Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 22, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

- Abercrombie & Fitch continues to decline as short interest builds ahead of earnings

- Short sellers still positioned against Gamestop as business continues to surprise

- Australian firms among the most shorted in Apac ahead of earnings

North America

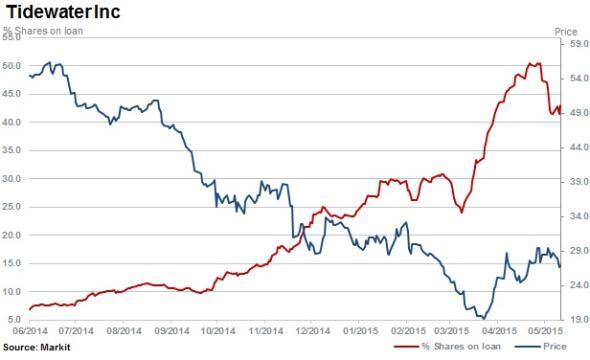

Already down by 50% in the last 12 months, the most short sold this week ahead of earnings in North America is Tidewater. With 43% of shares outstanding on loan, the firm provides offshore vessels to the global energy industry.

Shares have rallied in recent weeks along with the oil price recovery which has seen short sellers cover some of their positions from the April highs. Demand to short however remains strong, with the cost to borrow nearly tripling in the last month.

After being the most shorted ahead of earnings in November 2014, short sellers continue to position themselves in "ageing" Abercrombie & Fitch. The stock has declined a further 28%, with shares outstanding on loan currently at 19% ahead of earnings.

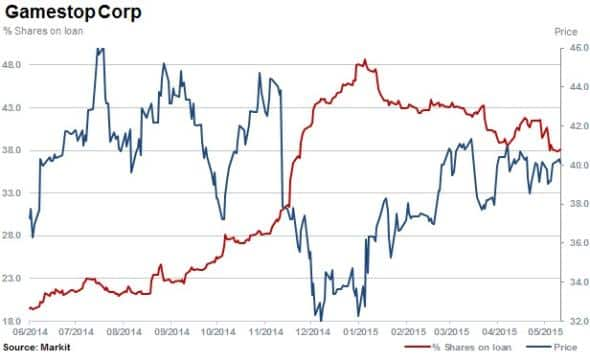

Short sellers' commitment has been tested as Gamestop shares have continued to climb. The retailer's stock is up 7% in the last three months yet remainsone of the most shorted companies in North America despite some recent covering. The number of GAME shares outstanding on loan has decreased by 11% in the last three months, but still remains highly elevated with the current borrow representing 38% of shares outstanding.

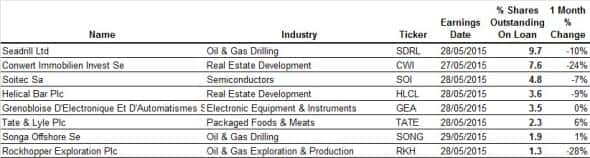

Western Europe

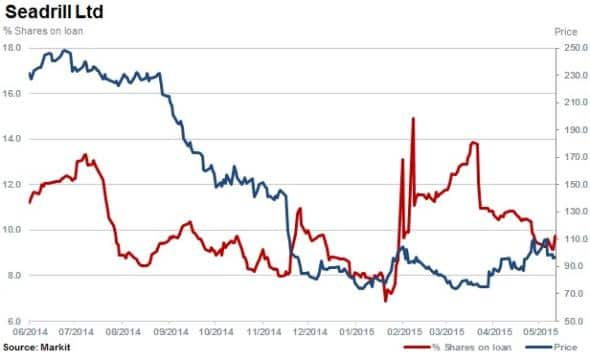

Short interest remains high in Seadrill at 9.7% of shares outstanding on loan. The offshore drilling contractor has seen shares fall by 55% since oil prices started to collapse in June 2014.

London based property investment and development group Helical Bar has seen a rise in short interest over the last nine months, increasing to 3.6%. In February, the firm stated that since April 2014 a total of "194m worth of investments have been sold as part of rotation out of shopping centres into logistical facilities. Shares have reacted well to recent moves with the stock up 20%, but despite this the firm has attracted increased levels of short interest.

Asia Pacific

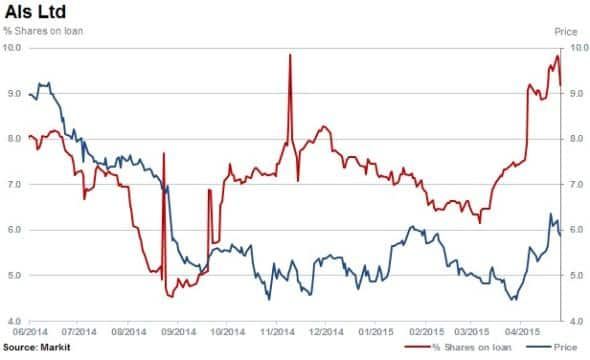

Australian based ALS provides testing services to mineral, life sciences and energy and industrial segments. The firm has seen a 23% spike in shares outstanding on loan. The company's stock is down by a third over the last year with approximately 50% of its sales exposed derived from minerals and energy operations.

Tough trading conditions in these sectors have been behind ALS's recent dividend cut with the firm trimming its final dividend payment by 40% from last year's level.

Australian foreign exchange service provider Ozforex, has seen shares outstanding on loan increase to 5.5%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}