Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 27, 2015

Signs of revival in covered bonds

Covered bonds remain out of favour with investors, but the recent reduction in volatility may help kick start the market.

- Covered bond yields doubled over the past month but investor demand remains muted

- Recent selloff in German bunds has coincided with covered bond spreads tightening

- Primary market issuance has slowed amid the recent volatility, but Sparkasse reignites

Just last month, it was reported ETF investors tracking covered bond indices were fleeing the asset class at a record pace. Low yields, driven by ECB buying in the asset class, had investors chasing yields elsewhere.

Covered bonds are a type of secured bond, predominantly issued in Europe. They are favoured by regulators for their rigidity and have been an integral part of the ECB's QE programmes since the financial crisis. No covered bond has ever defaulted in its hundred plus year history.

The past month however has seen yields across European sovereign bonds rise, with yields of euro denominated covered bonds rising in tandem. It was not long ago that market participants thought it inevitable that the ECB would have to have to buy negative yielding covered bonds. On April 20th, approximately 10% of the Markit iBoxx EUR Liquid Covered Index returned a negative yield; this has since shrunk to zero.

Yields double

The ECB's covered bond buying programme was creating a distortion between supply and demand. Buying has been more active in the secondary market, squeezing out private investors, who started to focus buying further up the term structure and towards lower quality, peripheral European financial institutions.

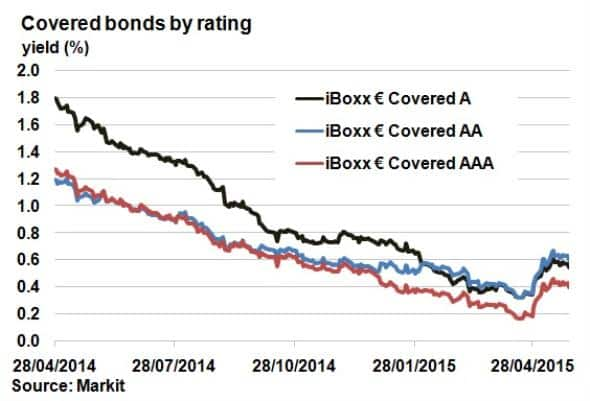

Yields were in steady decline for much of 2014, before the Markit iBoxx € Covered AAA index hit its lowest in April 2015, yielding below 0.2%. Lower rated covered bonds also converged towards zero, tightening the spread between them and AAA rated covered bonds.

Since mid-April yields have doubled, but from an investor's perspective, the recent rise has has done little in terms of creating demand for covered bond ETFs, with outflows continuing (albeit minimal).

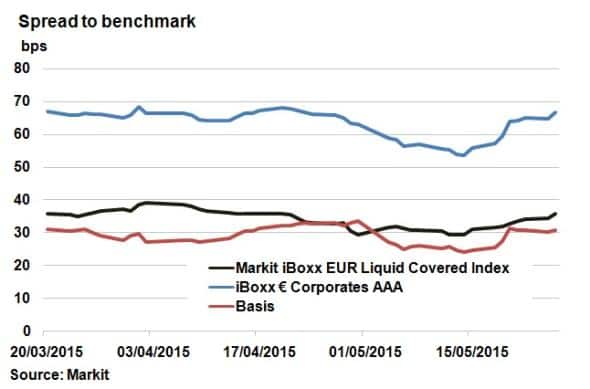

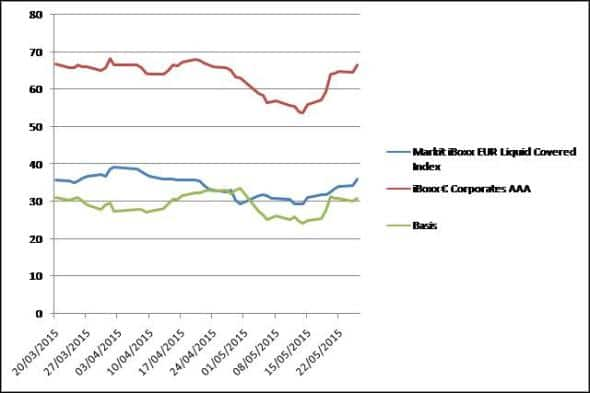

This negative sentiment might be due to the fact that yields are higher, but risk of holding alternative assets has remained consistent. The basis between the Markit iBoxx EUR Liquid Covered Index and the Markit iBoxx € Corporates AAA index has remained at around 30bps over the past month.

Primary market stalls

The recent volatility in European sovereign bonds has also had a big impact in the primary issuance market, which has grinded to a halt over the past month.

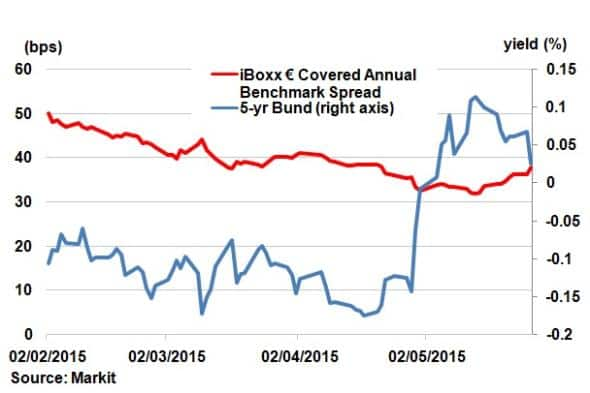

From April 20th to May 15th, 5-yr bund yields increased from -0.15% to 0.1% while covered bond spreads tightened. The iBoxx € Covered annual benchmark spread tightened from 38bps to 33bps but has since returned to 38bps. This suggests that the large swings in underlying rates were having an effect on pricing risk efficiently, hence why issuers decided they would be better off waiting.

The ten days has seen a notable reduction in volatility, helped by ECB rhetoric suggesting that it would be front loading QE purchases ahead of expected lower levels of liquidity in the summer. Movement in covered bond yields have since flattened out and talks of kick starting primary market issuance have begun with Sparkasse KolnBonn, an AAA German pfandbrief issuer looking re open the market.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-credit-signs-of-revival-in-covered-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-credit-signs-of-revival-in-covered-bonds.html&text=Signs+of+revival+in+covered+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-credit-signs-of-revival-in-covered-bonds.html","enabled":true},{"name":"email","url":"?subject=Signs of revival in covered bonds&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-credit-signs-of-revival-in-covered-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Signs+of+revival+in+covered+bonds http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27052015-credit-signs-of-revival-in-covered-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}