Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 28, 2017

France CDS bounce back after election

It seemed like Europe breathed a collective sigh of relief after the prospect of a far-right presidency in France receded.

The centrist Emmanuel Macron secured victory in the first-round of the French presidential election on April 23, beating National Front leader Marine le Pen into second place. The two will now face each other in the run-off vote, which Macron is widely expected to win.

Le Pen had promised to drive through populist economic and social policies, as well indicating that France should leave the EU. It was no surprise, then, that the markets welcomed Macron as the apparent anointed President. The Markit iTraxx Europe rallied from 74bps to 68bps, its biggest one-day improvement since the post-Brexit bounce back in late June last year. Rallies on a similar scale, at least in percentage terms, were observed in the other main indices such as the Crossover and Senior Financials.

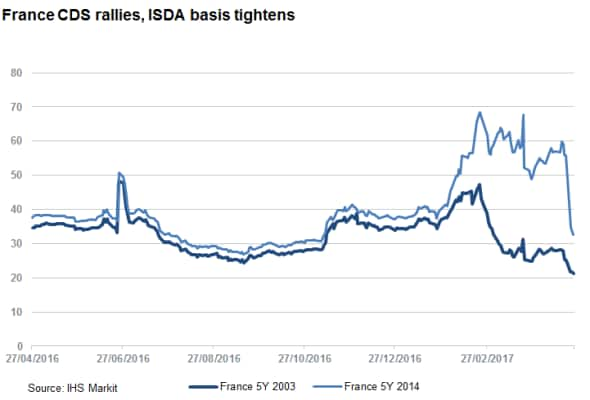

But the most dramatic change was in French sovereign CDS spreads, which rallied from 56bps to 35bps on the Monday following the election. This is the tightest level for almost six months.

It is important to note that these spreads are in the contract referencing 2014 ISDA definitions. This contract explicitly addresses the issue of redenomination of debt following a sovereign leaving the Eurozone, and as such the 2014 CDS was widely used as an instrument to hedge the tail risk of a Le Pen victory and possible exit from the euro area. Spreads widened sharply in reaction to Le Pen's strong showing in the polls, and it is therefore expected that they would contract sharply in reaction to her change in fortunes.

The basis between spreads on the 2014 and 2003 (where redenomination risk is more ambiguous) CDS shrunk to 11bps, its tightest level since mid-February. But this is significantly wider than the 2-3bps typically seen in less eventful times last year. Markets are aware that the risk of a Len Pen victory has diminished but not been eliminated, and Macron has stumbled in recent days. Macron is still the strong favourite to be the next President, but in the unlikely event of Le Pen upsetting the odds we would expect France CDS to balloon upwards, with the 2014 contract leading the way.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-credit-france-cds-bounce-back-after-election.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-credit-france-cds-bounce-back-after-election.html&text=France+CDS+bounce+back+after+election","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-credit-france-cds-bounce-back-after-election.html","enabled":true},{"name":"email","url":"?subject=France CDS bounce back after election&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-credit-france-cds-bounce-back-after-election.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=France+CDS+bounce+back+after+election http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-credit-france-cds-bounce-back-after-election.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}