Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 27, 2016

Investors favour high yield bonds following Brexit vote

Despite the rising risk in credit markets after last week's Brexit vote, investors' appetite for high yield bonds has remained resilient.

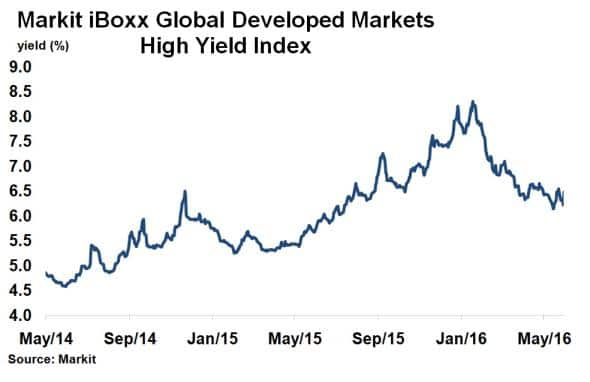

- Markit iBoxx Global Developed Markets High Yield Index saw yields rise 26bps to 6.48%

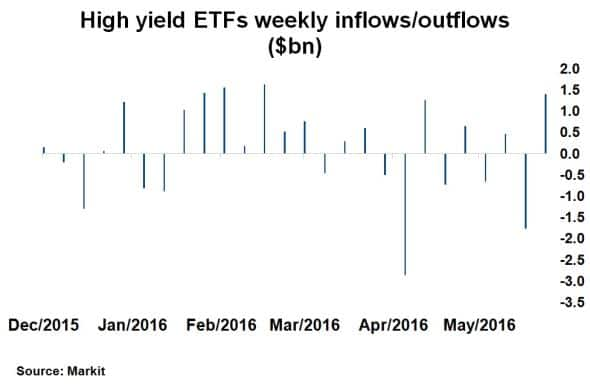

- ETFs tracking high yield bonds saw $1.38bn inflows last week despite Brexit volatility

- Day after Brexit vote saw $254m of inflows into high yield ETFs

Britain's shock decision to leave the European Union last week has pushed investors firmly into risk off mode. 'Safe haven' government bond yields have tumbled and credit markets have seen risk rise sharply. But despite the heightened level of uncertainty in global markets, the riskiest end of the corporate bond market - high yield (HY) - has seen continued to attract investors.

Investors keen on HY

Global high yield bonds, as represented by the Markit iBoxx Global Developed Markets High Yield Index, saw yields rise 26bp to 6.48% the day after the referendum result. While large in terms of a single day move, yields are still nearly 2% lower than the highs seen following the volatility seen at the start of the year. Brexit was viewed as a global risk off event, but some markets have evidently reacted in a more subdued manner than others.

In fact, investors have continued to turn towards the high yield bond market for returns. According to Markit's ETP analytics service, last week saw $1.38bn flow into ETFs tracking high yield bonds. It was the largest weekly inflow since the week starting March 14th and last Friday (day after Brexit) saw $254m of inflows as investors piled money into high yield ETFs.

While the Brexit vote brings economic and political uncertainty, especially in Europe, central bankers and policy makers have been quick to reassure a soft landing. Much of the global HY bond market is concentrated in the US, and the Brexit vote has already reduced the probability of another US interest rate increase this year plummeting Yields remain attractive in comparison to safe haven assets, and the key drivers of HY risk over the past two years, crude oil and commodity prices, have recovered since February's depths.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27062016-Credit-Investors-favour-high-yield-bonds-following-Brexit-vote.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27062016-Credit-Investors-favour-high-yield-bonds-following-Brexit-vote.html&text=Investors+favour+high+yield+bonds+following+Brexit+vote","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27062016-Credit-Investors-favour-high-yield-bonds-following-Brexit-vote.html","enabled":true},{"name":"email","url":"?subject=Investors favour high yield bonds following Brexit vote&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27062016-Credit-Investors-favour-high-yield-bonds-following-Brexit-vote.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+favour+high+yield+bonds+following+Brexit+vote http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27062016-Credit-Investors-favour-high-yield-bonds-following-Brexit-vote.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}