Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 23, 2015

Investors flee gold ETFs

Investors have continued to reduce their exposure to gold as the dollar strengthened to new highs in March.

- Investors trim their gold exposure in March by $1.8bn

- Offsets most of inflows recorded in 2015

- Apac investors buck the trend

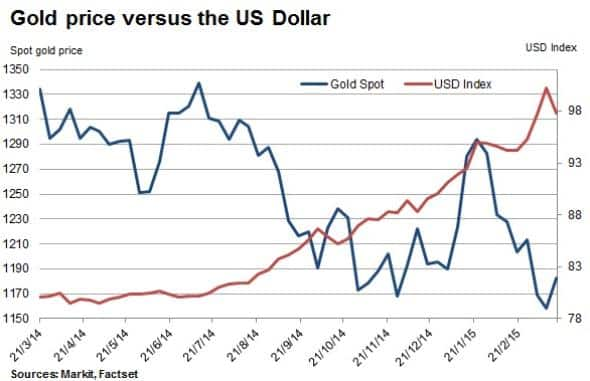

Inflation fears have largely abated and gold's spot price has declined by 39% from its all-time high of $1,921.17 in September 2011. The decline in the precious metal, which is currently trading at $1182.40, has coincided with a strengthening US dollar which has benefited from the US economic recovery.

The US dollar index has appreciated 23% since the end of 2012 with most of the dollar's relative strength only coming through in the past six months. With the prospect of the Federal Reserve looking to raise interest rates in 2015, the dollar looks set to strengthen further and an increase in yields will hurt the non-yielding precious metal.

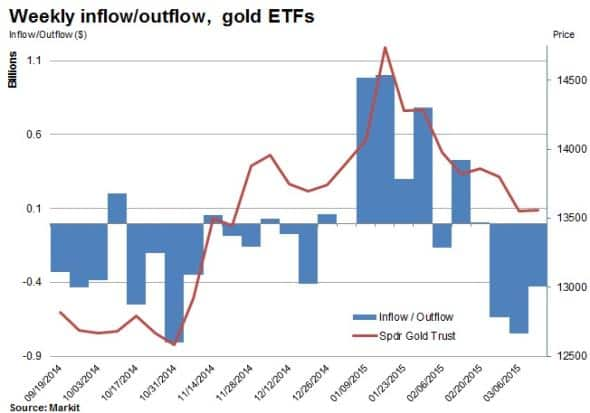

In the last three weeks alone, investors have pulled $1.8bn from Gold ETFs, which account for a large proportion of the $3.4bn of inflows recorded up until the end of February. This compounds a trend seen over the last 12 months with outflows totalling $3.5bn or 5.7% of the $62bn managed by gold ETFs.

The largest single name gold ETF is the SPDR Gold Shares ETF (GLD) with $28.3bn in AUM, accounting for nearly half of all gold ETF assets. The fund has seen a proportional share of outflows over March with $1.0bn of net redemptions.

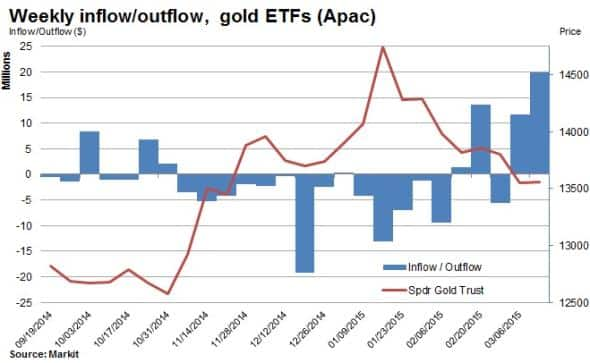

Gold loved in Asia

Asian investors represented the one bright spot for gold products over the last few weeks with inflows into Apac listed gold ETFs having accounted for $31.6m. While total AUM of these funds is small at $2.4bn the divergence highlights the differing in investor appetite for the precious metal across the world as central bank policy diverge and people in Asia maintain demand for the bright metal.

The fund accounting for the largest share of inflows is Shanghai listed Huaan Gold ETF. Priced in CNY, the fund aims to track the total return of the China gold spot price and currently has $46m in AUM representing ~2% of gold ETFs in the Apac region.

The largest gold ETF in Apac by AUM is the Goldman Sachs Gold Exchange Traded Scheme. The Indian fund currently has $406m in AUM and tracks the returns before expenses of gold returns in Indian Rupees.

Together with the Reliance Gold ETF, ETFS Physical Gold Australia and the Mitsubishi UFJ Japan Physical gold ETFs, these largest four ETFs represent 63% of gold ETF exposure in the region.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032015-Equities-Investors-flee-gold-ETFs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032015-Equities-Investors-flee-gold-ETFs.html&text=Investors+flee+gold+ETFs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032015-Equities-Investors-flee-gold-ETFs.html","enabled":true},{"name":"email","url":"?subject=Investors flee gold ETFs&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032015-Equities-Investors-flee-gold-ETFs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+flee+gold+ETFs http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032015-Equities-Investors-flee-gold-ETFs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}