Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 23, 2016

ETF safe havens gather billions as fees fall

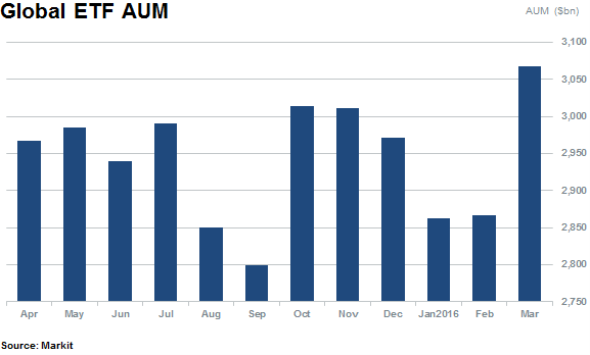

Global ETF AUM is holding above $3trn with the top three fund inflows of 2016 showing investors' flight to safety, while outflows from equity ETFs highlight increasing competition for AUM.

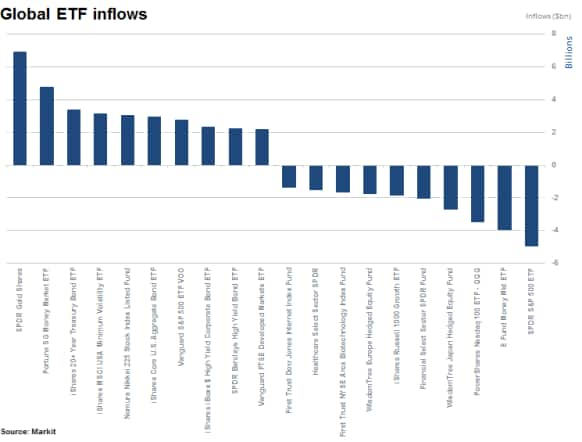

- Totalling $34bn gold and fixed income ETFs capture the largest 10 inflows

- Healthcare, internet and biotech funds among top 10 withdrawals totalling $25bn

- Issuers continue to lure investors' AUM with lower costs as the race to zero fees continues

Global ETF AUM has once again breached the $3trn mark, in part thanks to a recovery in equity markets as the asset class has gathered net inflows of $65bn thus far this year.

It took over ten years for ETF AUM to first reach the now seemingly elusive watermark of $3trn but expectations are expected to double for the relatively youthful asset class - reaching $6trn by the end of the decade.

Currently 76% of AUM tracks equities with 20% allocated to fixed income ETFs but the latter has posted some impressive growth numbers recently. The balance of ETFs are exposed to commodity and alternative asset classes.

With ETF investors seemingly convinced of the instruments' utility issuers continue to create products to provide an entire spectrum of investment products. This has recently seen outflows from riskier assets being countered with inflows into 'safe haven' assets, with a more encapsulating system for investor funds - benefiting issuers in general.

2016 inflows have been led by strong inflows into gold and fixed income products, representing two thirds of the largest 10 inflows, totalling $34bn. Only three equity ETFs are in the top ten funds by inflows. Conversely, the majority of the top ten outflows have come from equity ETFs with 90% of the "25bn of outflows seen fleeing equities.

Interestingly, while the Vanguard S&P 500 ETF (VOO) has attracted $2.8bn of inflows thus far this year its peer; the world's largest ETF by AUM at $178bn, the SPDR S&P 500 ETF (SPY) has seen outflows of $5bn.

While netting the inflows to the above ETFs reveal a reduction in exposure to the S&P 500, it highlights investors search for ever lower fees as issuers implement fee reductions in a battle for AUM.

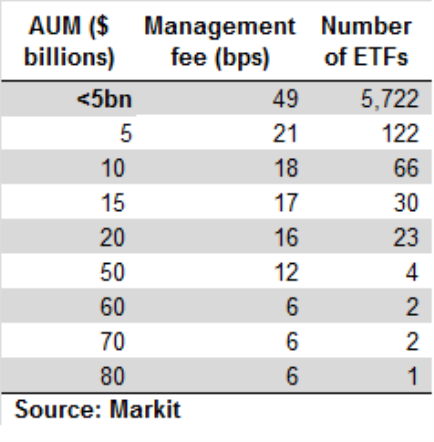

The average management fee across all ETFs is currently 49bps (basis points), however, leading funds by AUM charge a fraction of this with the SPY ETF as an example, charging 5.7bps.

However, the race to lower fees to attract funds only appears to start once an ETF reaches above $5bn in AUM. After this point, ETFs charge half the average management fee of the entire ETF universe.

Given the above, VOO offers the same theoretical exposure as SPY but at a management fee of 3.0bps a 47% saving. Additionally, the gross expense ratio is half that of SPY currently. This could explain the contrasting flows seen in and out of the ETFs thus far this year and that increased competition in ETFs continue to benefit investors.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-equities-etf-safe-havens-gather-billions-as-fees-fall.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-equities-etf-safe-havens-gather-billions-as-fees-fall.html&text=ETF+safe+havens+gather+billions+as+fees+fall","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-equities-etf-safe-havens-gather-billions-as-fees-fall.html","enabled":true},{"name":"email","url":"?subject=ETF safe havens gather billions as fees fall&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-equities-etf-safe-havens-gather-billions-as-fees-fall.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETF+safe+havens+gather+billions+as+fees+fall http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23032016-equities-etf-safe-havens-gather-billions-as-fees-fall.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}