Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 28, 2016

Carmakers help French dividends motor through

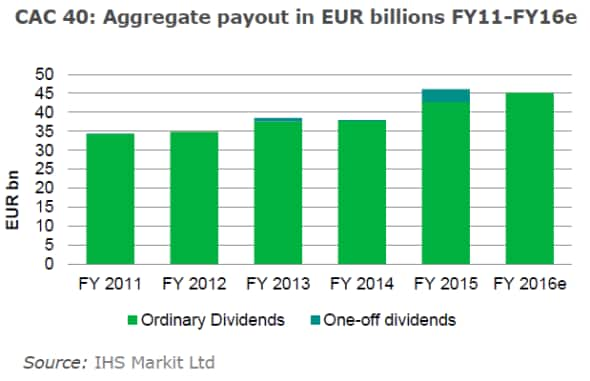

Dividend payments made by large cap French companies which make up the CAC 40 index are set to continue to grow in FY 2016 although the driving force behind dividends has changed from the previous year.

- Constituents forecast to pay "45.2bn of dividends in FY 2016, up 6% yoy

- 13 firms forecast to keep payments flat in FY 2016, up from nine in 2015

- Banks trading with attractive forward yield, but payout ratios within bounds

2016 is shaping up to be another strong year for French income investors as the aggregate dividends paid by the CAC 40 over FY 2016 is set to rise by 6% compared to the previous year. This strong rise means that ordinary dividends payments made by the country's large cap stocks will rise above the "45bn mark.

These increased payments, combined with the 5% year to date (ytd) fall in the index means that the average dividend across the index's constituents will be the highest since 2012 with a 3.5% forward yield. Interestingly, yield hungry investors, who have hovered up risk assets on the fixed income side, have yet to warm up to French equities despite their attractive yield. Investors have continued to pull money from ETFs that invest in French equities, according to the Markit ETF Analytics database.

The news isn't universally however buoyant as the 6% forecasted aggregate payment growth rate is set to be half that seen in FY 2015 when the index's aggregate payment grew by 13%. This relatively slow growth rate reflects a relative reticence to grow payments in the face of growing uncertainty; something that is evidenced by the fact that 13 firms are expected to keep their payment flat, up from nine in the previous fiscal year.

Caution from Banks

Furthermore the dividend growth engine has changed over the last 12 months as banks, which were the largest contributors to last year's bumper dividend haul, are set to hold their payments flat for the year. All three CAC constituent banks, BNP, Societe Generale and Credit Agricole all boosted their payments by over 50% in the last fiscal year, but the current low interest environment and coupled with new capital constraints means that all three firms are forecasted to pay flat dividends in the FY 2016.

Even in light of the flat payments, the sector still offers a much more attractive yield than the rest of the index as all three firms are forecasted to yield at least 5% in the next 12 months. The attractive yield offered across the sector, notably 2.5% more than that delivered across the index, is driven in large part by a slump bank share prices due to the tough operating conditions faced by European banks. A further degradation of operating conditions could turn a hunt for yield in the sector into a fool's errand, but the current forecasted payout ratios across all three firms are roughly within the range communicated by the firms in company presentations.

The largest single dividend payer in the index, energy company Total, is also taking a cautious approach by keeping its payment flat in the coming fiscal year.

Carmakers revving up

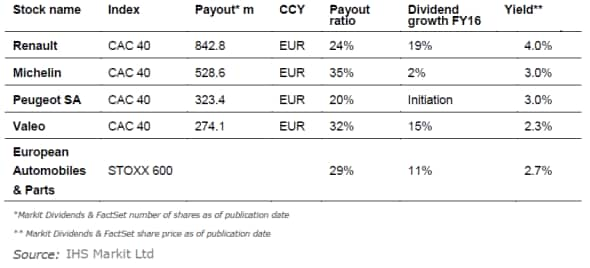

Automakers and their component suppliers are set to defy the relatively anemic dividend growth seen in many of the CAC 40 sectors as automobile and component firms are forecasted to pay 35% more dividends on aggregate over FY 2016.

This bumper dividend haul for the sector is driven by expectations that Peugeot will suspend its six year moratorium on payments as its ongoing turnaround plan comes to fruition. The "323m payments that Peugeot is forecasted to make represents 20% of the firms estimated net earnings, much less than the rest of its CAC sector peers. Short sellers could be in for a surprise as over 5% of Peugeot shares are now out on loan - something which will become increasingly expensive as it would add 3% to the cost of keeping their positions open as they would be liable for the dividend payment.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092016-equities-carmakers-help-french-dividends-motor-through.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092016-equities-carmakers-help-french-dividends-motor-through.html&text=Carmakers+help+French+dividends+motor+through","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092016-equities-carmakers-help-french-dividends-motor-through.html","enabled":true},{"name":"email","url":"?subject=Carmakers help French dividends motor through&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092016-equities-carmakers-help-french-dividends-motor-through.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Carmakers+help+French+dividends+motor+through http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28092016-equities-carmakers-help-french-dividends-motor-through.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}