Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 27, 2015

Kraft tie up lifts Heinz bonds; Greek credit woes

The Heinz merger with Kraft has resulted in rewards for bondholders while in Europe, Greece has regained centre stage as its credit deteriorates.

- Heinz bonds surged as yields converge with Kraft

- Greek CDS spreads continued to deteriorate and now imply a 75% chance of default

- Singapore replaced Australia as the highest yielding AAA rated government issuer

Kraft Heinz Co.

On March 25th, ketchup manufacturer Heinz Foods announced its intention to merge with Kraft Foods to create the third largest food and beverage company in North America. The $50bn acquisition was engineered by iconic value investor Warren Buffet and private equity firm 3G.

The move proved beneficial for existing holders of Heinz bonds as the 7.125% 2039 bonds saw its price surge by over 23% on announcement to $133.75. The last time that issue yielded less than 5% was just prior to a $23bn leveraged buyout by Warren Buffet.

The newly created company will not take on additional debt, meaning Heinz bondholders stand to benefit from Kraft's much better debt position and investment grade status. It was therefore no surprise that yields on the firm's bonds converged.

An equivalent Kraft issue, the 6.5% 2040, was yielding 4.54% after the news, 18bps less than the previously mentioned Heinz bond issue. Interestingly for an acquiring company, Kraft's bonds tightened by 14bps in the wake of the announcement, suggesting that the market thinks that the combined company stands to be advantageous for both sets of investors.

Greece has another go

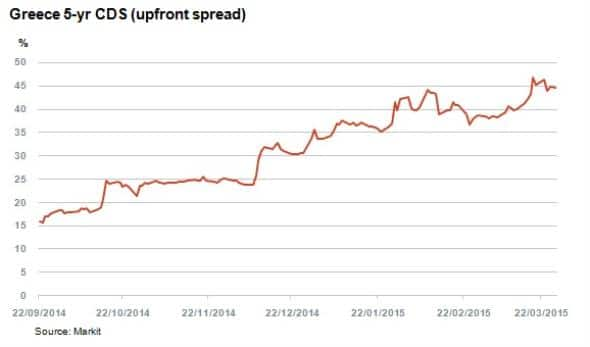

The big move in European credit markets this week came from Greece as the country approaches a €450m IMF loan repayment on April 9th. Greece has so far failed to reach agreement with European creditors over its plans to ease austerity. Greek policy makers are set to propose another set of reforms on Monday in their latest attempt to unlock bailout money, but the markets holds little faith of significant moves if CDS spreads are anything to go by.

Greece's 5-yr CDS spread hit 47% (upfront) towards the end of last week and continues to hover around that level. The cost to insure against Greek government default has been steadily rising since the middle of last year and every period of stabilisation has been met with further threats of a Grexit and eventual default. Swaps were implying a probability of default within five years of 69% just after talks between Greece and Europe broke down in February. However, that figure has now risen to 75%, with no end in sight.

Singapore

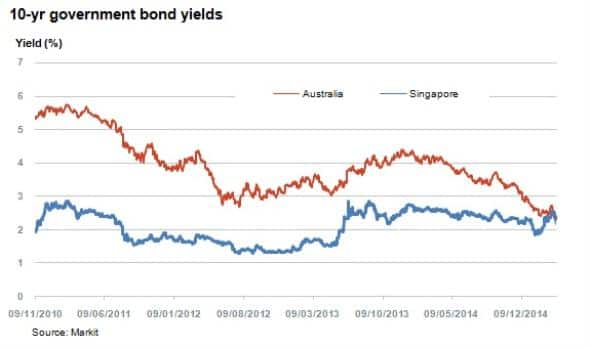

Income investors take note: Singapore has surpassed Australia as the highest yielding AAA government this week. As the only AAA rated Asian country, Singapore's 10-yr bonds yielded 2.49% at the start of the week compared to Australia's 2.39%.

Five years ago, the gap was 3.4%, but Australian has since enacted a loose monetary policy which has seen its bond yields fall significantly while Singapore yield have moved in the opposite direction.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-Credit-Kraft-tie-up-lifts-Heinz-bonds-Greek-credit-woes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-Credit-Kraft-tie-up-lifts-Heinz-bonds-Greek-credit-woes.html&text=Kraft+tie+up+lifts+Heinz+bonds%3b+Greek+credit+woes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-Credit-Kraft-tie-up-lifts-Heinz-bonds-Greek-credit-woes.html","enabled":true},{"name":"email","url":"?subject=Kraft tie up lifts Heinz bonds; Greek credit woes&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-Credit-Kraft-tie-up-lifts-Heinz-bonds-Greek-credit-woes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Kraft+tie+up+lifts+Heinz+bonds%3b+Greek+credit+woes http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032015-Credit-Kraft-tie-up-lifts-Heinz-bonds-Greek-credit-woes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}