Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 28, 2016

Japanese bonds rise despite BOJ disappointment

Japanese sovereign bonds managed to deliver positive returns today, while almost every other asset class suffered from the Bank of Japan's decision to reject further loosening of monetary policy.

- Japanese government bonds tightened by 3 bps today but corporate bonds saw risk surge

- Corporate bond CDS spreads jumped by over 4% after today's disappointment

- Japanese government bonds have seen their volatility rise to all-time highs in last 90 days

Japanese policy makers largely disappointed investors today when the Bank of Japan (BOJ) passed on an opportunity to increase its monetary stimulus. This had been anticipated after the flash April release of the Nikkei Japan Manufacturing PMI indicated that Japanese manufacturing conditions had deteriorated at the fastest pace in over three years.

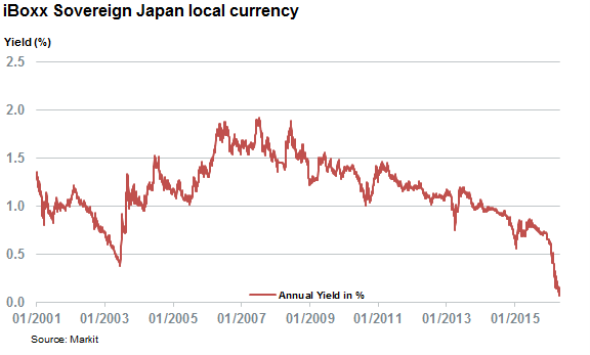

While the BOJ's inaction sent the Japan's equity market down sharply, the country's sovereign bonds, which had seen their yields plunge in the wake of last week's disappointing growth number, surprisingly rallied during the day. The Markit iBoxx Sovereign Japan local currency index which tracks the asset class traded 2.8bps tighter on the day to 12bps. This takes the index yield to within five basis points of its all-time low registered on April 20th.

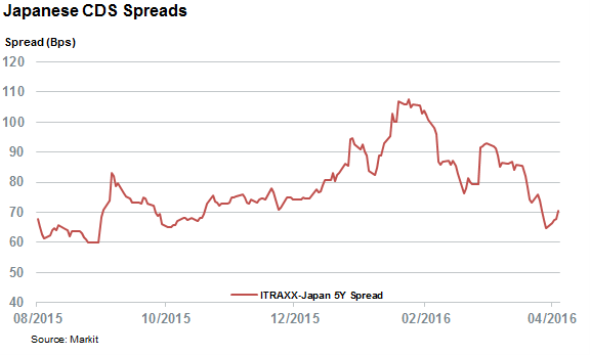

Corporate bonds were less fortunate given that the Markit iTraxx Japan index, which tracks the cost of insuring Japanese bonds against default, jumped by over 4% in the day. Investors had been anticipating the possibility of more corporate bond purchases as a possible BOJ policy step which had sent Japanese CDS spreads to six month lows in the last week. The sharp rise in credit risk, as seen by the rising cost required to insure Japanese corporate bonds against default, reflects the new reality in the wake of today's inaction.

The companies seeing the largest surge in CDS spreads are those with relatively large overseas exposure and stand to suffer from the Yen's recent surge, which accelerated after today's announcement. Heavy manufacturer Kawasaki Heavy Industries saw the largest CDS spread surge of the iTraxx Japan constituents as it registered a 10% jump to 60bps. Komantsu and Kobe Steel, both of whom derive a material portion of their revenues from overseas round out the top three CDS spreads surges.

Volatility surges

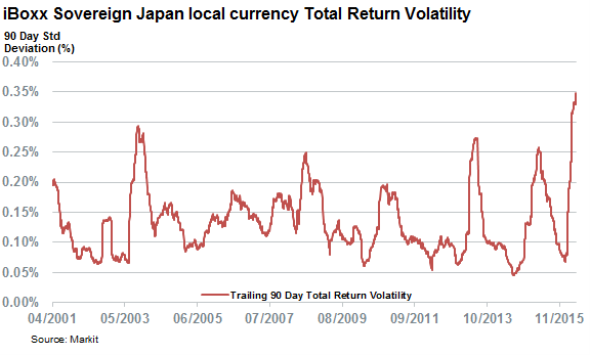

The recent yield collapse seen in Japanese government bonds has taken the asset class into unchartered volatile territory as the 90 trailing standard deviation of the Markit iBoxx Sovereign Japan local currency index total returns has jumped to all-time high levels since the BOJ decided to embark on its negative interest rate policy. That volatility measure now stands at 0.35% the highest since the index's genesis in 2001.

This surge in volatility is driven by duration risk which has surged as Japanese government bond yields hit their recent all-time lows. Duration in the Japanese sovereign bond index now stands at 9.5, nearly twice the levels seen when the index launched in 2001.

Duration risk looks set to play a key role in Japanese bonds going forward as the iBoxx Sovereign Japan local currency index experienced five of its ten most volatile days on record swings in the last three months. Minute rate swings have outsized influence on bond prices in such low yield environment and the positive returns delivered by Japanese government bonds today will no doubt see many breathe a sigh of relief given that the BOJ's inaction disappointed investors in pretty much every other asset class.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Credit-Japanese-bonds-rise-despite-BOJ-disappointment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Credit-Japanese-bonds-rise-despite-BOJ-disappointment.html&text=Japanese+bonds+rise+despite+BOJ+disappointment","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Credit-Japanese-bonds-rise-despite-BOJ-disappointment.html","enabled":true},{"name":"email","url":"?subject=Japanese bonds rise despite BOJ disappointment&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Credit-Japanese-bonds-rise-despite-BOJ-disappointment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+bonds+rise+despite+BOJ+disappointment http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-Credit-Japanese-bonds-rise-despite-BOJ-disappointment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}