Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 24, 2015

US homebuilders rally on buoyant data

US housing related shares are up sharply this month as homebuilders surge in the wake of strong sales numbers.

- Housing sector ETFs on track for their first inflow in three months after beating the market

- More homebuilders have seen shorts cover, compared to other housing related stocks

- Hovnanian and Mdc Holdings buck the trend, as short selling in both firms has risen sharply

The latest release of the US existing home sales survey gave cause for celebration for the homebuilding industry, as the report showed that sales volumes rose for the eighth consecutive month which sent sales to the highest level since 2009. Perhaps most encouraging for the housing sector is the fact that volumes also included a large proportion of first time buyers, who made up a third of all purchasers. With the US struggling with low home ownership rates, these new entrants to the market could provide added lift to the housing sector.

While US homebuilders have not seen the type of bullish mood seen by their UK listed peers, these impressive sales figures have certain improved investor sentiment in the region.

Housing shares surge ahead of market

Housing related shares have rallied on the back of the recent positive sales numbers. The iShares U.S. Home Construction ETF, the largest US related housing related ETF, jumped by over 2.3% this week; extending its June rally past the 4% mark. This performance puts the sector far ahead of rest of the US equity market, based on the recent 0.6% rise in the S&P 500.

The ETF's strong performance has been driven by homebuilders who make up 38% of its constituents by weight. As of yesterday's, close, the 16 homebuilders included in the fund were up by 5.5% in June so far; the largest increase seen in any of the eight constituent subsectors.

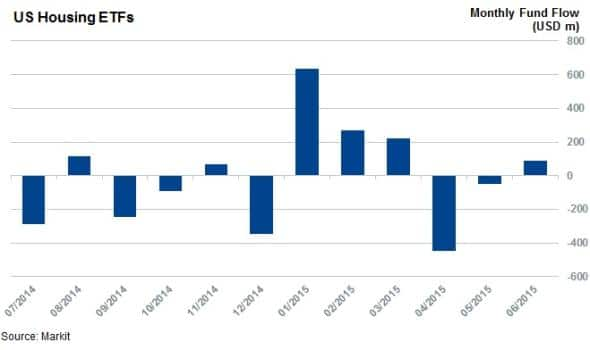

The impressive growth seen in both homebuilding shares and the housing sector in general has seen ETF investors add over $91m of exposure to the two largest housing sector ETFs; the aforementioned iShares product and the SPDR S&P Homebuilders ETF. This has helped the two funds reverse a trend which saw investors withdraw just under $500m from the two ETFs over the previous two months.

Ironically, the latest release of the existing home sales data coincided with the launch of an ultra-short product from ProShares which is aimed at investors wishing to take a negative view of the housing market.

Shorts sellers cover positions

Another encouraging sign from the recent survey was a slowdown in foreclosures and distresses sale. Foreclosures have continued to cloud the industry since the financial crisis, but the latest existing home sales data indicate that distressed homes sales are making up less of the current sales mix as well as commanding less of a discount. This suggests that the overall housing market may swing in favour of homebuilders as the recent. This changing tide in sentiment has seen short sellers move out of this section of the housing sector.

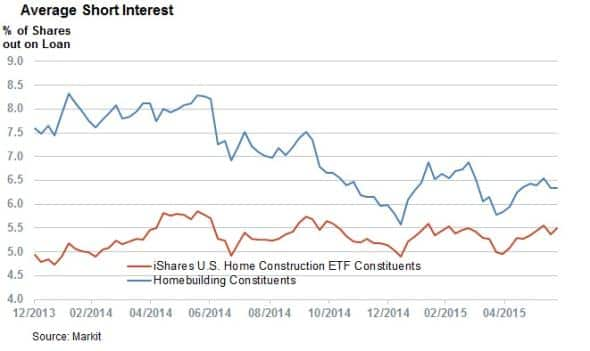

Homebuilders have historically been much more shorted than the wider housing segment, but the recent developments have seen the extra shorting activity seen in homebuilders fall to recent lows. This is best demonstrated by the fact that the average percentage of shares out on loan in homebuilding constituents of the ITB ETF has fallen from 7.6% to 6.3% over the last 18 months, while the demand to borrow shares in the overall sector has increased from 5% to 5.5%.

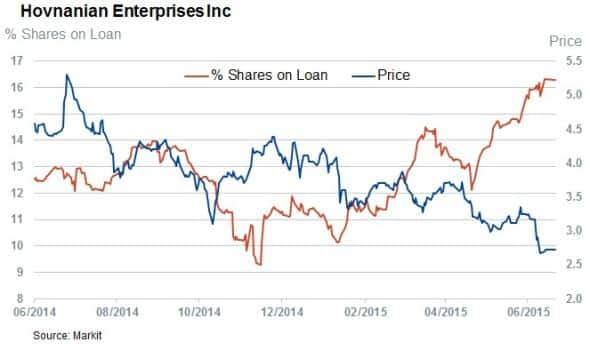

As ever in the stock market, there are exceptions to the rule with several companies failing to capitalise on the recent positive developments. Hovnanian Enterprises is chief among those with the firms recently positing disappointing earnings which has seen short sellers increase their positions by more than 50% since, to hit a two year high 16.6% of shares outstanding on loan.

The other firm to buck the covering trend is Mdc Holdings which has seen a 34% increase in demand to borrow since the start of the year to reach 17.4% of shares outstanding, making it the most shorted US homebuilder.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-equities-us-homebuilders-rally-on-buoyant-data.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-equities-us-homebuilders-rally-on-buoyant-data.html&text=US+homebuilders+rally+on+buoyant+data","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-equities-us-homebuilders-rally-on-buoyant-data.html","enabled":true},{"name":"email","url":"?subject=US homebuilders rally on buoyant data&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-equities-us-homebuilders-rally-on-buoyant-data.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+homebuilders+rally+on+buoyant+data http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-equities-us-homebuilders-rally-on-buoyant-data.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}