Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 25, 2016

Short sellers return to Macau casino operators

Short sellers have been targeting Asian gaming stocks as Macau, which has seen three straight years of falling gambling revenues, opens two casinos in as many months.

- Short interest across Asian gambling stocks is now 10% higher than recent lows

- Wynn Macau has seen short interest jump by a third in the last month

- Non Macau-based operators not targeted in recent wave of shorting activity

The pace of Macau casino openings has kicked into overdrive recently with yesterday's opening of the $4.1bn, 1,700 room Wynn Palace which will be followed shortly by the $2.7bn, 3,000 room Parisian Macau. These ambitious openings defy the ongoing slump in gambling volumes which are on track to fall by 10% year on year; further compounding last year's 34% decline as gamblers shy away due to China's ongoing corruption crackdown.

While the Macau gaming industry is trying to diversify away from its core revenue into the retail and entertainment space, recent statistics released by the region's tourism board have shown falling retail volumes and flat visitation numbers which underscores the challenge at hand. These numbers are echoed across the other key Asian gaming markets which have also felt the pain of newly shy Chinese gamblers.

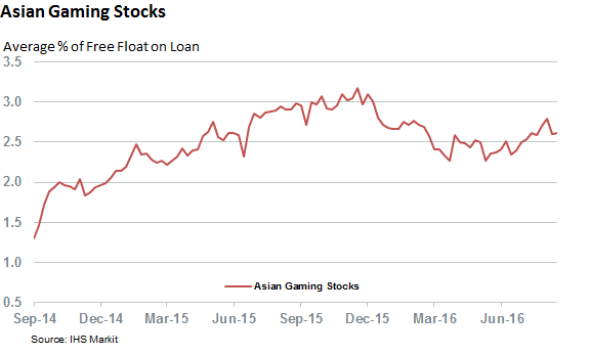

Short sellers, who are no strangers to taking a view on gambling stocks, have been busily adding to Macau operator short positions in the weeks leading up to yesterday's opening of the Wynn Palace which has in turn taken the average shorting activity across the region's gaming sector back up from recent lows. Current average short interest across the region now stands at 2.6% of free float on average, 10% higher than the lows set three months ago.

Shorting Macau

Wynn Macau and Sands China, which operate the Parisian and Palace properties, have been at the vanguard of the recent surge in shorting activity in the region.

Wynn has been a favorite for Macau bears for quite some time and the 32% jump in shares shorted over the last month means that bearish sentiment in the stock now stands at a six month high. Although the company's current short interest is still over a third lower than at the heights of last year's uncertainty, the resurgent short interest indicates that Wynn still has to placate its doubters.

Sands China has also seen its fair share of shorting activity in recent weeks with short sellers adding 20% to their positions, meaning that just under 3% of its free float is now shorted.

Melco international and Crown Resorts, which jointly operate the recently opened Studio City development have also seen short sellers circle in recent weeks with demand to borrow shares of the later doubling in the last month.

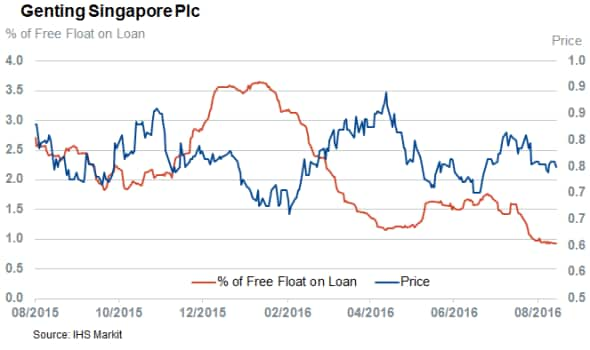

The recent jump in bearish sentiment has been limited to Macau operators for now as demand to borrow shares in Kangwon Land and Genting Singapore, the two largest non-Macau operators by market share, has not jumped materially in recent weeks. This would seem to indicate that short sellers aren't expecting the new Macau capacity to have any impact on the region's other markets in the near term. In fact, Genting's current short interest is now the lowest it's been in over three years

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082016-equities-short-sellers-return-to-macau-casino-operators.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082016-equities-short-sellers-return-to-macau-casino-operators.html&text=Short+sellers+return+to+Macau+casino+operators","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082016-equities-short-sellers-return-to-macau-casino-operators.html","enabled":true},{"name":"email","url":"?subject=Short sellers return to Macau casino operators&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082016-equities-short-sellers-return-to-macau-casino-operators.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+return+to+Macau+casino+operators http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082016-equities-short-sellers-return-to-macau-casino-operators.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}