Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 22, 2015

Mining bonds shunned as commodities slump

With commodity prices slumping, both investment grade and high yield mining sector bonds are experiencing a sharp selloff.

- Markit iBoxx $ Mining index seen its credit spread widen 15bps this week; near ytd highs

- Anglo American and Freeport bonds led the widening in the investment grade mining index

- Markit iBoxx USD Liquid High Yield Basic Materials Index yield now widest on record

Bearish sentiment for commodities has resumed amid reduced demand from China. The world's second biggest economy faces challenges in maintaining its projected growth rate, with some predicting a long term decline in China's appetite for commodities.

Iron ore, crude oil and most recently gold have seen sustained downward pricing pressure. This has also spread to other precious metals including copper, zinc and tin. As a result major commodity exporters, particularly those that have substantial trade links with China such as Australia, South Africa, Indonesia and Brazil, face uphill challenges.

Mining dumped

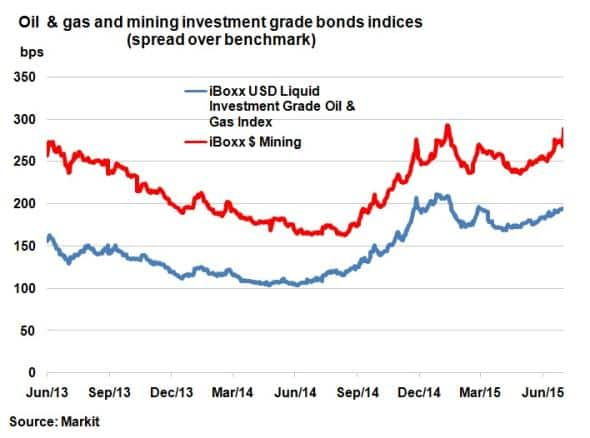

The pessimism around commodities and in particular the mining sector has spread into credit markets, with bond prices falling. The Markit iBoxx $ Mining index, made up of investment grade credits in the sector, has seen its spread over benchmark (a measure of credit risk) widen 15bps this week to 289bps. The level is just shy of January's year to date (ytd) high of 293bps.

Interestingly, the closely related Markit iBoxx USD Liquid Investment Grade Oil & Gas Index is only 2bps wider this week, even with recent declining oil prices. This contrast highlights the resilience of investment grade oil & gas sector compared to the mining sector.

Looking deeper into the Markit iBoxx $ Mining index, two credits stand out as seeing sustained selloff pressure.

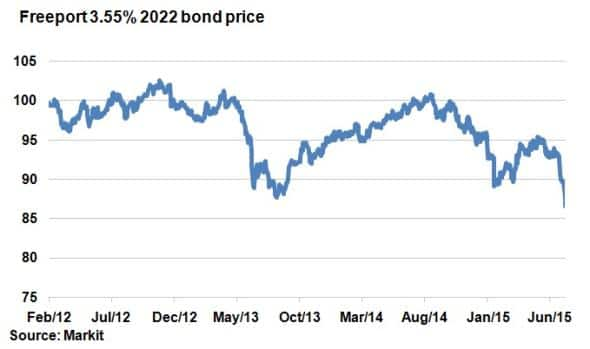

Freeport, one of the world's largest producers of copper and gold has seen its 3.55% bond due 2022 down 6.35pts (cash basis to par) this month to date. This translates into a $127m cumulative loss for investors in just this single bond. The sharp movement in price displays fragility and is more reminiscent of the high yield sector rather than a BBB rated investment grade name like Freeport.

The price of gold recently dipped below $1,100 per barrel for the first time in five years and even major commodity producers such as Freeport have come under fire from investors who believe operations will be further strained.

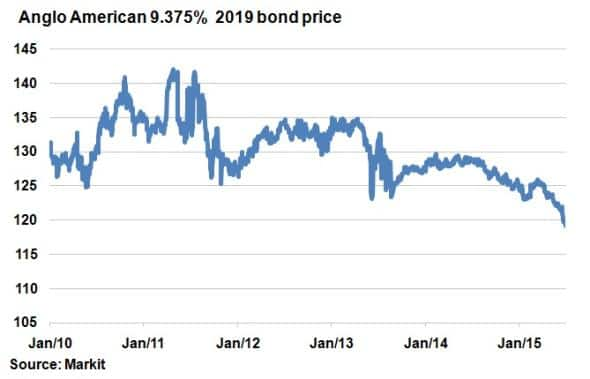

The other big loser in the sector has been UK based miner Anglo American. A big iron ore and copper producer, its bond due 2019 has hit a new five year low at 119.18pts.

High yield

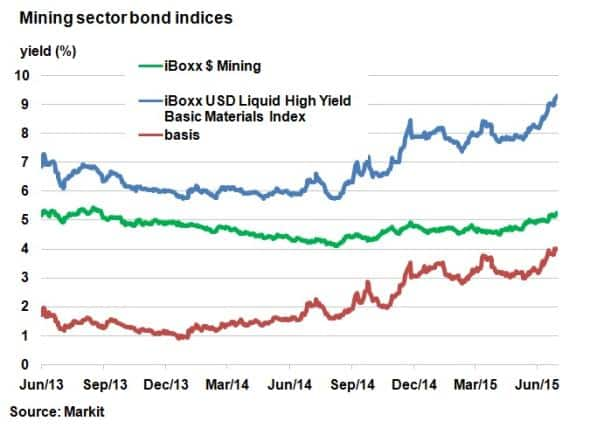

With the investment grade mining credits selling off sharply, it comes as no surprise that high yield names in the sector have moved in a more pronounced fashion.

The yield on the Markit iBoxx USD Liquid High Yield Basic Materials Index now stands at 9.28%; the highest since the index started in 2009. It has widened 100bps in just the past month alone, surpassing the recent highs reached in December 2014.

Coal firms Alpha Natural Resources Inc, Peabody Energy Corp and Arch Coal Inc have led the trend with their credits now trading at distressed levels.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Credit-Mining-bonds-shunned-as-commodities-slump.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Credit-Mining-bonds-shunned-as-commodities-slump.html&text=Mining+bonds+shunned+as+commodities+slump","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Credit-Mining-bonds-shunned-as-commodities-slump.html","enabled":true},{"name":"email","url":"?subject=Mining bonds shunned as commodities slump&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Credit-Mining-bonds-shunned-as-commodities-slump.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mining+bonds+shunned+as+commodities+slump http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Credit-Mining-bonds-shunned-as-commodities-slump.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}