Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 27, 2015

REITs reeling in returns

A recent report released by Markit's Research Signals reveals the significant outperformance of REITs in 2014 versus the broader market. Here the report's findings are analysed, delving into the deeper details behind the performance and investor's recent affair with the asset class.

- Record amount of investment flows into REIT exposed ETFs close on $8bn

- REIT model delivers cumulative excess returns of 74% since inception

- US REITs delivered total return of 30% in 2014, easily beating the broader market

US REITs; a recipe for success

Real estate investment trusts or REITs are companies that own or finance income producing real estate investments. As an asset class, REITs have become more desirable as investors continue to hunt for higher returns. Influenced by treasury yields pushing down, impacted by lower global interest rates, REITs' relative attractiveness to other asset classes has increased.

Higher yields, stronger economic activity, increased consumer confidence, positive jobs data and falling oil prices fuelled demand for REITS in 2014 and sent prices up - delivering substantial returns of over 30% to investors in the US.

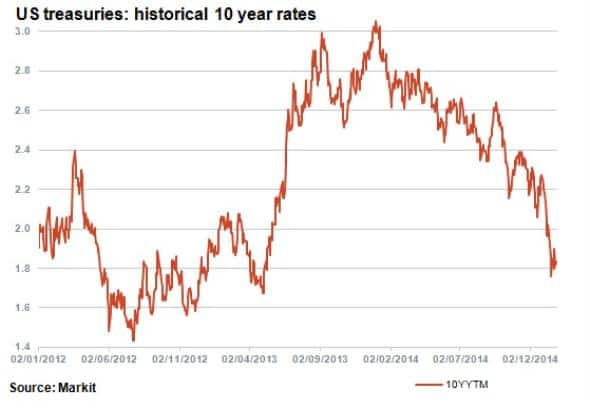

Yields on fixed income investments decreased dramatically in 2014. Influenced by the decrease in treasury rates; US 10 year yields decreased by 28.7% in 2014, increasing the relative appeal of REIT's yields.

Record ETF fund inflows

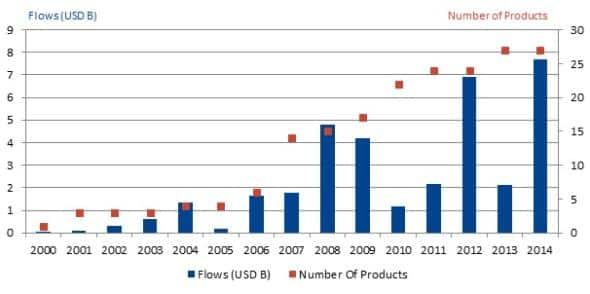

ETF inflows into products exposed to US REITs confirm that investor demand for exposure to the segment grew rapidly in 2014. Inflows reached almost $8bn in 2014, surpassing 2012's record of $6.9bn and overshadowing 2013's slowdown after inflows dropped to a $2.1bn.

The largest single name REIT ETF, with 77% of total AUM exposed to REIT investments in the US, is the Vanguard REIT ETF. With ticker VNQ, the funds AUM increased by 40% from $17.9bn in January 2014 to reach $29.8bn at present. During this time the fund's price increased by 34%.

Markit's REIT Model

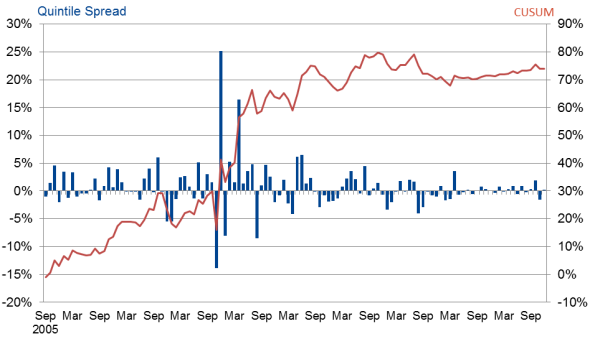

Markit's Research Signals REIT model went live in September 2005 with an initial universe of 115 US REIT names. Currently there are 133 individual REITs in the universe.

The model employs a bottom up approach to systematically evaluate publicly listed REITS by combining various fundamental indicators, property-level metrics and investor sentiment to create a composite ranking value. A composite ranking of companies is then complied to create a list of entities in the universe poised to outperform or underperform. The ranking is formulated by the use of eight modules* and the REITS are ranked according to the modules methodology*.

To confirm the model's effectiveness, a long short spread is calculated, which is obtained by theoretically going long the highest ranked quintile of REITs within the universe, and shorting the lowest ranked quintile of REITs.

Bad names performing badly

The model's returns have been reinforced by an underperformance of the lowest ranked REITs as short selling the fifth quintile REITS delivered significant returns. These REITs underperformed their peers by an average of 0.45% since the model was rolled out, driven by the fact that they trailed their peers in two out of every three months in the observation window.

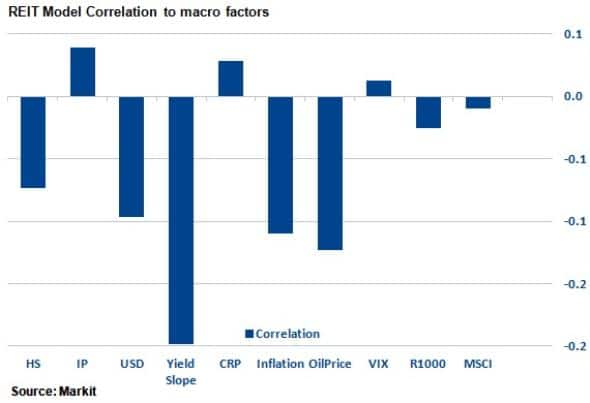

Correlating the model's return with other macro events provides some interesting results as it shows that by and large investors bid up high quality REITS in times of market stress. High scoring REITS outperform their poorly ranked peers in times when the yield curve slope falls; a phenomenon usually interpreted as a sign of stress in the fixed income markets, which could explain the recent factor performance.

In 2014 the average total return performance of US REITs larger than $5bn in market capitalisation, representing 48 securities, was 31%. The average performance year to date on the same group across the same universe is already 7.8%. As lower inflation levels lengthen the expected time horizon until central banks raise interest rates, REITS may be set to deliver another market-beating year.

*To access the full report on the modules, factor details, single names and current rankings of the Markit REIT model and others, please contact us.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-equities-reits-reeling-in-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-equities-reits-reeling-in-returns.html&text=REITs+reeling+in+returns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-equities-reits-reeling-in-returns.html","enabled":true},{"name":"email","url":"?subject=REITs reeling in returns&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-equities-reits-reeling-in-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=REITs+reeling+in+returns http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-equities-reits-reeling-in-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}