Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 25, 2016

Exploring Argentina's successful bond return

After attracting record orders and seeing strong secondary market performance, Markit reveals the factors which contributed to Argentina's successful return to international bond markets.

- Argentina's new 10-yr bond rallied, with yields falling to 7.14% from 7.5% coupon yield

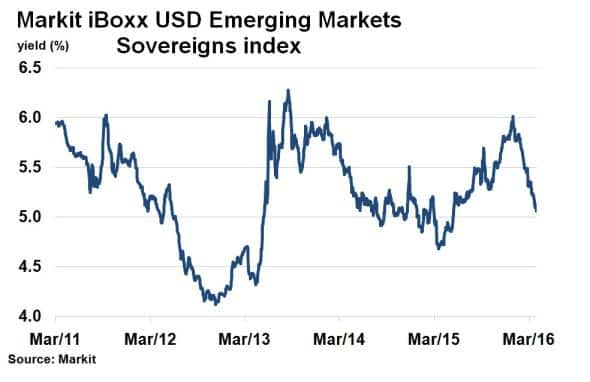

- The bond yields 200bps more than Markit iBoxx USD Emerging Markets Sovereigns index

- Latam region has seen sovereign credit spreads fall 35% since January

Last week saw Argentina return to international bond markets after a fifteen year hiatus. The return was met with strong investor demand and the bonds have rallied sharply in the secondary market.

Latin America's third largest economy sold 3-yr, 5-yr, 10-yr and 30-yr bonds at coupons of 6.25%, 6.87%, 7.5%, and 7.62%, respectively. The bonds attracted strong demand with $70bn of orders placed for just $16.5bn on offer. According to Markit's bond pricing service, secondary market performance was equally impressive, with the 10-yr 2026 bond seeing its mid yield (which moves inversely to price) falling to 7.01% on the first day of trading, before settling at 7.14% on April 22nd.

Argentina's spectacular return came as a surprise to many in the markets, given the countries default history. We assess investors' motivations for investing in a nation once widely considered a pariah.

Previous defaults were settled

Last Friday saw Argentina finally put an end to its 2001 default saga by paying off the remaining 'holdout' bondholders; paving the way for a return to the international bond market.

While a large percentage of the 2001 default bondholders had been settled over the past decade (for around 30 cents on the dollar), a small percentage of bondholders, largely US hedge funds, held out for a better deal. The legal wrangling was quickly resolved by new president Mauricio Macri, who offered the holdouts 75 cents on the dollar to settle.

The significance of the new president's swift actions and the high recovery value (much higher than a typical corporate bond) may have gone some way in instilling investor confidence in Argentina's return.

Attractive yields

Investor appetite for higher yielding bonds has returned over the past few months after a volatile start to the year in global markets. Negative yields and duration risk in developed nations has also played a part in attracting investors to higher yielding assets, such as longer dated and emerging market bonds.

Argentina's new 10-yr 2026 note currently offers a yield of 7.14%, significantly higher than the average US dollar denominated emerging market sovereign bond, which yields 5.12%, according to Markit iBoxx USD Emerging Markets Sovereign's index.

Buoyant Latam region

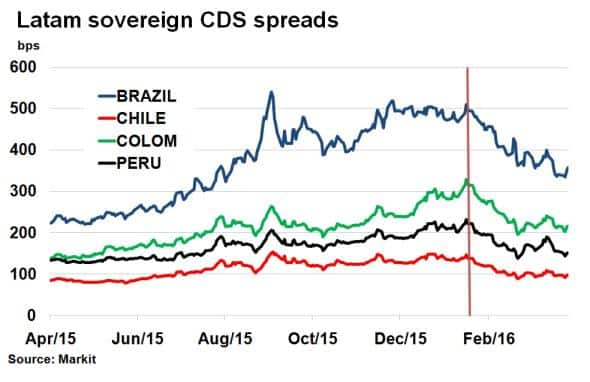

Recent optimism around neighbour Brazil has seen perceived credit risk in the wider Latam region fall to six month lows.

Peru, Chile and Colombia have all seen 5-yr CDS spreads tighten approximately 35% since negative sentiment bottomed at the beginning of 2016. Argentina's timely return has come when the Latam region is starting to recover from weak commodity prices and political tensions.

Optimistic fundamentals

President Macri's market friendly economic approach and diplomacy with holdout bondholders has done much to reduce political risk and improve investor sentiment, leading Moody's to upgrade Argentina's credit rating earlier this month. Investors have remained cautious towards broader emerging markets, stemming from fears over China and oil prices; a key driver of bond prices over the past two years. But Argentina's more diverse economy leaves them less susceptible to these factors. Although inflation and fiscal deficits remain high, judging by the performance of Argentina's new bonds, investors are betting on a sustained economic recovery.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Credit-Exploring-Argentina-s-successful-bond-return.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Credit-Exploring-Argentina-s-successful-bond-return.html&text=Exploring+Argentina%27s+successful+bond+return","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Credit-Exploring-Argentina-s-successful-bond-return.html","enabled":true},{"name":"email","url":"?subject=Exploring Argentina's successful bond return&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Credit-Exploring-Argentina-s-successful-bond-return.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Exploring+Argentina%27s+successful+bond+return http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042016-Credit-Exploring-Argentina-s-successful-bond-return.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}