Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 25, 2016

Risk widens among peripheral European bank credit

For this post:New banking rules have increased the cost of subordinated bank debt, with Europe's weaker institutions coming under investor scrutiny.

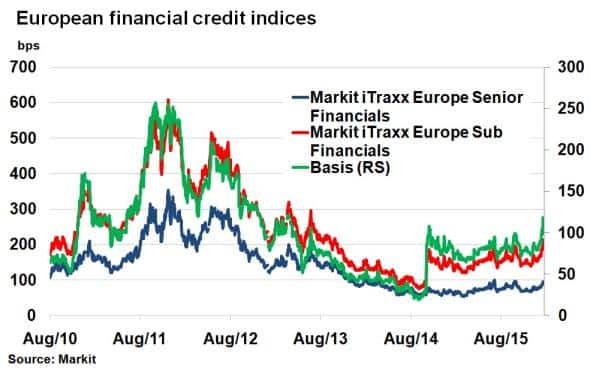

- The Markit iTraxx Europe Sub Financials index surpassed 200bps for the first time since October 2013

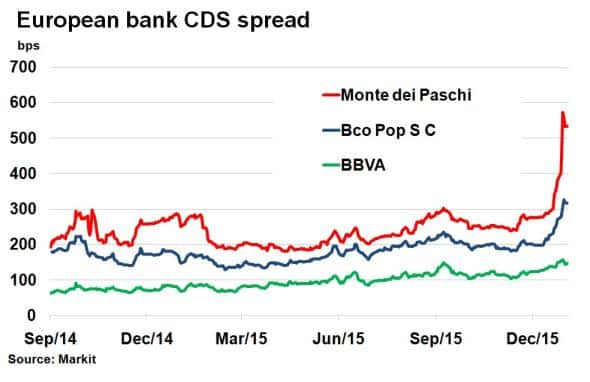

- Banca Monte dei Paschi 5-yr CDS spread has doubled since the turn of the year, now above 500bps.

- The basis between senior and subordinated financial bonds recently hit its widest level since December 2014

Last year the Markit iBoxx " Banks index was one of the outperforming bond sectors in Europe having returned 1.0%. The index which is largely made up of bonds issued by European banks, even managed to outperform defensive sectors such as Healthcare and Utilities, while Europe's ongoing regulatory oversight and relaxed monetary conditions kept market confidence in check.

Risk widens

2016 however, has started weakand this is seen by the heightened risk in Europe's major credit indices. The Markit iTraxx Europe Senior Financials index widened to 96bps last week, just 4bps tighter than at the height of the Greek crisis last July, which threatened to break up the Eurozone.

The situation is bleaker when it comes to insuring bonds lower down the capital structure. The Markit iTraxx Europe Sub Financials index widened 58bps from the start of the year to January 20th, surpassing 200bps for the first time since October 2013, and the widest level since the new 2014 ISDA definitions (that incorporated new rules around government interventions). The basis between senior and subordinated also widened to two year highs, but remains well below the levels seen during Europe's banking crisis in 2011.

The heightened risk perception in the European banking sector was sparked last month when Portuguese lender Novo Banco was forced to 'bail in' select senior bonds by the central bank in order to plug a "1.4bn capital shortfall exposed by ECB stress tests. The possibility of a CDS trigger (which is still ongoing) sent spreads considerably wider. The debacle did little to breed confidence in investors who seem dumfound by the lack of clarity among Banking Union rules.

The knock on effects were felt further last week, when Italian bank Banca Monte dei Paschi di Siena came under scrutiny as concerns over bad loans surfaced. Its 5-yr CDS spread subsequently widened to 581bps as of January 21st, more than double the value seen at the turn of the year. Risk has also spread among weaker peripheral European banks such as fellow Italian bank Intesa SanPaolo and Spanish lenders BBVA and Banco Popular. The latter have both seen significant CDS spread widening.

Bail in

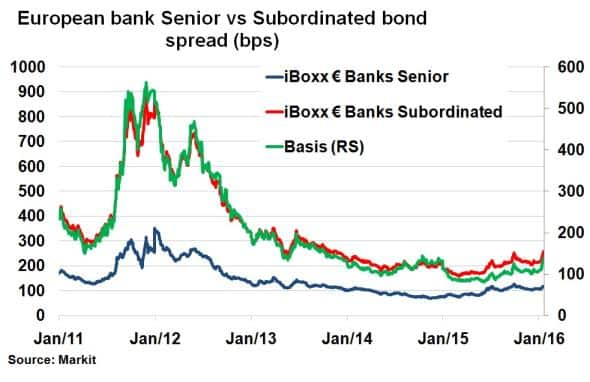

The prospect of further bondholder 'bail ins' has also widened the basis between senior bond and subordinated bond spreads as investors seek greater return under the new rules.

The benchmark spread for the Markit iBoxx " Banks Subordinated index currently stands at 250bps as of January 22nd, touching last September's highs. But the basis between subordinated and senior (as represented by the Markit iBoxx " Banks Senior index) was as high as 139bps last week, the widest since December 2014 as investors brace themselves for tougher, if somewhat controversial new banking regulation.

Neil Mehta, Analyst, Fixed Income, IHS Markit

Posted 25 January 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-credit-risk-widens-among-peripheral-european-bank-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-credit-risk-widens-among-peripheral-european-bank-credit.html&text=Risk+widens+among+peripheral+European+bank+credit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-credit-risk-widens-among-peripheral-european-bank-credit.html","enabled":true},{"name":"email","url":"?subject=Risk widens among peripheral European bank credit&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-credit-risk-widens-among-peripheral-european-bank-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk+widens+among+peripheral+European+bank+credit http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25012016-credit-risk-widens-among-peripheral-european-bank-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}