Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 22, 2016

Markit Securities Finance forum: an overview

A recap of the key themes discussed at this week's 16th Markit Securities Finance forum which revealed the opportunities and challenges facing the securities finance market today.

- Short sellers perform best in uncertain and volatile markets, including the current climate

- Trade reporting at the forefront of industry's mind, though many still struggle to understand it

- Blockchain could potentially ease the settlement burden, but industry remains too fragmented

Securities lending is an uneven game. A small minority of assets generates the vast majority of demand and associated revenues. This holds true across both the assets being borrowed, such as the small proportion of assets trading special, and small proportion of beneficial owners willing to be most flexible with the type of collateral they are willing to accept in return.

Short sellers, which drive a lot of the industry's demand, experience this unevenness first hand. Only a small minority of their positions drive returns, especially since macro events can wipe out returns from shorting strategies as secular bull markets leave slim pickings for short sellers. This trend was discussed extensively in the first keynote and panel discussing at the episodic nature of short seller returns.

While the small number of shares which attract the largest amount of interest from short sellers command a higher fee, the panel largely agreed that short sellers can still earn positive returns net of fees although there is still a lot to be learned about the drivers of specialness.

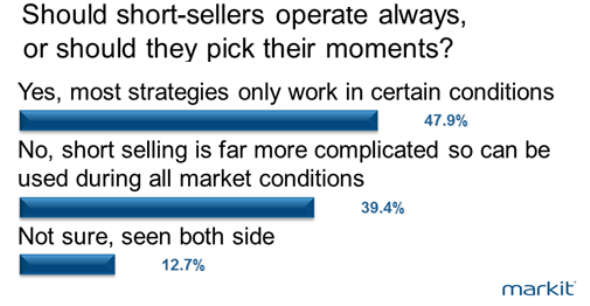

The audience polling found that short selling practitioners could best address this phenomenon by dipping in an out of the strategy to avoid long stretches of underperformance which eat into returns and risk losing investor confidence in an era where investment horizons are much shorter than a few years ago.

One bright spot for the industry is that short selling thrives in volatile uncertain market, such as the current one. Markit data shows a notable increase in short interest in recent months, which is likely to translate into revenues for the industry in the near term.

While the resurgent popularity of short selling is promising, the panels all generally agreed that the industry still faces revenue pressures. These pressures have been particularly driven by cash reinvestment trades becoming tougher in the current low interest rate environment.

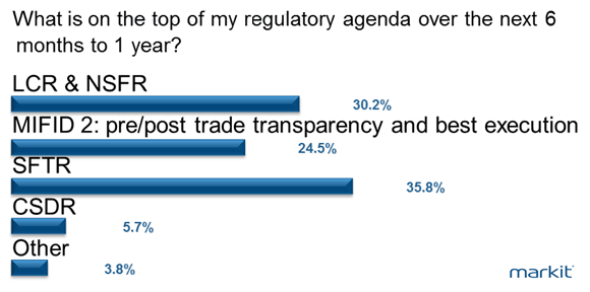

Regulation continues to pose a challenge for the securities finance industry. A large majority of the audience felt that the greatest impact of new regulation on the industry was increased cost rather than increased transparency and lower risk.

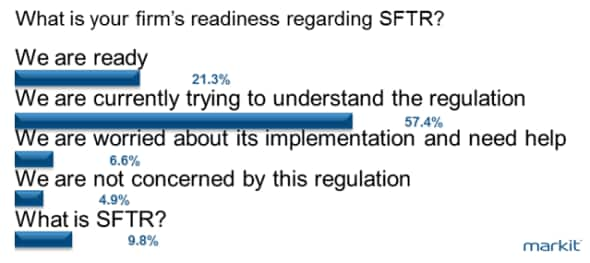

The regulation du jour, according to the audience polling, is the reporting requirement set to be mandated by the Securities Finance Transaction Regulation (SFTR) which is due to kick in 2018. Although 18 months away; half the audience admitted that they are still trying to get to get its head around the regulation.

Pierre Khemdoudi, co-head of Markit Securities Finance picked up on this angst in his closing statement which revealed that Markit is actively looking to leverage its proven processing pedigree in order to help the industry address its SFTR challenges.

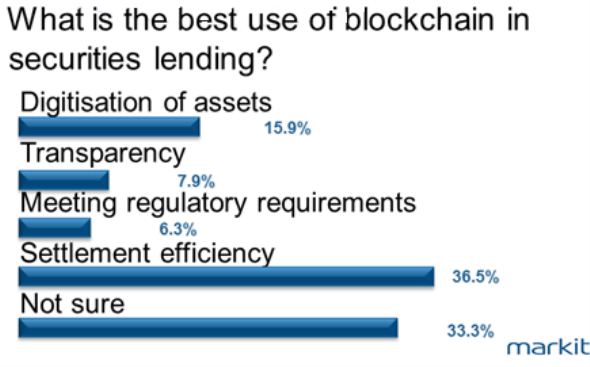

Looking further ahead, the forum's fireside talk on blockchain looked at the technology's potential application within the financial industry. Blockchain has progressed in leaps and bounds in the last 18 months to reach the stage where several financial industry participants, Markit included, are already running proofs of concepts. While these proofs of concept have yet to reach the securities lending universe, ideas such as smart contracts, which operate within the blockchain framework, have the potential to materially transform the way the market handles trade reconciliation and collateral requirements.

This optimism was picked up by the audience, which felt that blockchain had the potential to increase settlement efficiency; something which continues to be an industry-wide problem, particularly in the fixed income space.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Markit-Securities-Finance-forum-an-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Markit-Securities-Finance-forum-an-overview.html&text=Markit+Securities+Finance+forum%3a+an+overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Markit-Securities-Finance-forum-an-overview.html","enabled":true},{"name":"email","url":"?subject=Markit Securities Finance forum: an overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Markit-Securities-Finance-forum-an-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markit+Securities+Finance+forum%3a+an+overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Markit-Securities-Finance-forum-an-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}