Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 23, 2015

Utilities sector lags wider corporate bond market

While bond spreads have tightened across corporate credit over the past month, the utilities sector continues to lag the broader corporate bond market.

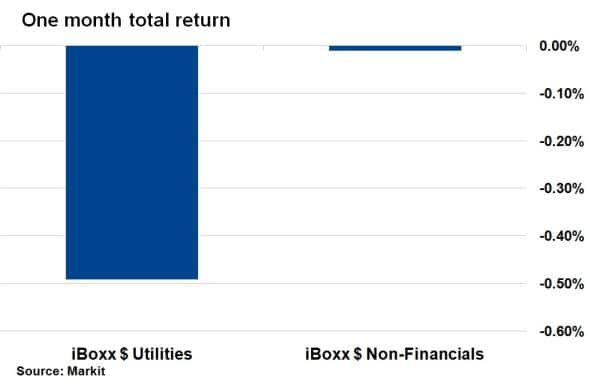

- iBoxx $ Utilities has underperformed the $ Non-Financials by 0.49% over the past month.

- Over this time, both iBoxx $ Utilities and $ Non-Financials have seen credit fundamentals improve.

- iBoxx $ Utilities index has an average maturity two years greater than that of $ Non-Financials, increasing its interest rate risk.

According to Markit's iBoxx indices, the utilities sector was the third worst performer among corporate sectors in August, with only commodity price sensitive sectors such as basic materials and oil & gas returning lower. August was a particularly bad month for risky assets, culminating in "Black Monday" on August 24th. Dollar denominated corporate bonds have since rallied, but the utilities sector has continued to lag.

Over the past month, the iBoxx $ Utilities index has underperformed the wider dollar denominated corporate bond market, as represented by the iBoxx $ Non-Financials index, by 0.49% on a total return basis.

Both indexes enjoyed a relief rally after Black Monday, with bond spreads tightening across the board as fear among investors subdued. In fact only five of the 35 constituents of the iBoxx USD Liquid Investment Grade Utilities index saw their spread over benchmark widen over this period. So what has been driving the lower returns attributed to the utilities sector?

Interest rate sensitivity

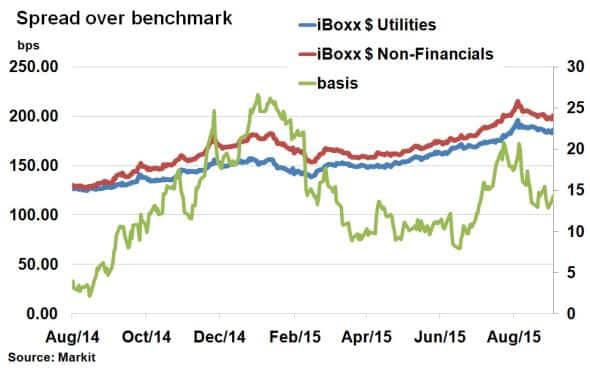

A naturally defensive sector capable of riding tough market conditions and economic downturns, the utilities sector has seen its bond spread over treasuries, a proxy for credit risk, widen from 150bps earlier this year to 187bps at the latest level. The broader corporate bond market as represented by the iBoxx $ Non-Financials index has seen a similar trend.

The iBoxx $ Utilities and iBoxx $ Non-Financials indices have seen their spread over benchmark fall 8bps and 15bps, respectively, over the past month, with the basis tightening from 19bps to 14bps. While this explains why utilities have underperformed corporate bonds in general, it does not explain the negative total return over the past couple months since when bond spreads tighten, bond prices typically go up.

The utilities sector is renowned for comprising corporations that have stable business models and predictable cash flow streams. This has historically led to bonds being issued with higher maturities than the broader market. The iBoxx $ Utilities index has an average maturity two years greater than that of the iBoxx $ Non-Financials index, with duration, a measure of interest rate sensitivity, averaging 8.35 years and 7.39 years, respectively. Over the past month, underlying benchmark treasuries have sold off, with 10-yr yields 16bps higher. This volatility has led to bonds with a higher duration more susceptible to returns being ebbed away by market risk even as credit fundamentals have improved in dollar denominated corporate credit over the past month.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-credit-utilities-sector-lags-wider-corporate-bond-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-credit-utilities-sector-lags-wider-corporate-bond-market.html&text=Utilities+sector+lags+wider+corporate+bond+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-credit-utilities-sector-lags-wider-corporate-bond-market.html","enabled":true},{"name":"email","url":"?subject=Utilities sector lags wider corporate bond market&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-credit-utilities-sector-lags-wider-corporate-bond-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Utilities+sector+lags+wider+corporate+bond+market http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092015-credit-utilities-sector-lags-wider-corporate-bond-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}