Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 22, 2015

Prowling tiger, hidden dividends

China's slowdown is impacting South Korea's export exposed economy; however, Markit's data indicates that some investment strategies and sectors are proving resilient and investors can expect healthy dividends from the nation as a whole.

- Investors back winners as Price Momentum focused strategies consistently outperform

- Long term winning Deep Value strategies underwater as market strain sees trend reversal

- South Korea to enjoy third successive year of double digit dividend growth to KRW 14.3tn

Asian manufacturing under pressure

July PMI data indicated that China, Taiwan, South Korea, Indonesia and Malaysia have all experienced manufacturing declines while Japan and India reported solid expansions. PMI survey participants in South Korea, where PMI readings are the weakest in almost two years, indicated that the contraction in output stemmed from unstable economic conditions and reduced sales volumes.

There are some signs of improvement, however, with the central bank opting to hold rates steady in October, even after exports plunged in September by 14.7%, led by shipbuilders and petroleum products

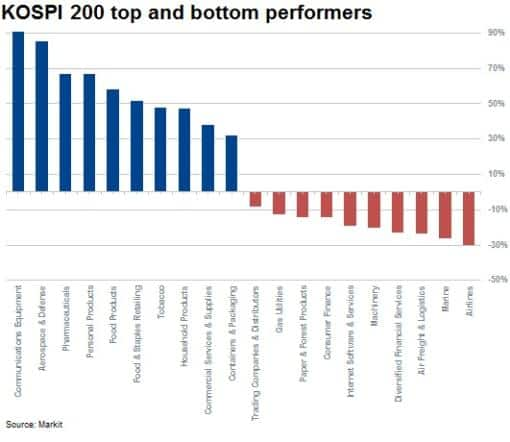

South Korean confidence is based on the balance of the economy. The country's GDP is made up of 50% exports, with half of that dependant on China. Interestingly, two-thirds of constituents in the KOSPI 200 index are actually up year to date, with an average return (of those up) of 36%. Even incorporating stocks that are down year to date, the average return across constituents is still a healthy 16%.

However, due to the sheer size of larger companies' weight in the South Korean economy and the KOSPI 200 index, the index is relatively flat year to date with the Kiwoom Asset Kosef200 ETF up a mere 0.8%.

The top three sectors that have underperformed in the country include Airlines, Marine and Air Freight & Logistics.

Flavours of Samsung

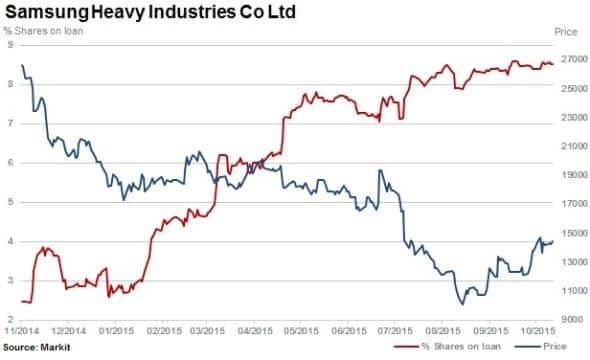

South Korean industrials, including shipbuilders, continue to suffer, and a 25bps cut to interest rates by the central bank in June was hoped to prop up markets. This occurred as China, the country's biggest export destination, devalued its renminbi.

This particularly hit Samsung Heavy Industries, where short interest has increased to 8.4% of shares outstanding on loan. The stock is down 45% over the last 12 months.

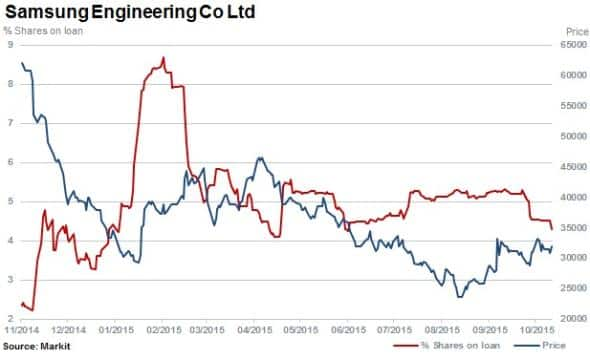

Samsung Engineering shares are down over 50% over the last 12 months and fell dramatically further yesterday, closing 19% down after the company reported losses and plans to sell $1bn in shares to shore up finances.

Samsung Electronics, despite posting declining sales, trades 6% higher over the same period with negligible levels of shorting activity.

Dividends continue to grow

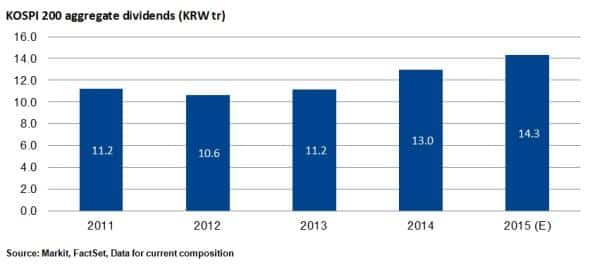

Despite the current pressures facing the South Korean economy, the country is set to enjoy a third successive year of double digit dividend growth. Markit is forecasting aggregate dividends from KOSPI 200 companies to reach KRW 14.3tn for FY15, a 10% rise compared with KRW 13tn paid the previous year.

The continued surge is led by Hyundai Motor's and Woori Bank's interim dividend initiations while Samsung Electronics distributed twice the prior interim dividends and S Oil paid out a one-off large sum of dividends to compensate the previous year's final dividend omission.

The largest sector contributor with the projected total dividends of KRW 2.9tn is Personal & Household goods, the only sector forecast to cut dividends among 18 dividend-paying sectors. This is because Samsung Electronics, which traditionally paid 60%-70% of the sector aggregate dividends, has no plans for a special increment in this year's final dividend and is forecast to keep the FY13 dividend level, in line with its policy of distributing approximately 1% of share price as dividends.

The Automobiles & Parts sector's expected 17.6% growth is backed by Hyundai Motor's and Kia Motors' clearer dividend plans. Starting from this year, both aim to raise payout ratio to 15% in the short term and to 20%-30% in the mid to long term period.

Picking the winners in Korea

During the equity market selloff in the past three months, investors have backed winners in Korea, as indicated by Markit Research Signals' Price Momentum model. Using a one month holding period, the style has consistently outperformed in the region with a 69% hit rate.

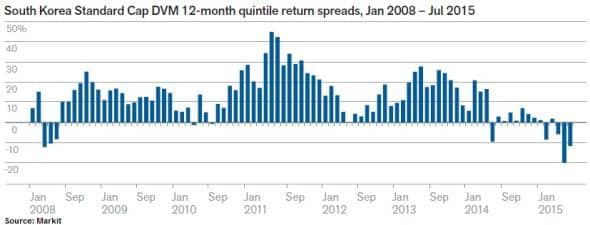

On a longer term basis with a holding period of 12 months, the Deep Value model has consistently outperformed. However, the recent sell off has seen some reversal in this strategy as seen below. The model's hit rate is a high 89%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102015-Equities-Prowling-tiger-hidden-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102015-Equities-Prowling-tiger-hidden-dividends.html&text=Prowling+tiger%2c+hidden+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102015-Equities-Prowling-tiger-hidden-dividends.html","enabled":true},{"name":"email","url":"?subject=Prowling tiger, hidden dividends&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102015-Equities-Prowling-tiger-hidden-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Prowling+tiger%2c+hidden+dividends http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102015-Equities-Prowling-tiger-hidden-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}