Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 28, 2015

Investors favour shallow end of volatility pool

Historically volatile shares have been actively shunned by the market over the quarter in the wake of recent valiantly.

- The most volatile US shares have underperformed the market by 14% ytd

- US low volatility ETFs have seen their best inflow quarter in over two years

- Historically calm utilities are back in favour with ETF investor after two quarters of outflows

Market volatility is back on investors' minds since the start of the year after a period of relative calm. The VIX index reached a four year high a month ago and has traded above the 20 mark ever since, over 50% more than the average seen in the opening eight months of the year.

The return of volatility has seen US investors shun historically volatile shares while sending them clamouring towards ETFs that target the calmer end of the market.

High vol underperforms

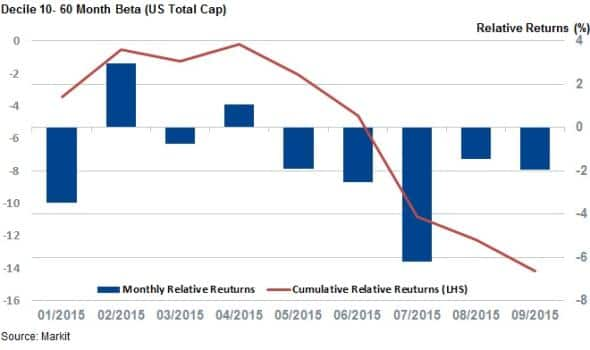

The rise in market volatility over the last few months has seen historically volatile US shares grossly underperform the rest of the market over the last quarter. The most volatile 10% of shares in the US market ranked by the Markit Research Signals 60 Month Beta factor, which ranks shares based on market adjusted price movements in the last five years, have fallen by 9% over the last three months.

While most of this underperformance was seen over July, when the most volatile shares lagged the market by 6.2%, highly volatile shares have continued to lose ground over August and September, trailing 1.4% and 1.9%, respectively.

The market was already sceptical of volatile shares, as seen by the 4% underperformance delivered by the most volatile decile group in the first six months of 2015, but the recent Chinese weakness, commodities slump and resulting volatility has seen the trend kick into high gear.

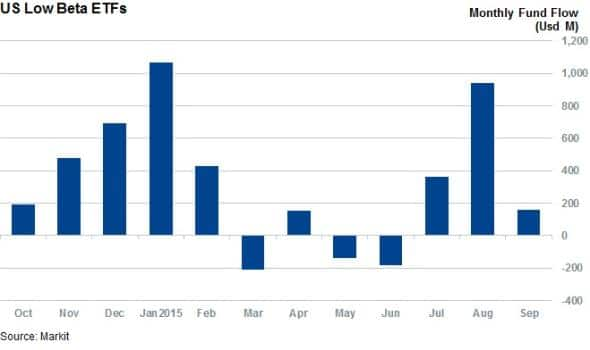

Low volatility ETFs gain

Low volatility ETFs, which promise investors exposure to the calmer end of the market, have proven popular in light of the recent market conditions and resulting underperformance delivered by the volatile end of the market. The 19 US "low beta" ETFs have seen $1.46bn of inflows over the third quarter, the most since Q2 2013.

As demonstrated by the Research Signals beta factor, focusing on the shallow end of the volatility pool has proven to be a winning bet over the quarter. The iShares MSCI USA Minimum Volatility ETF is flat for the quarter while the SPDR S&P 500 ETF is down by 5.5% for the same timeframe. That fund now manages more than $6bn for the first time.

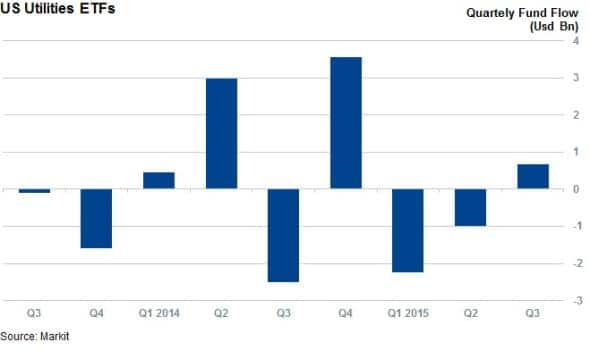

Utilities ETFs back in favour

This risk aversion is also evidenced in sector ETF fund flows. Utilities, which have the lowest average historical beta score of any sector group in the Markit total cap universe, have been the main beneficiary of this trend. The 12 US ETFs focused on utilities have seen an injection of over $660m of new assets from investors in the last three months, snapping a trend which saw over $3bn pulled from the same funds in the opening two quarters of the year.

This has also proved to be a winning move given that the largest utilities ETF, the Utilities Select Sector SPDR Fund has outperformed the S&P 500 by 10% in the three months since the end of June.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Equities-Investors-favour-shallow-end-of-volatility-pool.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Equities-Investors-favour-shallow-end-of-volatility-pool.html&text=Investors+favour+shallow+end+of+volatility+pool","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Equities-Investors-favour-shallow-end-of-volatility-pool.html","enabled":true},{"name":"email","url":"?subject=Investors favour shallow end of volatility pool&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Equities-Investors-favour-shallow-end-of-volatility-pool.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+favour+shallow+end+of+volatility+pool http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092015-Equities-Investors-favour-shallow-end-of-volatility-pool.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}