Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 22, 2016

Bipartisanship in biotech short interest

US elections loom at the end of the year with the outcome impacting stocks in different ways, but shorts sellers have already voted on the biotech sector's outlook.

- Short interest in biotech stocks at record highs as a handful of stocks post positive returns

- While shorts may have missed headline names, sector sees comprehensive short selling

- Best relative sector performers are among the most shorted stocks currently

Strong momentum in biotech stocks during 2015 created some difficult battles for those shorting the sector, but a now infamous Hilary Clinton tweet saw sentiment quickly sour.

As the elections in November 2016 draw closer it looks as if neither outcome will be able to assist in improving the current outlook for the biotech sector. The potential reversal of impacts felt by stocks benefiting from the Affordable Care Act, which Republicans aim to repeal and replace, joins the pledge by Democrats taking aim at excessive price increases by some drug companies which has dominated headlines.

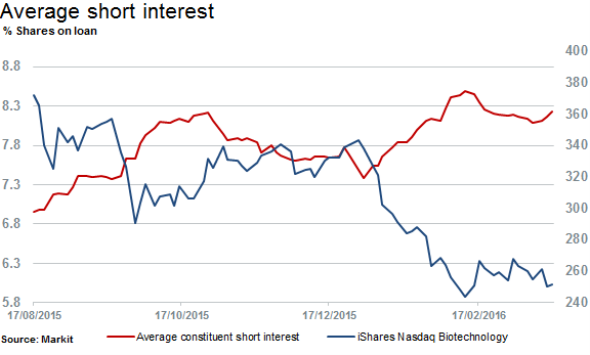

Short sellers continued to build up their positions in the sector since the 'tweet' and prices have continued to stumble. The iShares Nasdaq Biotechnology ETF (IBB) is down a drastic 37% from highs seen in mid last year. The ETF currently has $5.8bn of AUM, the largest in the category currently.

Average short interest of IBB's constituents has once again breached 8% of shares outstanding on loan. Almost two thirds of constituent firms have more than 5% of their shares sold short, according to data from Markit Securities Finance andExchange Traded Products.

Based on the IBB ETF, stock pickers in the sector would have had a tough time in 2016 as less than 11 constituents (6%) have delivered positive returns year to date, with only four of those six of achieving returns above 5%.

However from a short seller's perspective, biotech stocks have proven a winning strategy in 2016 - across the 190 stocks that make up IBB, more than 50% of stocks have declined by more than 30% so far this year.

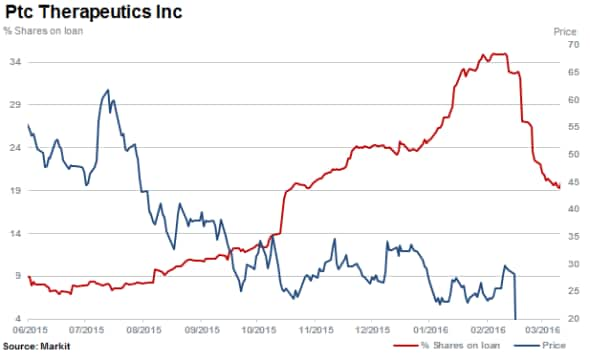

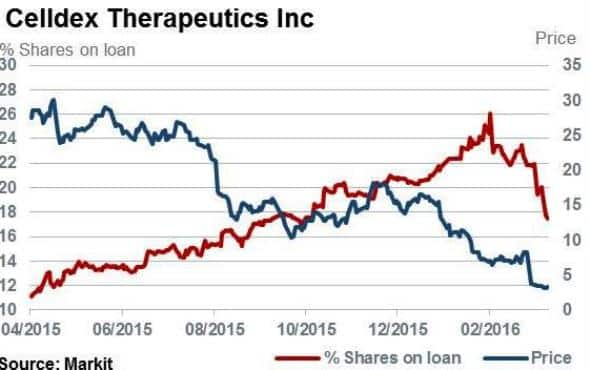

The worst performing constituent of the ETF, falling 82% in 2016 alone, is Ptc Therapeutics which still has a fifth of shares currently outstanding on loan. Ptc is closely followed by Celldex falling 79% and also still has material levels of short interest at 17.5%.

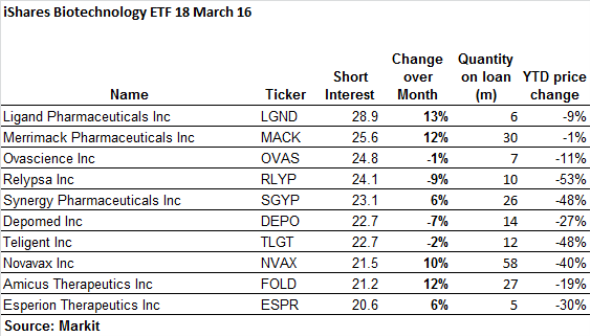

Interestingly, two of the most shorted stocks currently among the 190 IBB constituents are Ligand and Merrimack Pharmaceuticals who both feature in the top twenty performers year to date - declining by a relatively low 9% and 1% respectively.

Ligand currently has 29% of shares outstanding on loan whilst Ligand has 26%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-equities-bipartisanship-in-biotech-short-interest.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-equities-bipartisanship-in-biotech-short-interest.html&text=Bipartisanship+in+biotech+short+interest","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-equities-bipartisanship-in-biotech-short-interest.html","enabled":true},{"name":"email","url":"?subject=Bipartisanship in biotech short interest&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-equities-bipartisanship-in-biotech-short-interest.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bipartisanship+in+biotech+short+interest http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-equities-bipartisanship-in-biotech-short-interest.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}