Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 25, 2016

Banks dominate shifts in CDS bond-basis

Negative sentiment around global banks has shifted the CDS-bond basis into more positive territory, while weak commodity prices continue to linger on the negative side.

- Recently, the main drivers of the CDS-bond basis have been banks Europe and commodities in the US.

- Credit Agricole's 2021 bond has seen a 104bps positive shift in CDS-bond basis this year

- Enbridge Energy Partners LP and Buckeye Partners now both exhibit a large negative basis

The CDS-bond basis captures the relative value between a cash bond and CDS contract of the same credit entity. It is defined as an entities bond swap spread subtracted from its CDS spread.

CDS-bond basis = CDS spread - cash bond spread

Both spreads measure an entity's credit risk, so theoretically the basis should be zero. In practice other factors such as liquidity and transaction costs come into play, distorting the basis and giving rise to arbitrage opportunities.

Taking advantage of a positive basis would involve selling the cash bond (paying spread) while selling protection (receiving spread) on the same credit. Conversely, a negative basis trade would involve buying the bond (receiving spread) while buying protection (paying spread) on the same credit.

Dataset

An analysis of investment grade corporate bonds sees many such discrepancies that could be arbitraged away. Our sample of bonds is taken from Markit's iBoxx indices, which only incorporates bonds of a certain issue size and bond type. Since the 5-yr point on a CDS curve is typically the most liquid tenor, only bonds maturing between June 2020 and June 2021 have been taken for practical reasons. This analysis is based on the actual CDS-bond basis (mid) as calculated by Markit's bond pricing service.

Markit iBoxx " Corporates

In Europe, the prominent theme so far this year has been the fear around the region's banking sector, which stemmed from a possible flare up of bad loans and the lending margin implications of low interest rates. Volatile global financial markets have also weighed on risk sentiment. This has seen a large positive shift in the CDS-bond basis as investors turned to CDS contracts to hedge against macroeconomic and counterparty risks.

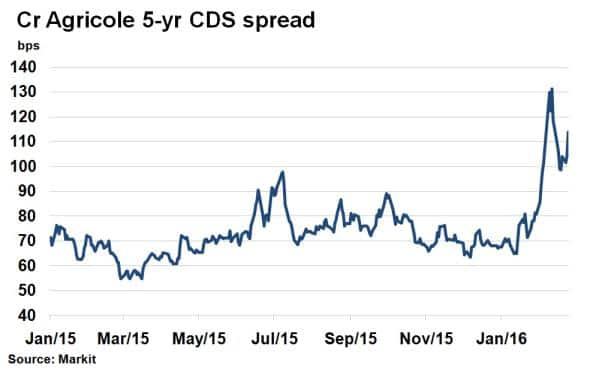

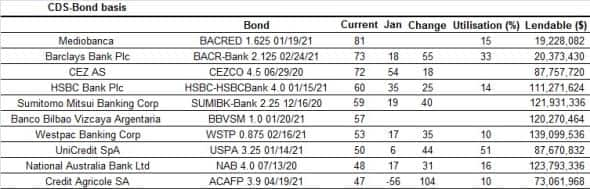

While some entities, usually multinational global or defensive corporations such as Heineken NV, EWE AG and Vattenfall AB, continue to exhibit a negative basis, the positive basis has been more prominent of late. French bank Credit Agricole SA's 3.9% coupon bond maturing in 2021 has seen the biggest change in basis, 104bps, from the start of the year (January 5th) to present (February 22nd). In this case, the basis shifted from a negative (-56bps) to positive (47bps); highlighting the swift widening in the entity's CDS spread relative to its bond.

Banks such as Mediobanca, HSBC and BBVA rank high on the list of entities exhibiting a large positive basis, as does British bank Barclays has seen its 2.125% bond maturing in 2021's basis widen to 73bps from 18bps at the start of the year. According to Markit's securities finance data, $20.4m of the bond is in lending programmes, of which only 32.7% is currently utilised; providing ample opportunity to short sell the bond to take advantage of the arbitrage opportunity.

Markit iBoxx $ Corporates

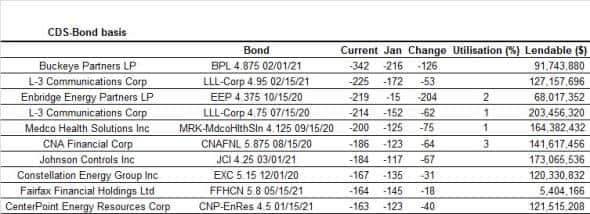

Large shifts in the CDS-bond basis among US dollar investment grade corporate bonds continues to be dominated by the commodity price complex.

Weak prices continue to exert significant clout on financial markets, especially among the oil and gas and basic materials sectors. As bond prices have tumbled, very much like their high yield counterparts, asset swap spreads in these sectors have risen, opening up a more pronounced negative basis. Enbridge Energy Partners LP has seen a -204bps shift so far this year while Buckeye Partners's 4.875% 2021 bond now exhibits a basis of -342bps.

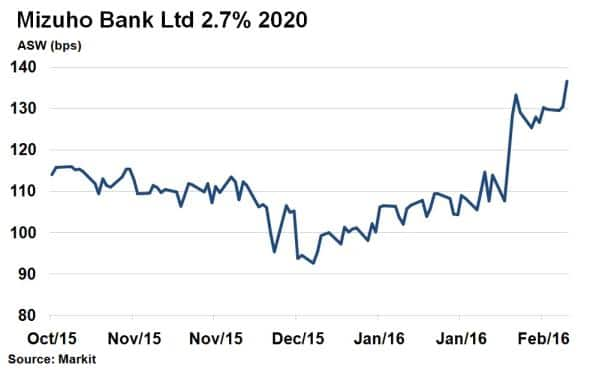

On the positive basis side, reverse -Samurai bonds (Japanese entity issuing in US dollars) dominate the list of entities that exhibit a large positive basis including Mizuho Bank Ltd (32bps), The Bank of Tokyo-Mitsubishi UFJ Ltd (30bps) and Sumitomo Mitsui Banking Corp (27bps). The introduction of negative interest rates in Japan this year has heightened credit risk while simultaneously suppressing bond yields.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-credit-banks-dominate-shifts-in-cds-bond-basis.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-credit-banks-dominate-shifts-in-cds-bond-basis.html&text=Banks+dominate+shifts+in+CDS+bond-basis","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-credit-banks-dominate-shifts-in-cds-bond-basis.html","enabled":true},{"name":"email","url":"?subject=Banks dominate shifts in CDS bond-basis&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-credit-banks-dominate-shifts-in-cds-bond-basis.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banks+dominate+shifts+in+CDS+bond-basis http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-credit-banks-dominate-shifts-in-cds-bond-basis.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}