Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 23, 2016

Tide turns for US high yield bonds

After underperforming for much of 2015, US HY bonds have outperformed IG counterparts this year, and investors are starting to take notice.

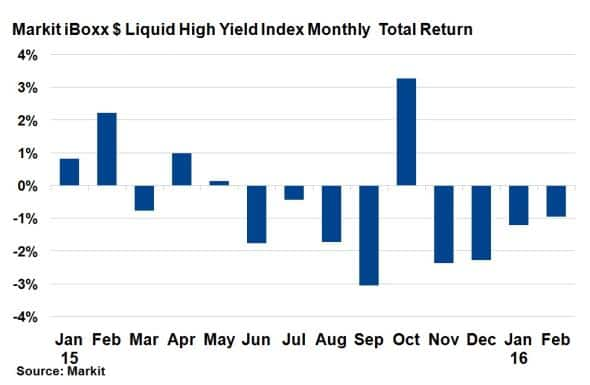

- Markit iBoxx $ Liquid High Yield Index has seen negative returns for seven of the last eight months

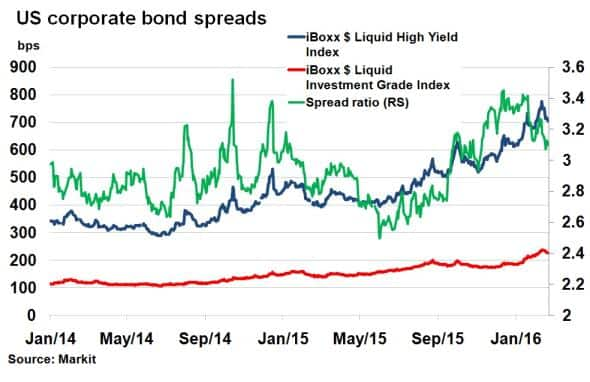

- US HY has outperformed US IG this year with the spread ratio falling from 3.32 to 3.1

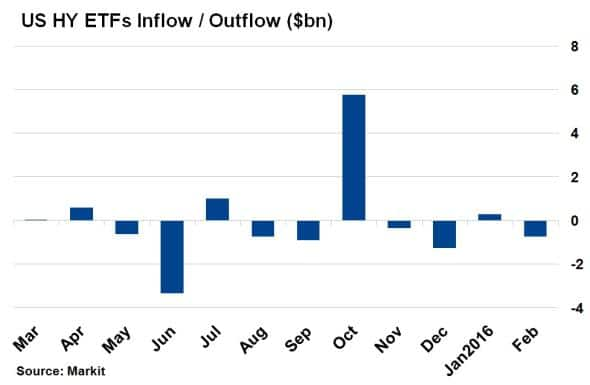

- Despite spending February in the red, the past week has seen $1bn of US HY ETF inflows

The past year has not been great for the US high yield (HY) bond market as investors have shunned the market in favour of higher quality assets. However, recent macroeconomic developments have renewed investor appetite.

Embroiled in weakening commodity prices, a concern over global growth and bouts of idiosyncratic risk, US HY bonds, as represented by the Markit iBoxx $ Liquid High Yield Index have seen negative returns for seven of the last eight months. This month however, there has been a recovery of sorts, with the index being down as much as 4.15% on February 11th, before regaining over 3%, to -0.96% as of February 22nd.

The bounce in HY has gone hand in hand with oil and commodity prices, which remain the key driver of sentiment. Just last week, Qatar, Russia, Saudi Arabia and Venezuela agreed to freeze oil production to January's levels as long as others (Iran and Iraq in particular) agree to do the same. Over the past week, crude oil prices have leapt 15%. Other developments, such as the easing of fears around the European banking system and optimism around support for China's currency have also boded well for risky assets.

HY outperforms

Despite the negative returns this year, US HY bonds have outperformed their higher quality investment grade (IG) counterparts, as represented by the iBoxx $ Liquid Investment Grade Index. Stocks posted strong gains over the past week and higher commodity prices boded well for US HY bonds. The annual benchmark spread ratio between HY/IG has fallen from 3.32 to 3.10 so far this year, showcasing HY's relative outperformance. It marks a stark contrast to the trend seen in the second half of 2015, where the ratio rose from 2.5 to 3.32.

Funds recoup outflows

The positive sentiment around US HY bonds is also reflected in investor activity through ETF flows.

Since the beginning of February $734m has exited ETFs tracking US HY bonds, on course to be the fifth month out of the last seven to see outflows. But this figure could have been higher; the past week has seen $1bn of inflows into US HY ETFs according to Markit's ETP service, recouping the much of this month's outflows.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022016-credit-tide-turns-for-us-high-yield-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022016-credit-tide-turns-for-us-high-yield-bonds.html&text=Tide+turns+for+US+high+yield+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022016-credit-tide-turns-for-us-high-yield-bonds.html","enabled":true},{"name":"email","url":"?subject=Tide turns for US high yield bonds&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022016-credit-tide-turns-for-us-high-yield-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tide+turns+for+US+high+yield+bonds http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022016-credit-tide-turns-for-us-high-yield-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}