Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 24, 2014

US securities lending revenue on the rise

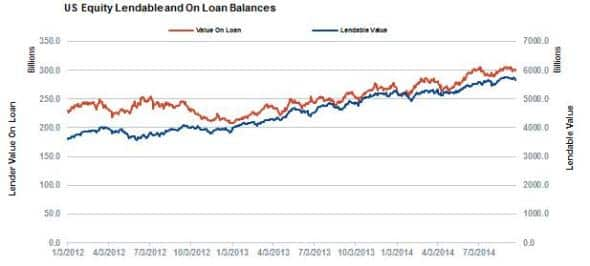

We are on track to see the most profitable year of revenues from securities lending in the last three years. Lendable and on loan balances have steadily risen as the US equity market reaches new highs.

- Daily revenue generated from securities lending for US equities is up 20% this year

- Increasing value on loan is offset by increasing lendable value, keeping securities lending return to lendable flat

- Demand for deep special stocks has increased in 2014

Equity lending

Security lending revenue decreased from for US equities from 2012 to 2013 by over $250m. This trend looks likely to reverse this year this year, owing to rising on loan balances which have been pushing up overall securities lending revenue.

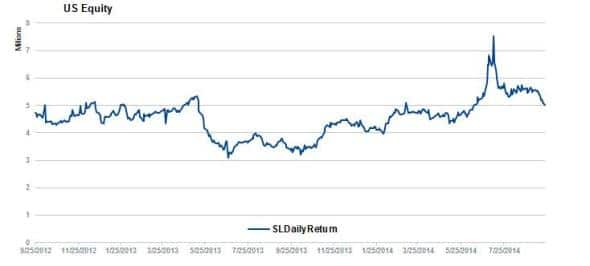

While the rise in lendable value is in line with the increase in the S&P 500, the increase in daily revenue is up over 20% year to date; two and a half times above the index jump.

Note that the spike in mid-July was primarily the result of CBS Corp's spin off of CBS Outdoor Americas Inc. On Friday July 11th and over the weekend, lending revenues for the CBS Corp alone was over $1m each day. In the following weeks, revenues quickly reverted back to normal levels below $1000 a day as the trade unwound.

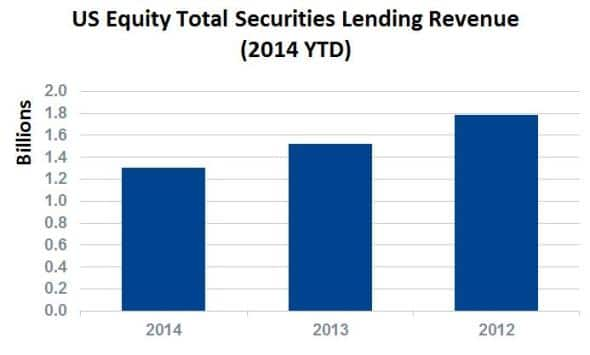

Revenues on track to return to 2012 levels

This strong return to form has 2014 on track to return to the levels seen in 2012. The year's revenue tally so far ($1.30 bn) is on track to at least match 2012's $1.79bn aggregate revenues, which could represent an approximate 15% lift in revenues.

Demand for deep specials rises

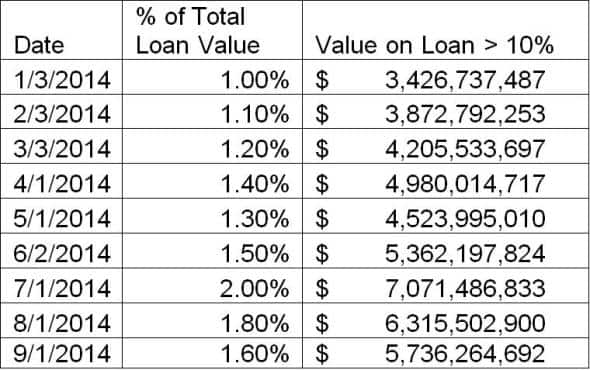

One of this year's revenue drivers has been an increase in demand for deep specials, defined as the instruments which command a fee of more than 10%.

At the start of the year there were $3.4b dollars on loan in names with > 10% fee; this increased above $7b in July and remains elevated at $5.7n as of September 1st. This increase saw deep specials make up a greater share of the overall on loan balance of US equities. Aggregate balance of deep specials represented 1.0% of the total in January; this has now increased to 1.6% on September 1st.

At the extreme end of the scale, the share of the aggregate balance in names with a fee of more than 20% more than doubled since the start of the year, moving from 0.3% of total US equity loan balances in January to 0.7% at the start of September.

Fixed Income

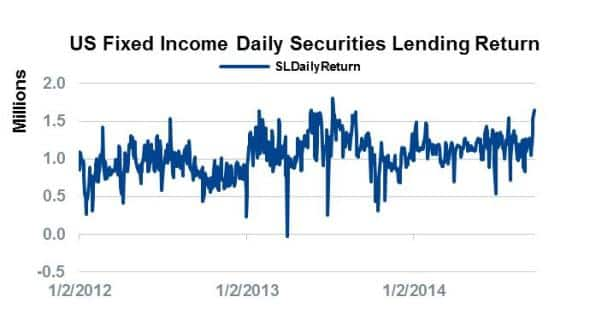

The lending of US government, corporate and convertible bonds has provided over $220m in revenue so far this year. Bonds do not see the same type of special behaviour, although there are some exceptions trade at GC levels. Daily revenues have fluctuated over the past few years, trending upwards slightly but not a significant amount.

Andrew Laird | Securities Finance Analyst, Markit

Tel: +1 646-312-8990

andrew.laird@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Equities-US-securities-lending-revenue-on-the-rise.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Equities-US-securities-lending-revenue-on-the-rise.html&text=US+securities+lending+revenue+on+the+rise","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Equities-US-securities-lending-revenue-on-the-rise.html","enabled":true},{"name":"email","url":"?subject=US securities lending revenue on the rise&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Equities-US-securities-lending-revenue-on-the-rise.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+securities+lending+revenue+on+the+rise http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092014-Equities-US-securities-lending-revenue-on-the-rise.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}