Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 28, 2015

UK bears retreat in Q4

UK shares have been on a tear so far this quarter, which has prompted short sellers to trim their positions from the recent highs seen at the end of the last quarter.

- Average short interest in the FTSE 350 has fallen by 8% from the September highs

- Eight of the ten most shorted FTSE 350 constituents at the end of Q3 have seen covering

- ETF investors are staying on the sideline as UK equity funds have seen outflows in Q4

After a torrid third quarter which saw the FTSE 350 drop 12%, UK shares are having a resurgence in the closing months of the year. The index of large and mid-cap UK shares has managed to climb 5.5% in the opening weeks of Q4 putting it within 1% of breaking even for the year to date.

This resurgence in UK equities has seen short sellers pare back their positions in the index's constituents over the last three weeks. The current average short interest across the FTSE 350 index stands at 1.71% of shares outstanding, marking a 7% retreat from the highs seen in the closing days of the last quarter.

While the covering marks a significant climb-down from the highest levels of shorting activity seen by the index in over 18 months, the current demand to borrow shares in the index is still over 50% higher than the levels seen 18 months ago.

Covering across the board

The most shorted firms at the peak of the recent shorting cycle have led the charge as six of the ten most shorted firms at the end of September have seen a fall in demand to borrow.

This trend was led by dairy firm Dairy Crest, which has seen a significant 22% fall in demand to borrow its shares after its shares surged in the last week. This sudden covering saw Dairy Crest fall out of the top ten most shorted list, with the firm now the 16th most shorted constituent of the index.

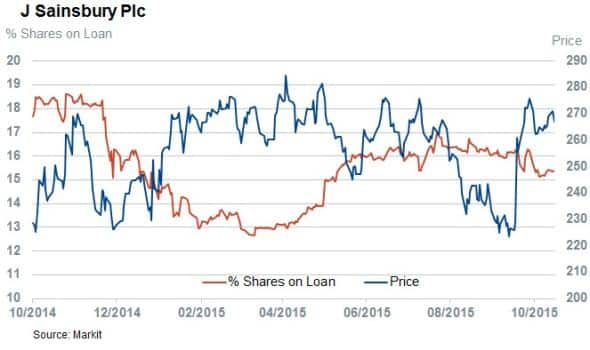

Better than expected results also saw Sainsbury shares surge by over 15%. This has seen some tapering off of the demand to borrow the firm's shares, with short interest in Sainsbury's now 5% off the levels from October 1st.

Morrison's and Tesco shares are also up sharply over October, and both firms have seen some covering from the all-time highs seen four weeks ago.

Sector wise, the covering has been pretty much across the board with shorting activity decreasing for 21 of the 24 components of the GICS level 2 sectors in the last four weeks.

One particular standout in the last few weeks has been utility firm Drax Group, which has seen its short interest surge by 17% so far in October. This surge in shorting activity coincides with the UK inking a deal with China to partner up to build the country's first nuclear power plant in over 20 years.

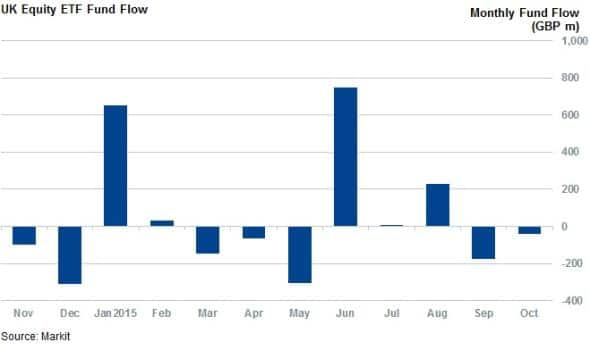

Interestingly, ETF investors have not been getting behind the UK's equity rally as UK equity ETFs have seen a modest "40m of outflows so far in October. While not material from an AUM point of view, the outflows show that the recent rally still has to convince investors.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102015-equities-uk-bears-retreat-in-q4.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102015-equities-uk-bears-retreat-in-q4.html&text=UK+bears+retreat+in+Q4","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102015-equities-uk-bears-retreat-in-q4.html","enabled":true},{"name":"email","url":"?subject=UK bears retreat in Q4&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102015-equities-uk-bears-retreat-in-q4.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+bears+retreat+in+Q4 http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28102015-equities-uk-bears-retreat-in-q4.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}