Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 26, 2016

Brazilian bond returns rally; Irish election jitters

Despite another downgrade to junk status, Brazilian sovereign bonds have been a stand out performer so far this year. Meanwhile Irish sovereign credit risk soars as election jitters develop.

- Markit iBoxx USD Brazil Sovereigns Index has returned 5.7% year to date

- Ireland's 5-yr CDS sovereign spread has widened 69% this month pre-general election

- Leveraged loans returns have stemmed their freefall over the past week, gaining 14bps

Brazilian bonds sizzle

Moody's downgraded Brazil's government bond rating to junk (below BBB) this week, the last to do so among the major rating agencies. The recession-ridden South American nation continues to be hampered by political wranglings and a challenging economic environment.

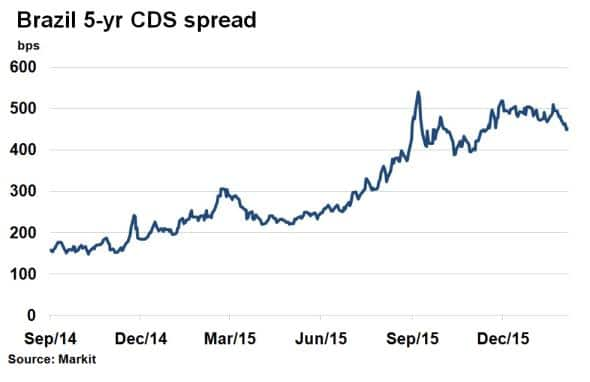

Brazil's 5-yr sovereign CDS spread, a proxy for credit risk, has continued to remain at elevated levels after doubling over the past year. According to Markit's CDS pricing service, the current spread of 452bps implies a single B credit rating based similar credits in the sector, suggesting more downgrades to come.

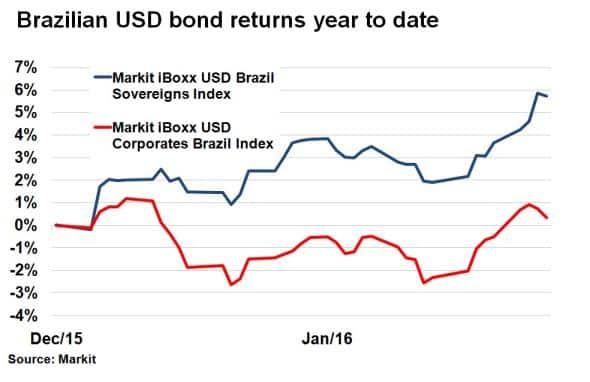

Despite this, Brazilian bonds have performed well so far this year, beating the returns of developed nation sovereign bonds such as US treasuries and German bunds. Credit spreads have tightened 22bps over the past week amid a more positive commodity price backdrop and this has spurred on returns on bonds offering attractive yields. The Markit iBoxx USD Brazil Sovereigns Index has returned 5.7% year to date, while corporate bond counterparts, as represented by the Markit iBoxx USD Corporates Brazil Index, have seen returns rise into positive territory for the year.

Irish election

The people of Ireland go to the polls today in a tightly contested general election, coming with it political uncertainty. The incumbent coalition government administered a mighty economic recovery post 2011's EU and IMF bailout, making Ireland one of the fastest growing nations in Europe over the period. But with it came austerity, and voters may be swayed towards smaller parties, increasing the chances of a hung parliament.

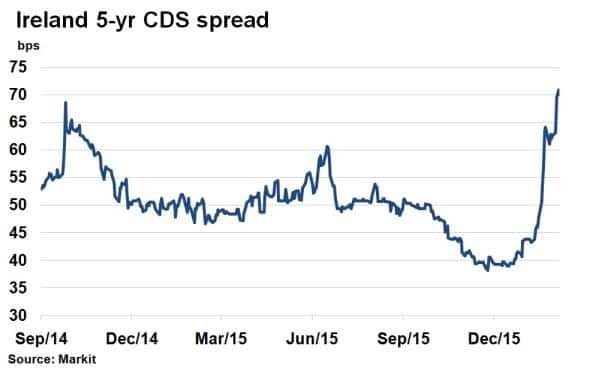

The uncertainty has led to a sharp widening of Ireland's 5-yr CDS sovereign spread, which has leapt 69% so far this month. Other European countries such as Portugal, Spain and Greece saw similar moves amid political uncertainty last year and investors are keen to hedge their potential downside risks.

Loans halt freefall

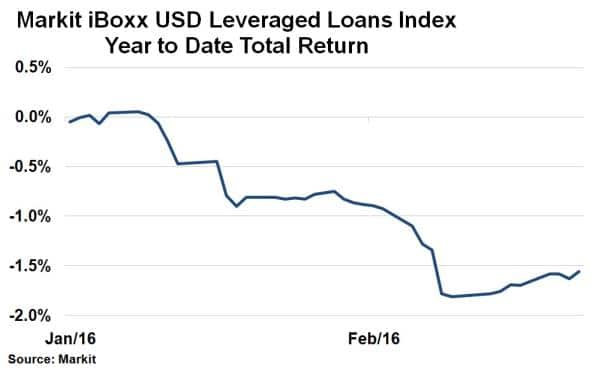

Along with high yield bonds, leveraged loans have had a torrid past year. Returns have been in freefall and defaults in the asset class are rising.

But over the past week sentiment among the riskiest forms of debt has been turning, as represented by the returns on the Markit iBoxx USD Leveraged Loans Index, which have gained 14bps over the past week. The index however remains down 1.56% on total return basis year to date, but the freefall has been stemmed for now.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-credit-brazilian-bond-returns-rally-irish-election-jitters.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-credit-brazilian-bond-returns-rally-irish-election-jitters.html&text=Brazilian+bond+returns+rally%3b+Irish+election+jitters","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-credit-brazilian-bond-returns-rally-irish-election-jitters.html","enabled":true},{"name":"email","url":"?subject=Brazilian bond returns rally; Irish election jitters&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-credit-brazilian-bond-returns-rally-irish-election-jitters.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazilian+bond+returns+rally%3b+Irish+election+jitters http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26022016-credit-brazilian-bond-returns-rally-irish-election-jitters.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}