Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 28, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the coming week.

- In the US teenagers' changing tastes impact apparel retailers who find themselves fashionable among short sellers

- A trade that continues to play out is guns versus non-lethal weapons amid US civil unrest

- In the UK, pubs deal with brewery tie up changes, M&A activity and consolidation

- Australian food distributor Metcash struggles as the resource boom fades in the country

North America

Clothing retailers, merchandise and department stores dominate the most shorted companies ahead of earnings this week in the US.

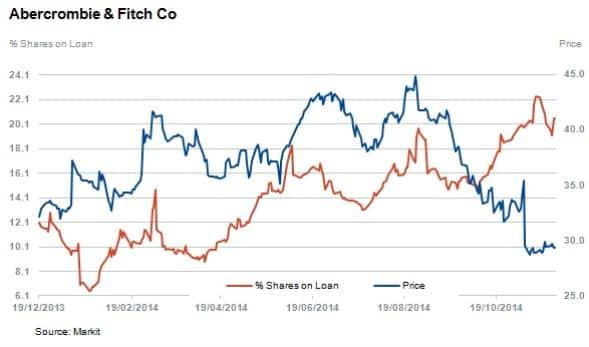

Most shorted is apparel retailer Abercrombie & Fitch. The stock is down 10% year to date and almost 35% down on highs. The company recently announced expansion and looks to open stores in Mexico during 2015. The brand and the companies use of logos however has fallen out of favour with teenagers as H&M and Zara gain market share. This seems to have driven the negative sentiment as short sellers side with the teenagers.

Five Below is an "extreme-value" retailer of trending products geared towards the pre-teen market. Five Below's products are priced below $5 and the chain has aggressive rollout plans but analysts have cautioned against the high growth stock trading on rich multiples, similar to that of Amazon.

The third most heavily shorted apparel retailer is Aeropostale with 18% of shares outstanding on loan. The firm operates retail chains geared towards children and teens, but products have not resonated well with the target market. The company is also coming off two consecutive quarters of decreased sales and reporting losses.

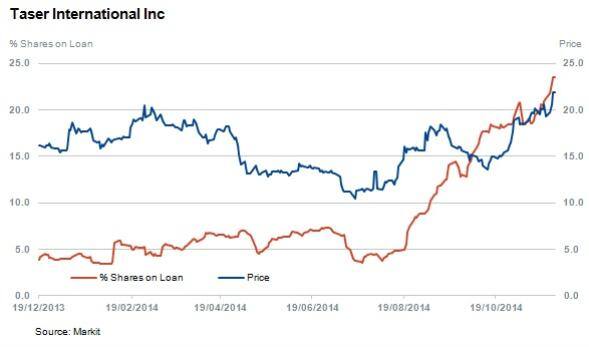

Smith and Wesson short interest continues to be high ahead of earnings whilst Taser has defied shorts sellers since September and is up 108% on lows reached during the year.

Smith & Wesson and Taser have 15.8% and 23.5% of shares outstanding on loan respectively amid increasing tensions between protestors and police which is currently blighting the US.

Europe

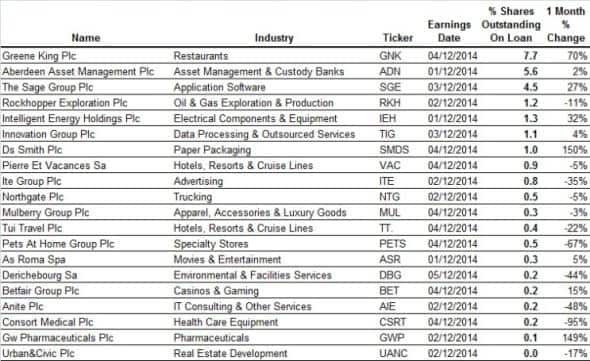

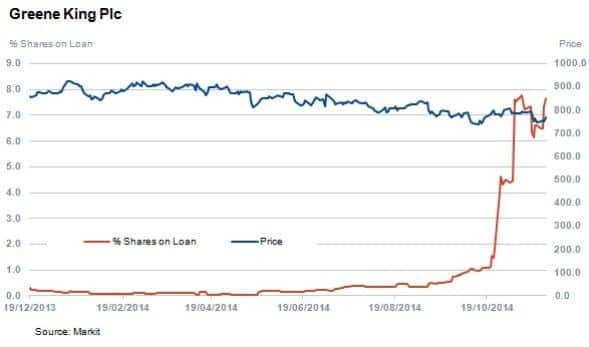

Greene King is the most shorted in Europe this week ahead of earnings with 7.7% of shares outstanding on loan. The pub group acquired Spirit Pub with shares and cash.

This short interest seems to be motivated by merger arbitrage, but we have also seen sector UK pub shares slide on recent news that regulations breaking the beer tie between pubs and breweries in November 2014 will be implemented.

Aberdeen asset management sees continued short interest this week ahead of earnings with 5.6% shares outstanding on loan.

Sage group has seen a 30% increase in short interest over the last month up to 4.5% as the share price increased by 8%. The accounting software firm missed midyear analyst expectations of revenue as the company announced that Guy Berruyer would retire as ceo by March 2015. Earlier this month Stephen Kelly joined as the new ceo.

Asia Pacific

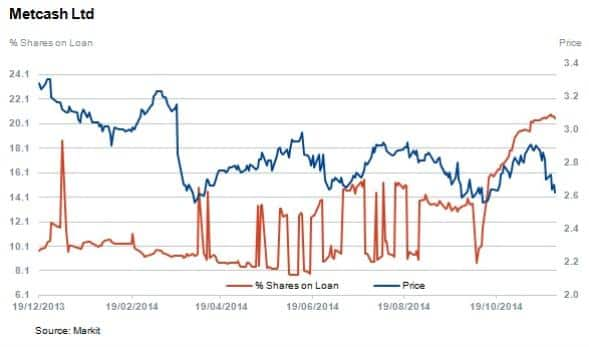

Australian food distributor Metcash is by far the most shorted stock in the region with 20.5% of shares outstanding on loan compared to next most shorted Koloa Holdings with 6.1% short interest.

Metcash, a food retailer who according to LHC Capital (who is short the stock), is facing increasing competition and a subdued environment post the resource investment boom the country has enjoyed for some time.

Korean manufacturer of a host of electronic products currently has short interest of 6% in the stock which is down some 62% from highs reached in the first quarter of the year. This contrasts with the previous year when the shares surged 77% as investment interest peaked in the region.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28112014-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}