Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 27, 2014

Gauging negative investor sentiment

We analyse the informational content in the shares seeing the greatest proportion of lending program inventory out on loan, finding the most in demand US small cap shares have consistently underperformed over the last five years.

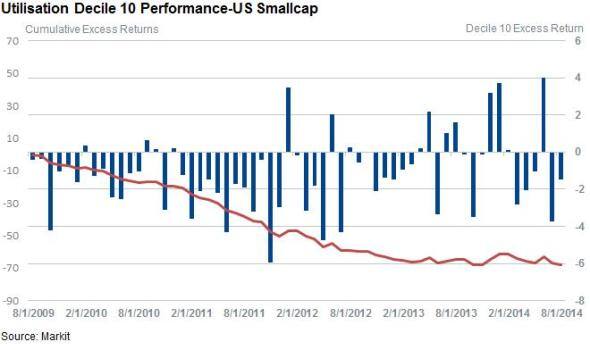

- The 10% of US smallcap shares with the highest demand to borrow relative to available shares have underperformed the market by a cumulative 70% in the last five years

- The most in demand shares have underperformed by three out of four months over this period

- Biotech and Pharmaceutical shares see highest short interest

As with the fee charged to borrow a share in the securities lending market, the proportion of shares out on loan in a lending program provides a good gauge of negative investor sentiment. This utilisation number climbs as short seller appetite grows, with the most in demand shares often seeing more than 90% of all inventories out on loan, as is the case in recently listed El Pollo Loco.

Analysts looking to gauge negative investor sentiment ought to take heed of this number as it provides insights into names which aren't widely held by institutions who lend their assets. This is particularly useful for small cap names where negative sentiment may be high, but the aggregate short base, as measured by the proportion of shares outstanding, remains low owing to the fact that short sellers have a small pool of shares to borrow in order to sell short.

Most borrowed consistently underperform

In the US market, the 10% of shares which see the greatest securities lending utilisation have consistently lagged behind their peers over the last five years. The cumulative underperformance across this group of shares cumulates to 68% over the last five years. On a consistency basis, the number of months when the most in demand names underperform the market outnumber those when they outperform by a factor of three to one, making it one of the most consistent factors in Markit Research Signal's suite of factors for the US Smallcap universe.

This makes the most shorted group the least well performing of the ten decile groups when ranking by utilisation by quite a margin. On a monthly basis, the most shorted names have underperformed every peer group by at least 79bps.

Pharma currently most targeted

As for the shares currently seeing the greatest demand to borrow from short sellers, we see Pharmaceutical and Biotech companies secure the highest utilisation. These two industry groups make up 61 of the 210 companies in the most in demand group.

Leading the way in the sector is Organovo which has 90% of its lending program inventory out on loan. So far this year the company's shares are down by 26%. This company is relatively tightly held, with only about 10% of its shares currently in lending programs. This compares to 20% on average for the constituents of the S&P, meaning so short sellers have a much smaller pool of assets to borrow from in Organovo.

Also earning the highest (Worst) score in the category are Newlink Genetics and Inovio Pharmaceuticals.

Signal fades in large cap names

While utilisation's ability to uncover underperforming shares among small cap names has been strong over the last five years, the signal hasn't performed as well among larger shares which tend to be more widely held. This could stem from the fact that these large cap shares have plenty of availability.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27082014gauging-negative-investor-sentiment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27082014gauging-negative-investor-sentiment.html&text=Gauging+negative+investor+sentiment","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27082014gauging-negative-investor-sentiment.html","enabled":true},{"name":"email","url":"?subject=Gauging negative investor sentiment&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27082014gauging-negative-investor-sentiment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Gauging+negative+investor+sentiment http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27082014gauging-negative-investor-sentiment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}