Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 22, 2016

US short sellers hold steady despite rough week

Last week saw the most shorted shares surge and lead the market upturn, but short sellers are staying the course as short positions hover near four year highs.

- Highly shorted shares steered the market last week, led by ADT's painful short squeeze

- Short sellers not giving up on the market as average short interest is only 1% off four year high

- One-third of S&P 500 constituents see material shorting activity, up from one-fifth a year ago

The ongoing market volatility turned against US short sellers last week as their highest conviction names led the S&P 500 to its largest one week gain since November of last year. The 10% most shorted names at the start of the week returned 4.7% on average; this came in 1.2% ahead of the average return delivered by the index. In fact, the most shorted 10% of shares were the single best performing group of shares when ranking by short interest, highlighting the disappointment faced by short sellers.

While this displeasure was fairly widespread among S&P 500 short sellers, due to the fact that over 80% of the most shorted constituents saw their shares advance last week, three high conviction names proved to be particularly painful for short sellers as they surged by more than 25% over the course of the week.

ADT was by far and away the most painful high conviction short last week as its price surged by 49% after it revealed that it had agreed to be taken over by private equity firm Apollo Group at a large premium. Short sellers had borrowed 24% of ADT shares which put them in line for a $500m paper loss in the wake of the takeover announcement. There appears to be little appetite to take the other side of the trade as demand to borrow ADT shares has fallen by a third in the last wake of the announcement.

Short sellers stay the course

The other two names experiencing painful short positions have not seen the same eagerness to cover as Chesapeake Energy and Freeport-McMoran have actually seen a rise in demand to borrow as shorts doubled down in the wake of the recent rally, according to Markit's daily short interest data.

Short sellers have also largely remained steadfast across the rest of their high conviction shorts, which saw short sellers cover less than 3% of their positions on average among the 10% most shorted constituents of the S&P 500 last week.

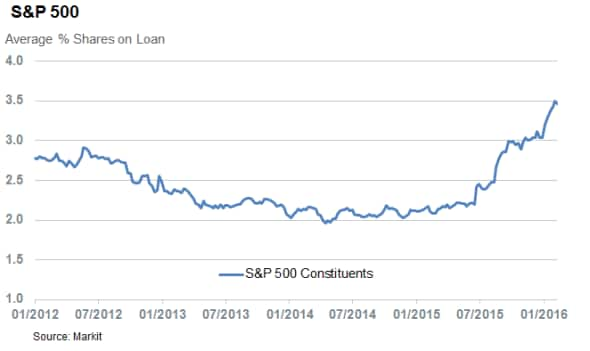

This trend also holds across the rest of the index as the current average short interest across its constituents stands at 3.46%, 1% less than the four hear highs seen the previous week.

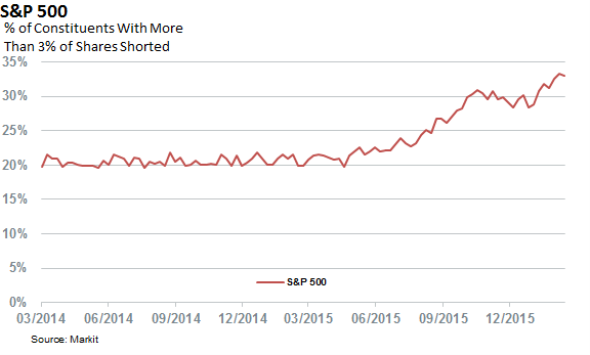

In fact, the current market still remains the most shorted in recent memory as one-third of the current S&P 500 constituents now see a material 3% or more of their shares out on loan. That figure stood at 20% as late as a year ago, showing that bearish sentiment is not solely driven by a few heavily shorted names. The current surge in shorting activity is across the index's constituents.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-equities-us-short-sellers-hold-steady-despite-rough-week.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-equities-us-short-sellers-hold-steady-despite-rough-week.html&text=US+short+sellers+hold+steady+despite+rough+week","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-equities-us-short-sellers-hold-steady-despite-rough-week.html","enabled":true},{"name":"email","url":"?subject=US short sellers hold steady despite rough week&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-equities-us-short-sellers-hold-steady-despite-rough-week.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+short+sellers+hold+steady+despite+rough+week http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022016-equities-us-short-sellers-hold-steady-despite-rough-week.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}