Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 24, 2016

Gold offers silver lining to South African investors

South African investors have been flocking to gold, both physically and through associated miners, as the commodity's resurgence has offered one of the few bright spots in an increasingly gloomy market.

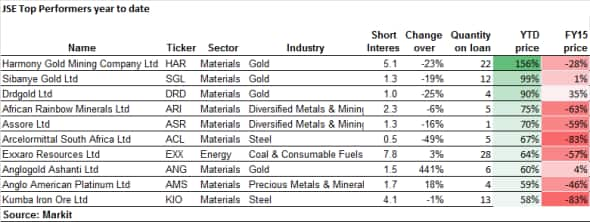

- Commodities firms make up the entirety of the ten best performing South African firms ytd

- Both domestic and local investors have fled South African ETFs in the last two years

- Short sellers in South Africa target consumer and financial services stocks exposed to domestic turmoil

South Africa budgets to avoid downgrade

After a brutal 2015, South African gold miners are staging an impressive rally while average short interest across South African equities has been rising as the country faces rising inflation and a collapse of its currency. These developments come ahead of one of the most anticipated government budgets which the government hopes will restore investor confidence.

The government has already taken steps to assuage investor sentiment by re-instating finance minister Pravin Gordham in order to fend off a credit ratings downgrade to junk. However further fiscal strain on the struggling resource-based economy may push consumers to the edge as rising interest rates and inflation continues to squeeze incomes.

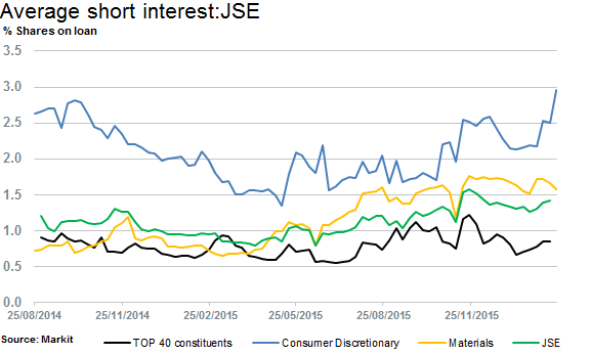

Average short interest across the Johannesburg Stock Exchange (JSE) and the TOP 40 index has increased by 13% and 24% to hit 1.5% and 0.9% of shares outstanding respectively year to date.

This trend is led by consumer related shares as short sellers trade the impact of the country's rising inflation and weakening economic growth. To this end consumer discretionary retailers have seen average short interest increase by 38% while consumer staples have seen demand to borrow rise by 35%. The two highest conviction shorts in the sector are credit retailers Lewis Group and Truworths with warehouse retailer Massmart rounding out the top three.

Lewis Group has more than one-quarter of its shares outstanding on loan after its shares fell by 40% in the last 12 months. Trueworths has seen its demand to borrow double in the last few weeks reach an all-time high of 12.3% despite the fact that its shares have been much more resilient than its more heavily shorted peer.

While shorts have targeted consumer shares, those in the materials sector have seen covering year to date. Short interest in the sector has declined 6% year to date (ytd), led by gold mining stocks.

Gold regains investment allure

South African gold mining stocks, led by Harmony Gold Mining and Sibanye Gold are up 156% and 99% respectively and dominate the top ten performers' year to date. Mining and resource stocks have benefited from a drastically weaker local currency, higher dollar gold price and lower operating costs due to a decline in energy prices.

The newfound resilience seen by the country's commodities sector has not helped shares overcome the harsh economic reality however as the country's main stock index, the JSE 40 is down by 6.2% year to date.

SA ETF investors lean towards gold

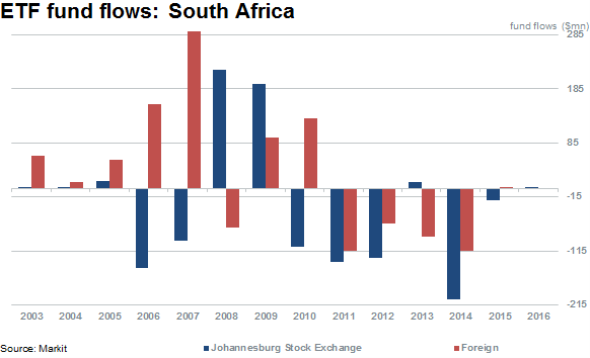

ETF fund flows out of the country have reflected the deteriorating investor sentiment as locally listed ETFs exposed to domestic equities, which have grown from 8 to 44 products in the last 12 years, have seen their second straight yearly outflows last year. Overseas ETFs exposed to the country have continued to see funds withdrawn since 2008.

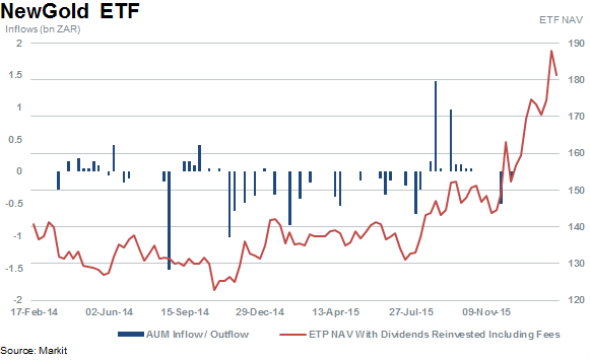

While domestic equities have fallen out of favour with South African investors, those exposed to gold have seen large inflows as investors look to protect against the falling rand. The ABSA Bank (a member of Barclays for now) manages the NewGold ETF which now manages a third of the country's ETF AUM.

This has proved to be a winning bet as the ETF, which tracks the rand price of gold, has risen 26% in the past three months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-equities-gold-offers-silver-lining-to-south-african-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-equities-gold-offers-silver-lining-to-south-african-investors.html&text=Gold+offers+silver+lining+to+South+African+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-equities-gold-offers-silver-lining-to-south-african-investors.html","enabled":true},{"name":"email","url":"?subject=Gold offers silver lining to South African investors&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-equities-gold-offers-silver-lining-to-south-african-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Gold+offers+silver+lining+to+South+African+investors http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022016-equities-gold-offers-silver-lining-to-south-african-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}