Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 23, 2015

Sterling high yield picks up

High relative yields and a pickup in liquidity have brought the sterling high yield market back to life.

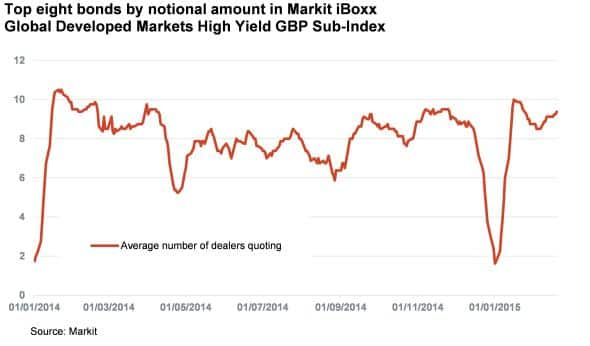

- Number of dealers quoting sterling high yield has steadily increased over the last three months

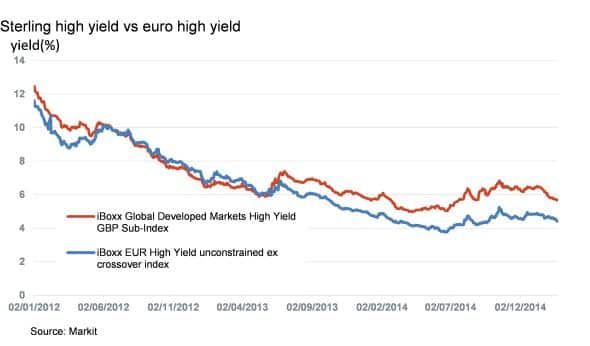

- The yield premium to hold sterling high yield bonds over equivalent euro high yield is 125bps up from nought in 2013

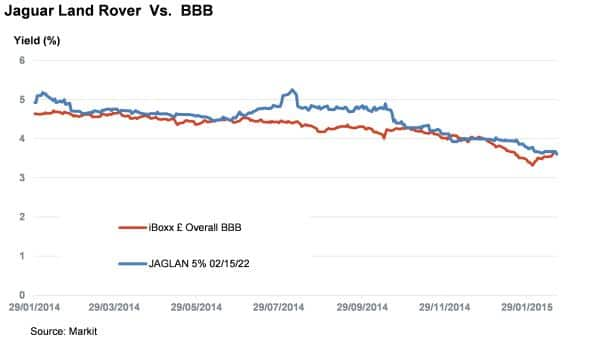

- High yield issuer Jaguar Land Rover trades in line with BBB investment grade bonds

Late last week, Jaguar Land Rover, a luxury British car maker, raised "400m in the European high yield market. So far this year sterling deals have been rare sights, although more may be set to follow in Jaguar's footsteps. The collapse of Phones4U last September and the consequential fall in its bonds dented confidence in the market. This development, along with volatility in the broader global high yield market had practically bought primary markets to a standstill for six months.

Liquidity picking up

The year has started with an uptake in the number of dealers quoting sterling high yield bonds, an indication of liquidity in the market. The Markit iBoxx Global Developed Markets High Yield GBP Sub-Index offers a snapshot of this market (by notional amount outstanding). The average number of dealers quoting the eight bonds hit 9.75 late January, the highest figure in a year; a large uptick

from last September when the average number dipped to 6.38.

Sterling vs. euro

In today's yield sparse environment, one of the appealing aspects of high yield sterling deals is that headline yields are much wider than equivalent euro deals. The yield disconnect began mid-2013, and the gap has since widened to 125bps, with the iBoxx Global Developed Markets High Yield GBP Sub-Index yielding 5.66% and the iBoxx EUR High Yield unconstrained ex crossover index at 4.41%.

While much of this yield difference can be attributed towards falling government bond prices, even when singling out credit quality by comparing spreads over swaps, sterling high yield still provides around 20bps extra return in comparison to euro high yield. This difference steadily rose over the last six months to a high of 69bps on January 15th as the sterling market was shunned. As liquidity and primary market activity has picked up, the yield gap has since come down.

Is Jaguar high yield?

An interesting aspect of the recent Jaguar issuance was how the deal developed during the pricing process and in particular investor sentiment with regards to the quality of the issuer.

Initial talks were for a "300m deal and pricing was set in the 4% region, which was already seen as on the low side for a high yield issuer. The deal finally priced with a coupon of 3.875%, and the amount issued was increased to "400m on the back of the strong demand. Jaguar Land Rover has a current average rating of BB, according to Markit iBoxx.

The deal had an investment grade feel which has been reflected by the performance of existing Jaguar Land Rover bonds in the secondary market. The 5% bond due 2022 tightened 7bps on Friday, to a mid-yield of 3.61% which was less than the average yield on the same day as the iBoxx " Overall BBB index, the lowest rung in the investment grade ladder. The bonds also held up well during last September's volatility, staying below 5% when the broader sterling high yield market started to rise above 6%.

The price action shows investors are treating Jaguar Land Rover as investment grade and may be anticipating an upgrade, but also shows the strong investor appetite for quality sterling high yield.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-credit-sterling-high-yield-picks-up.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-credit-sterling-high-yield-picks-up.html&text=Sterling+high+yield+picks+up","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-credit-sterling-high-yield-picks-up.html","enabled":true},{"name":"email","url":"?subject=Sterling high yield picks up&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-credit-sterling-high-yield-picks-up.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sterling+high+yield+picks+up http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022015-credit-sterling-high-yield-picks-up.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}