Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 23, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Food producers heavily represented with Cal-Maine seeing most bearish sentiment

- The AA sees the largest jump in short interest leading up to earnings in Europe

- Homeware retailer Dcm is the most shorted Asian company announcing earnings this week

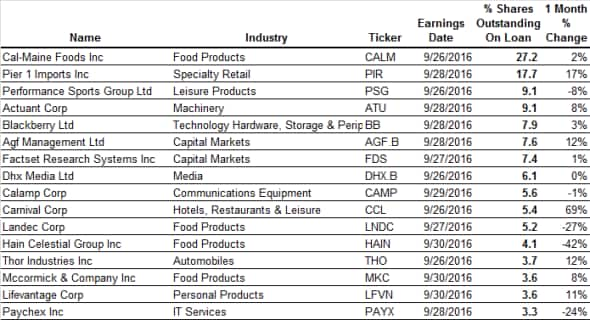

North America

Food producers are the key short play among firms announcing earnings this week with four producers seeing more than 3% of shares out on loan ahead of earnings.

The most shorted of this week's lot is egg producer Cal-Maine which has over 27% of its shares out on loan. Short sellers have continued to add to their positions in Call-Maine shares ever since they began to slide from their highs last summer.

This price slide and the subsequent increase in short positions have been driven by "extreme" volatility in the price of eggs which led the firm to report a $0.01 loss per share in its latest quarterly earnings. Analysts are expecting this week's earnings to be even worse for the company, something which short sellers are positioning to benefit from as to borrow Cal-Maine shares has increased by 20% since the end of July.

The other food retailers seeing heavy demand to borrow in the last few weeks include Landec, Hain Celestial and McCormick which have between 3% and 5% of their shares out on loan.

Homeware retailer Pier 1 Import is the only other firm besides Cal-Maine to see more than 10% of its shares out on loan prior to earnings. Demand to borrow Pier 1 shares has increase by 17% in the last four weeks after the company preannounced a very disappointing 6.7% decline in year on year sales.

Another firm seeing a large rise in short interest in recent weeks is Blackberry as demand to borrow its shares has increased by a third since the end of July. While short interest in Blackberry is still around half the levels it was at its highs at the end of last year, the recent increase in demand to borrow indicates that the company's plan to diversify away from its current core enterprise communication business is being met with scepticism.

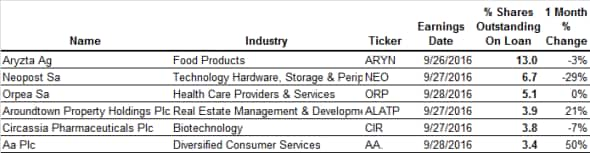

Europe

Food also features prominently on short sellers' minds this week as Swiss listed frozen foods manufacturer Aryzta has 13% of its shares out on loan ahead of its earnings announcement on Monday. Aryzta shares have been buffeted by poor business conditions and a slew of corporate restructuring. Aryzta shareholders are saw some respite from the bad news last week as its stock price rebounded by nearly 10% after the company announced that it has appointed a new chairman.

UK roadside assistance provider AA Plc has seen the largest increase in shorting activity leading up to earnings as demand to borrow its shares jumped by 50% in the last month.

This surge in shorting activity comes despite the fact that AA recently offloaded its Irish operations to private equity group Carlyle for "156.6m.

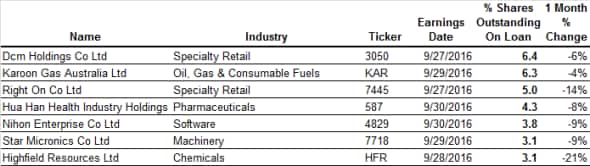

Apac

Home ware retainer DCM is the most shorted Asian name announcing earnings this week with 6.4% of its share out on loan. DCM's short interest spiked back in July after a strong run in its share price, but short sellers have been covering heading into earnings as the current demand to borrow DCM shares is down by a quarter in the from the recent highs.

The demand to borrow this week's lot of heavily shorted Asian stocks has been declining heading into earnings as all seven firms on this week's screen have seen a fall in the amount of shares out on loan in the last four weeks.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}