Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 24, 2015

AB InBev and VW cloud dividend outlook

Markit Dividend Forecasting is expecting Volkswagen's 2016 dividend to be suspended in light of the relentless deluge of negative news around the emissions scandal.

- Automaker exposure could put pressure on STOXX 50 dividend yield

- VW dividend expectations moderated lower with full suspension expected in 2016

- Acquisition of SABMiller could require AB InBev to rebase dividend to fund merger

Hard knocks for STOXX investors

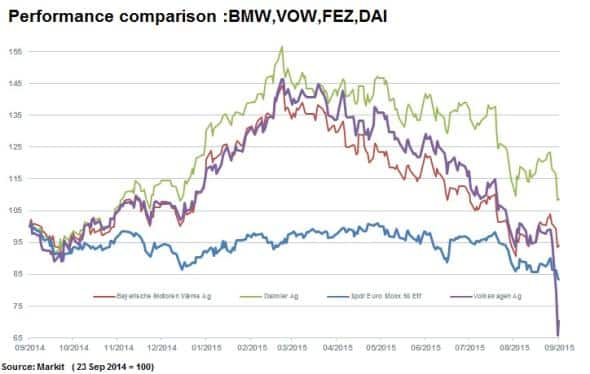

The STOXX 50 index has had a tough week. Volkswagen's (VW) emission scandal continues to spread through the automotive sector, dragging down the share prices of some of its largest constituents and dividend payers.

Additionally, the possibility of a reduced dividend from AB InBev is impacting STOXX 50 dividends in the short term. The company may need to meet funding requirements for one of the largest mergers in history if the proposed deal with SABMiller progresses.

Combining the above potential impacts reveals that approximately 4.3% of the STOXX 50 dividends for the next financial year is at risk (on a DIPS calculation basis). If the emission crisis is not limited to VW and further impacts BMW and Daimler, which could be the case, closer to 10% of STOXX 50 dividends could be at risk.

Winter gone

Current issues have seen $17bn wiped off of Volkswagen's market cap in a week that ushered the resignation of the CEO. This has also seen the market take an increasingly sceptical view of its German peers, especially in light of claims that one of BMW's SUV engines was more polluting than initially claimed.

Volkswagen at the centre

Volkswagen has set aside €6.5bn to cover potential direct costs related to regulatory fines. However, the full impact on future sales figures remains to be seen.

While Volkswagen has a substantial amount of cash, last year cash flow from operations was at around €22bn with free cash flow of around €6bn. It may become increasingly challenging to fund dividends amid difficult operations and perhaps even unpalatable to pay cash dividends in the short term. Last year the company paid total dividends of €2.2bn, €1.4bn on ordinary shares and €877m on preferred shares.

Data from Markit Pricing's Equity Volatility service shows the implied dividend for VW has fallen over 70% since Friday, down to €1.3 at close yesterday. This number was matched in the single stock dividend future price on Eurex. Accordingly Markit Dividend Forecasting has cut its forecasts for VW and looks for a suspension of the FY15 dividend, expected to be announced in late February 2016.

ETF dividends

Markit Dividend Forecasting provides coverage of a number of ETFs, including the SPDR EURO STOXX 50.

The ETF is down 8.8% year to date and has a historical yield of 3.5%. Dividends in FY16 and FY17 are currently forecast to yield 3.7% and 3.9%, respectively.

The ETF's exposure to the automakers and world's largest brewer could impact the future forward yield as forecasts and company announcements continue to react to market conditions.

A list of covered ETFs with dividend forecasts is available here.

Risk to AB InBev dividend on merger

While no offer price has been disclosed as of yet, the size of the acquisition of SABMiller is likely to require debt financing on the part of AB InBev, pushing gearing levels to 2008 peaks. This would not leave much manoeuvring room for AB InBev (but could be negated by North American asset disposals).

Based on the above, Markit Dividend Forecasting has released a full report outlining the case for a possible lowering of AB InBev's dividend. To read the full report on the risk to the AB InBev dividend please contact us.

Despite contacting VW, Markit Dividend Forecasting has not as of yet received updated comment regarding the dividend policy of VW.

To find out more about Markit's Exchange Traded Product data or Markit Dividend Forecastingplease contact us.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-equities-ab-inbev-and-vw-cloud-dividend-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-equities-ab-inbev-and-vw-cloud-dividend-outlook.html&text=AB+InBev+and+VW+cloud+dividend+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-equities-ab-inbev-and-vw-cloud-dividend-outlook.html","enabled":true},{"name":"email","url":"?subject=AB InBev and VW cloud dividend outlook&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-equities-ab-inbev-and-vw-cloud-dividend-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=AB+InBev+and+VW+cloud+dividend+outlook http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-equities-ab-inbev-and-vw-cloud-dividend-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}