Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 22, 2017

ETFs set to smash inflow record

Global ETFs expected to take in more than $500bn of new assets in 2017

- YTD inflows have already surpassed the previous annual record of $378bn

- Japan hides a challenging year for the Asian ETF industry

- Fixed income funds are driving the overall growth of the sector

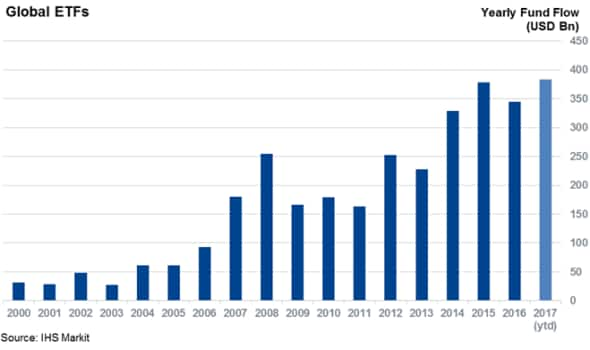

With a deluge of cash flowing into global ETFs, the industry is sailing upon another record year. The more than 7,100 funds tracked by IHS Markit's ETF analytics database saw inflows of nearly $380bn year-to-date - which is $2bn more than the previous full-year record set in 2015.

On average, investors ploughed more than $50bn into ETFs each month this year, and the tea leaves are revealing that annual inflows may surpass $500bn. If this fortune holds true, the industry will notch its largest growth rate in five years.

While most regions contributed to the 2017 growth, US investors have been the most eager to invest in ETFs. US funds account for more than 70% of this year's global inflows with $275bn of new funds collected. This year-to-date figure represents a $10bn increase over full-year 2016.

Funds listed in Latin America and Canada are also popular; investors shifted $15.6bn year-to-date, beating their previous record haul by more than 25%.

European ETFs are amassing assets at a slower pace - but the $61bn of year-to-date inflows are expected to comfortably overtake 2015's record haul.

In Japan, the country's ongoing quantitative easing program has supported ETF growth, but the rest of the Asian ETF industry has had a much tougher 2017. In fact, investors have pulled a net $4.8bn from non-Japanese Asian funds.

Asset class drivers

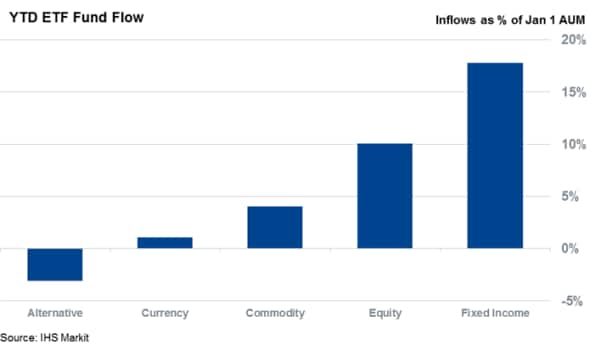

Asset class variations have been just as drastic since the start of the year.

Fixed income funds, led by those investing in corporate bonds, are by and large the most popular asset class with investors this year: they have grown by more than 17% since the start of the year with $111bn of inflows.

Equity funds have gathered more than twice the inflows, however, this represents a tenth of their AUM recorded on January 1st.

Commodity funds have had a lackluster 2017 - the $3.9bn amassed this year represents about 3% of the assets managed by these ETFs at the start of the year.

Alternative products, which invest in things like VIX and managed futures, are the only major ETF asset class to register a net outflow. Investors have pulled $792m from these funds since the start of the year, mostly due to profit taking from the inverse VIX funds.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22082017-Equities-ETFs-set-to-smash-inflow-record.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22082017-Equities-ETFs-set-to-smash-inflow-record.html&text=ETFs+set+to+smash+inflow+record","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22082017-Equities-ETFs-set-to-smash-inflow-record.html","enabled":true},{"name":"email","url":"?subject=ETFs set to smash inflow record&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22082017-Equities-ETFs-set-to-smash-inflow-record.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETFs+set+to+smash+inflow+record http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22082017-Equities-ETFs-set-to-smash-inflow-record.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}