Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 27, 2016

Refinery shares stumble as margins crack

Refining shares were the winning energy trade during the recent market slump, but slipping margins have seen these stocks lose their hard earned gains while also attracting short sellers.

- Short interest in refinery shares is up by a quarter while upstream firms have seen covering

- Western Refining, Hollyfrontier and Pdf Energy all have more than 7% of shares shorted

- Refinery shares have underperformed oil exploration and production firms by 20% this year

Downstream refinery activity proved to be the most resilient part of the oil value chain over the last two years, but the relative stability offered by refining is eroding in the face of growing oversupply.

High distilled goods production and a resulting build up in unsold inventory have eroded profit margins in the segment. A recent report on oil uncertainty from the US Energy Information Association stated that the pace of gasoline production in June was "likely putting downward pressure" on prices. These refining headwinds are filtering through to company results as oil giant BP, the first integrated oil major to report second quarter earnings, reported its lowest second quarter refining margin since 2010 on Tuesday.

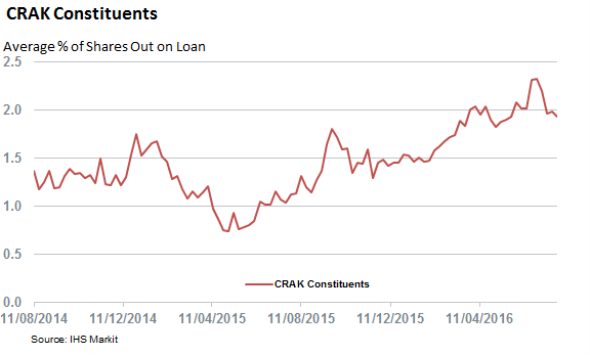

These shrinking margins have seen short sellers hone in on refinery exposed shares which make up the VanEck Vectors Oil Refiners ETF which trades under the CRAK ticker.

These companies have seen their average short interest surge by a quarter since the start of the year and had more than 2.3% of their shares shorted at the end of last month, the highest level in over two years. All this runs against that seen in the rest of the energy sector which has seen shorts cover a fifth of their positions year to date (ytd).

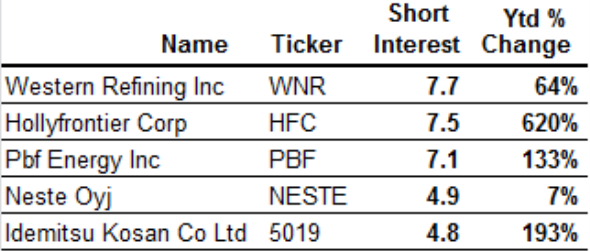

US shares most targeted

US refiners have driven this surge in shorting activity as US traded Western Refining, Hollyfrontier and Pdf Energy make up three of the four firms that have seen their short interest increase by more than 3% of shares outstanding since the start of the year. These three firms now make up the entirety of the CRAK constituents that see more than 7% of shares shorted.

The other firm seeing a large surge in short interest among CRAK constituents is Japanese refiner Idemitsu Kosan although its ongoing merger with rival Showa Shell Sakiyu could be driving the shorting activity.

All four firms are due to announce earnings in the next seven days which should provide some greater insight into the situation.

Refinery shares underperform

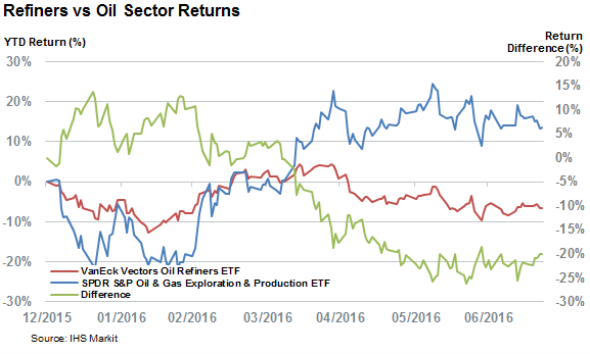

This surge of shoring activity has occurred in the wake of some fairly severe underperformance for the sector as the CRAK ETF, which was a winning energy bet at the start of the year, has given up all of the relative outperformance. The ETF now lags its largest oil related peer, the SPRD S&P Oil & Gas Exploration & Production ETF, by 20% year to date on a total return basis.

Most of the increase in shorting activity occurred prior to the most severe underperformance seen since April which indicates that short sellers have timed their rotation into refiners well.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-equities-refinery-shares-stumble-as-margins-crack.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-equities-refinery-shares-stumble-as-margins-crack.html&text=Refinery+shares+stumble+as+margins+crack","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-equities-refinery-shares-stumble-as-margins-crack.html","enabled":true},{"name":"email","url":"?subject=Refinery shares stumble as margins crack&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-equities-refinery-shares-stumble-as-margins-crack.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Refinery+shares+stumble+as+margins+crack http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072016-equities-refinery-shares-stumble-as-margins-crack.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}