Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 23, 2015

Ruble weakens dividend surge

Russia's previous efforts to raise cash flow for state departments and improve the profile of its companies to foreign investors have been wiped out by the ruble's dramatic decline amid economic sanctions and lower oil prices.

- Aggregate dividends in rubles expected to soar 21%, but decline 22% in dollar terms

- Dividend growth expected to stall in FY15

- ETF investors' risk rewarded by year to date Russian equities rally

Strapped for cash and barred from access to international capital due to sanctions, the Russian government has turned to state controlled companies to gain access to valuable cash resources. While not directly appropriating cash assets of companies, as allegedly may have occurred with Russian pensions funds, the government has influenced the dividend policies of companies.

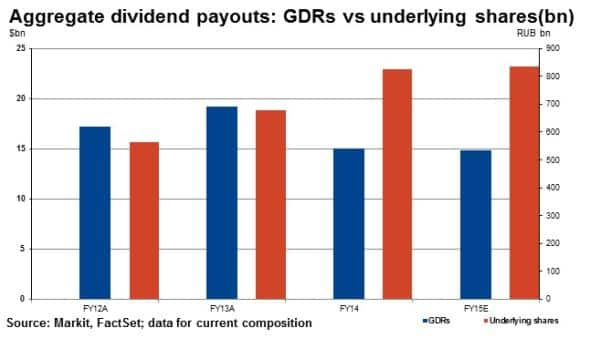

Russian dividends, in ruble terms, have soared in FY14 by 21% to RUB 824bn for Russian global depositary receipts (GDRs). However foreign holders have been impacted by the ruble's decline, with total dividend payments on track to decline 22% from $19.2bn in FY13 (fiscal year), reaching $15bn in FY14.

The earnings of many Russian companies have been significantly affected by FX fluctuations over the past 12 months, especially those who generate sales in local currency while serving debts in US dollars or euros. In order to maintain their level of payouts in foreign currency terms, some companies like Gazprom, Lukoil and Novatek have committed to much higher payout ratios than outlined in dividend policies.

Markit Dividend Forecasting is expecting MICEX50 companies' dividend payouts to decline in FY15 by 3.5% but still increase by 1% for the underlying 15 Russian GDRs. While on aggregate, more stable levels of dividend growth are expected there are indications that companies' earnings and cash resources cannot sustain the elevated dividend yields.

Compared to their emerging market peers, Russian companies currently have much higher dividend yields. GDR currently sees average dividend yields above 4% versus comparable emerging market yields of 2.5%.

But continued dividend growth outpacing earnings in the current economic climate is unlikely to be sustainable in the long run.

ETF investors continue risky ride

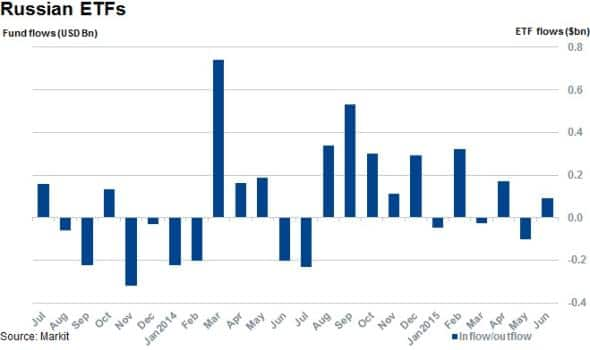

Even amid continued unrest and sanctions in Russia and Ukraine, ETF investors continue to position themselves to benefit from a recovery in the Russian market as net long inflows into ETFs have totalled $406m year to date.

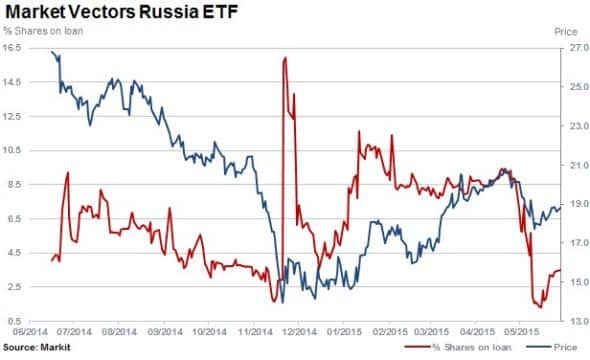

The largest Russian exposed ETF by AUM at $2.1bn is the Market Vectors Russia ETF (RSX) which benchmarks the DAXglobal Russia+ Index, tracking the 30 largest and most liquid Russian companies trading as GDRs. The ETF's NAV is up by 29% year to date, despite falling by 9% in the last month.

Short interest in RSX has been volatile in recent months, with short sellers covering over the last six months as the ETF rallied. Shares outstanding on loan has spiked as high as 16% in December 2014 but has declined throughout 2015 to 3.5%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-equities-ruble-weakens-dividend-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-equities-ruble-weakens-dividend-surge.html&text=Ruble+weakens+dividend+surge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-equities-ruble-weakens-dividend-surge.html","enabled":true},{"name":"email","url":"?subject=Ruble weakens dividend surge&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-equities-ruble-weakens-dividend-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ruble+weakens+dividend+surge http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-equities-ruble-weakens-dividend-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}