Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 24, 2014

Geopolitical worries drive energy investments

Recent geopolitical concerns have seen energy prices rise in recent months, also driving a wave of bullish activity toward energy markets.

- ETPs with energy exposure are on track for their largest quarterly inflow in four years

- Investors are preferring to position in equity tracking energy exposures as opposed to commodity tracking ETPs

- Shorts in oil and gas production firms have also covered in recent weeks

The recent turmoil in Ukraine and the Middle East has seen energy prices spike up again after a couple of relatively calm years. Faced with the prospects of further uncertainty and a recovering economy, Brent crude prices have risen to their highest level in over 18 months after jumping by 4% in the last month. The recent uncertainty is also reflected in natural gas prices which are 10% higher than this time last year. These developments have seen investors rush to gain exposure to the energy market, after largely eschewing these investments over the last couple of years.

Appetite strong for energy investments

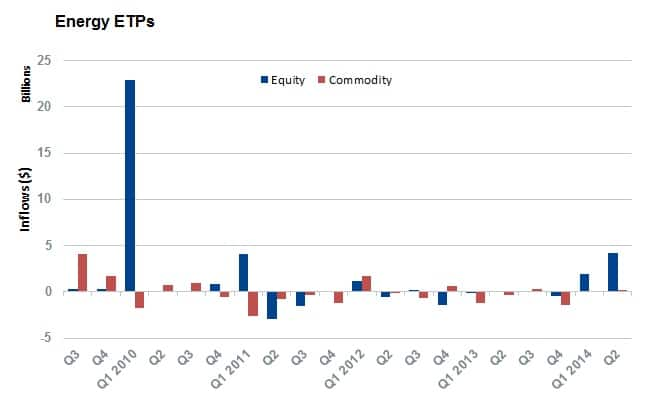

All this uncertainty has provided impetus for energy ETFs, which have seen large inflows since the start of the year. So far this quarter, the 321 ETPs tracking energy assets have seen over $6.4bn of net inflows. Most of these inflows were seen in the second quarter, when the troubles in Ukraine and Iraq gathered momentum. The large inflows in the wake of troubles around the globe have energy ETPs on track for their best quarter with regards to inflows since the first quarter of 2010.

Investors prefer equity exposure

Interestingly, the recent strong inflows have centred on products with equity exposure in energy producing and exploration firms, rather than products that offer exposure to the physical commodities.

Year to date, equity energy funds have seen over 20 times the inflows secured by their commodity peers. While it makes sense that equity funds would see larger inflows as their asset base is five times that of commodities funds, the share of flows coming to equity exposed funds far outweighs their share of assets managed.

This preference seems to have paid out however, as equity funds have generally risen by a wider margin than their commodity peers. For example the Energy Select Sector SPDR Fund, the largest equity focused energy ETP, has risen by nearly 10% in the last month; over twice the rise seen in oil prices. Having a dividend (the XLE yields of 1.6%) also helps in times of market stability such as those seen over the three years. With this in mind, the XLE has seen its asset base rise by nearly 50% since the start of the year after investors piled $3.53bn into the fund.

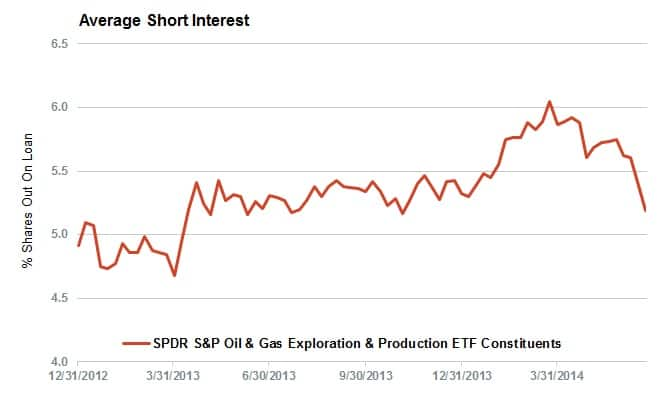

Short sellers retreat

The stagnant energy prices saw many energy firms attract short sellers, but the rebound in prices along with strong equity performance has seen shorts trim their positions over the last couple of months. The 84 constituents of the SPDR S&P Oil & Gas Exploration & Production fund, which includes both large diversified players and smaller niche exploration firms, has seen shorts retreat by over 14% in the last eight weeks as its NAV surged by a fifth.

The largest short covering was seen in Western Refinery which has seen its demand to borrow collapse to less than a tenth of what it was eight weeks ago.

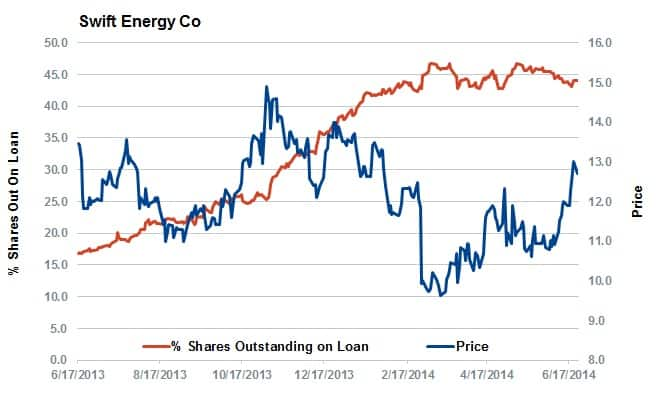

It’s worth noting that despite the steady covering, shorts are still very active in oil firms as these firms see over twice the average short interest seen in the S&P 500. On the heavily shorted side of the picture Swift Energy, Approach resources and Northern Oil have actually seen their short interest tick up slightly over the last eight weeks.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062014120000geopolitical-worries-drive-energy-investments.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062014120000geopolitical-worries-drive-energy-investments.html&text=Geopolitical+worries+drive+energy+investments","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062014120000geopolitical-worries-drive-energy-investments.html","enabled":true},{"name":"email","url":"?subject=Geopolitical worries drive energy investments&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062014120000geopolitical-worries-drive-energy-investments.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Geopolitical+worries+drive+energy+investments http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062014120000geopolitical-worries-drive-energy-investments.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}