Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 25, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Over a quarter of Energy Xxi shares shorted despite a collapse in its share price

- Software firms Globo and Rocket Internet see shorts add to their positions before earnings

- Textile machinery firm Tsudakoma has 3% of shares shorted after recent underperformance

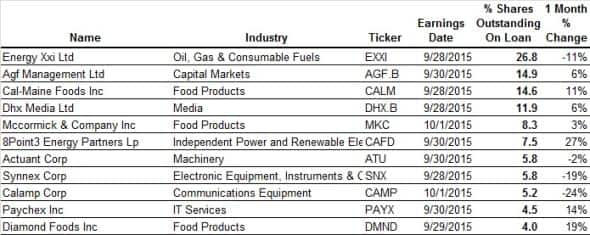

North America

The week's most shorted share globally is oil exploration firm Energy Xxi, which has 26.8% of its shares now out on loan. The ravages of the oil price collapse have taken their toll on the company, with shares now over 90% in the last 12 months. This looks to have prompted some short sellers to cover as demand to borrow the firm's shares is down by a tenth in the last four weeks.

The headwinds in the energy space have also hurt utilities firms indirectly, which has seen short sellers converge to the sector. This trend means that newly listed 8Point3 Energy makes the list of the most shorted shares ahead of earnings with 7.5% of its shares out on loan ahead of earnings. This demand to borrow the firm's shares has paid off up to now as 8Point3 Shares have fallen by a third from the highs seen in its trading debut.

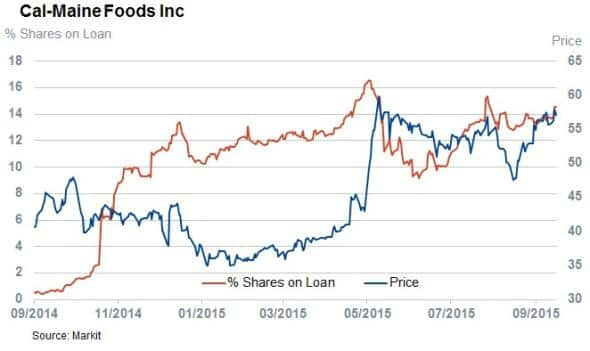

Specialty foods manufacturers are also on the menu for short sellers this week with nut firm Diamond Foods and egg producer Cal-Maine Foods both making this week's most shorted list. Both firms have seen short sellers add to their positions by more than 10% in the month leading up to earnings, but this has proven to be a tough meal to swallow. Both firms have seen their shares be largely resilient in the face of the recent market downturn.

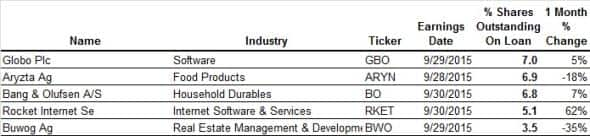

Western Europe

Food manufacturers are also on the list of the most shorted firms ahead of earnings this week with confectioner Aryzta seeing just under 7% of its shares out on loan ahead of earnings. Short sellers have been relatively late to the game with this firm seeing demand to borrow only climb past the 4% mark after its shares were down by a third from the highs seen in the middle of last year. Demand to borrow has since climbed to 8%, but short sellers have been trimming their positions in the run-up to next week's earnings announcement.

Sector wise, two internet firms, Globo and Rocker Internet, make the most shorted firms in this week's screen. The latter has seen short sellers continue to add to their positions since its IPO at the end of last year. Rocket has been controversial for building a business model based on backing copies of businesses it views as underserved in global markets. The market looks to be sold on the firm's model, however, as its shares are down by 40% from their trading debut.

High end electronics firm Bank & Olfsen also make this week's list with 6.8% of shares out on loan. The firm disappointed in its last earnings round, propelling short sellers back up the 6% mark.

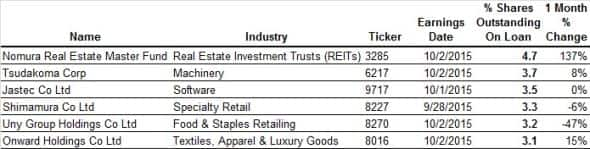

Asia Pacific

Asia sees relatively low earnings activity next week with no firm seeing more than 5% of shares out on loan in the run-up to earnings.

The Nomura Real Estate Master Fund Inc is the most shorted equity listing leading up to earnings though the recent borrow activity looks to be tied to its ongoing merger with a fellow REIT.

Tsudakoma is the second most shorted firm leading up to results with 3.7% of shares out on loan. Borrow demand for the textile equipment manufacturer has picked up by 8% in the last four weeks as the firm lowered its projections for the year's profit forecast by over a quarter. Its shares have also faced headwinds and are currently down by over a quarter year to date.

Simon Colvin, Research Analyst at IHS Markit

Posted 25 September 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25092015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25092015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25092015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25092015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25092015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}