Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 28, 2016

Spot risky dividends, with confidence

Dividend policies across the world were experiencing the largest shakeup in three years before Thursday's Brexit referendum, which has caused even more uncertainty.

- Risk to Eurostoxx 50 dividend forecasts doubles post Brexit result

- Emerging markets in Asia attract the highest risk to dividend forecasts as payments grow

- US dividend sustainability under threat as dividend growth seen outstripping earnings

With the fallout from the UK's Brexit vote set to cloud market visibility, Markit Dividend Forecasting has released a timely enhancement to its dividend forecasting service; dividend forecasting confidence ranks.

To read the full report on current dividend confidence levels and to find out more about the methodology - please contact us.

Dividend blues

Attractive dividend yields ultimately rely on receiving expected payments and while emerging markets represent an attractive opportunity for yield hungry investors, they also carry increased uncertainty, according to the newly released Markit dividend forecasting confidence ranks.

The introduction of confidence metrics helps investors to better gauge the relative and specific confidence ranks of global companies' dividend forecasts.

Over 135 firms that make up blue chip indices reduced payments in the 2015 financial year, the highest number recorded in over three years, and Markit Dividend forecasting expects much of same for 2016.

Confidence metrics are focused around three main risks regarding dividend forecasts; the upcoming dividend, the ex-date risk and the long term sustainability of the forecast.

Confidence risks allow investors or users to discriminate on specific company ranks relative to peers, which is especially useful in times of uncertainty

Emerging markets, declining confidence

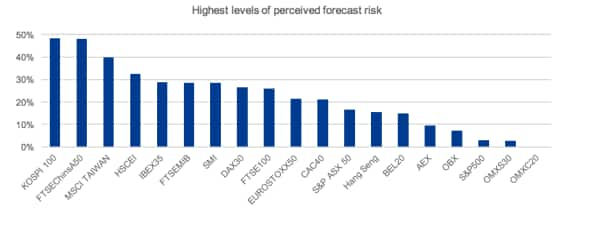

Aggregating confidence ranks across global indices indicates that emerging markets carry the highest level of forecast uncertainty driven by the recent economic volatility and corporate governance policies.

South Korean dividends currently have the highest level of aggregated forecast risk despite their recent strong growth. Dividends boomed following government policy to increase cash distributions and this has seen 47 of the KOSPI 100 constituents boost payments by more than 10% in the past year. This shows that confidence ranks reflect both upside and downside risk to current forecasts.

The blue chip Chinese indices, both mainland and offshore, and Taiwanese equities round out the list of the four global indices where a third or more of dividend payments earn the highest level of perceived risk payment.

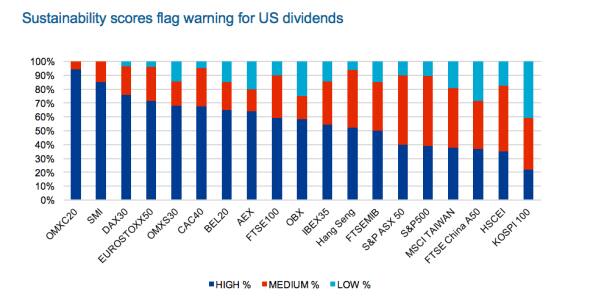

The uncertainty around dividend payments across the region is underscored by the fact that many of the region's dividend policies fall short of the most strenuous sustainability requirements, according to Markit's dividend sustainability scores. Sustainability scores are a company specific metric based on affordability ratios and gauge a company's unique ability to pay dividends

European indices rank strongly on that measure with Danish OMX and the Swiss SMI not seeing any of their constituents earn a low sustainability score.

US dividends are on a much shakier dividend ground however, with US firms across the S&P 500 earning a much lower dividend sustainability score. This is an interesting point to note as US dividends have been increasing by double digits since the financial crisis. Only 3.2% of firms cut dividends last year, however the number of cuts looks set to increase as the pace of increases has outstripped earnings growth.

What now for Europe?

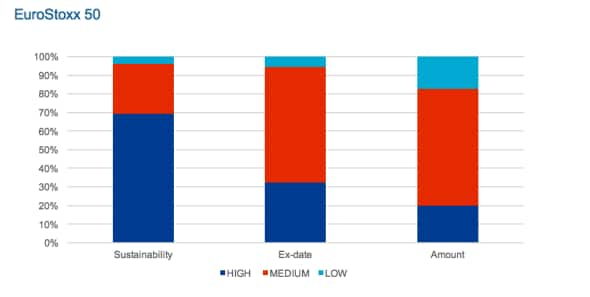

EuroStoxx 50

It is far too early to know the full implications of the Brexit decision, but market indicators in the immediate aftermath are pointing to severe volatility: shares prices and dividend futures have plummeted. This provides even more impetus to understand the relative risk and confidence that surrounds dividend forecasts and forward looking yields.

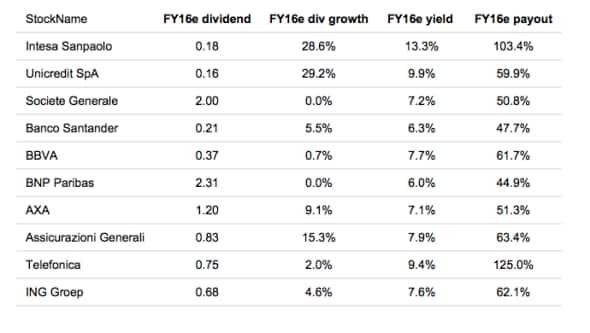

Forecast risk in these markets is currently concentrated in Oil & Gas and Basic Resources as cyclical industries continue to dominate risk. Banks and Insurance firms currently carry high risk levels - particularly in Italy, where these stocks have recently taken a hit to price levels.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28062016-equities-spot-risky-dividends-with-confidence.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28062016-equities-spot-risky-dividends-with-confidence.html&text=Spot+risky+dividends%2c+with+confidence","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28062016-equities-spot-risky-dividends-with-confidence.html","enabled":true},{"name":"email","url":"?subject=Spot risky dividends, with confidence&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28062016-equities-spot-risky-dividends-with-confidence.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Spot+risky+dividends%2c+with+confidence http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28062016-equities-spot-risky-dividends-with-confidence.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}