commodity resumed its downward spiral in early 2015. Short sellers seem to think the slump is going to continue, and the demand to borrow Western shares is near the all-time high heading into Tuesday's results.

Retail Food Group also sees record high short interest heading into earnings. Short sellers increased their borrow ten folds since the start of the year.

The most shorted firm outside of Australia is Great Wall Motor, which has 11% of its shares out on loan. The Chinese car manufacturer has been a popular target for short sellers over the last few months. The demand for cars in its home country started to tail off, prompting Great Wall to step up its marketing and discounting efforts.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}