Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 29, 2016

Dollar emerging market bonds steam ahead

US dollar denominated emerging market bonds see returns outperform developed market peers, as investors regain confidence in the region.

- Dollar denominated EM sovereigns and corporates have returned 4.3% and 3.2% respectively, so far this year.

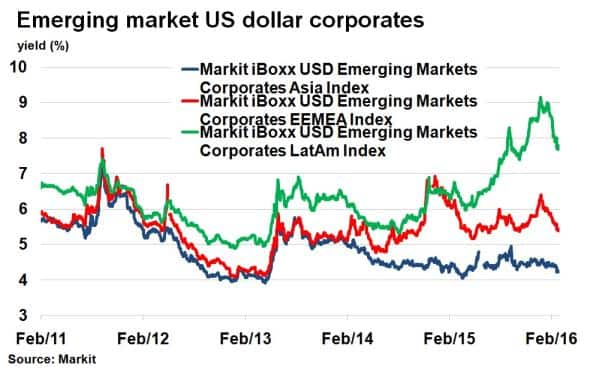

- The yield on the Markit iBoxx USD Emerging Markets Corporates LatAm Index has fallen 1.3% since the end of January.

- The past two months have seen EM sovereigns produce returns reminiscent of the post "taper tantrum'' rally.

Returns on US dollar denominated emerging market (EM) bonds have outstripped developed nation peers so far this year, as confidence in the region has returned after market volatility in late 2015.

Since January 2016, dollar denominated EM sovereigns and corporates have returned 4.3% and 3.2% respectively, according to Markit's iBoxx indices. The returns surpass those of developed markets, beating US treasuries (2.7%), German bunds (3.6%) and US investment grade bonds (2.9%).

EM debt has outperformed as investor confidence has returned to the region this year. Fears of further downside risk in oil and commodity prices have dissipated, while worries about China's economic stagnation have fizzled. The US Fed's decision to keep rates on hold so far this year has also boded well for the $4trn asset class, stemming further appreciation of the US dollar.

Yields fall

Dollar denominated EM corporate bonds, as represented by the Markit iBoxx USD Emerging Markets Corporates Overall Index, has returned 2.39% so far this month on a total return basis. The index is on course for the eighth best month since the financial crisis but lags last October's return of 2.77%.

Among the regions that have led the rally, yields on Latin American (LatAm) US dollar denominated corporate bonds have fallen to 7.7%, from over 9% towards the end of January. During that period, the price of crude oil has jumped by a third, to the benefit of petroleum and commodity based companies in the region. The yield on the Markit iBoxx USD Emerging Markets Corporates LatAm Index however, remains 140bps wider than its past five year average. Elsewhere, yields in the Eastern Europe, Middle East and Africa (EEMEA) region have fallen to 5.44%, the lowest since July last year.

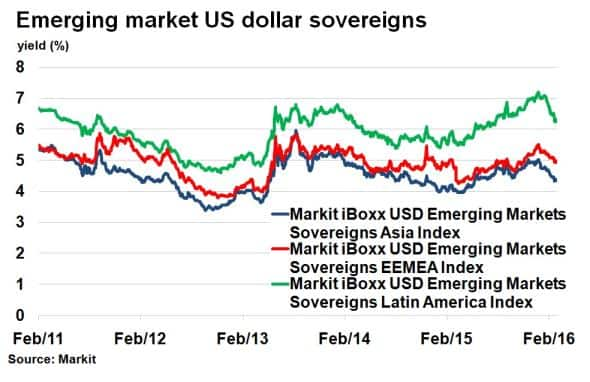

Sovereign bonds have enjoyed a more sustained rally over the past two months. The Markit iBoxx USD Emerging Markets Sovereign's index has enjoyed above average returns for the past X consecutive, with the past two months featuring in the top list for monthly returns post financial crisis. The only other consecutive months in the list are from late 2013, as emerging markets rallied post "taper tantrum" fears.

LatAm's largest US dollar denominated sovereign bond issuer Brazil has rallied on the back of stronger commodity prices despite ongoing political turmoil. The yield on the Markit iBoxx USD Emerging Markets Sovereigns Latin America Index is at its lowest since last August. Asia continues to be the strongest EM region (lower yields display a stronger credit position), with the Markit iBoxx USD Emerging Markets Sovereigns Asia Index 59bps tighter than the Markit iBoxx USD Emerging Markets Sovereigns EEMEA Index.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-credit-dollar-emerging-market-bonds-steam-ahead.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-credit-dollar-emerging-market-bonds-steam-ahead.html&text=Dollar+emerging+market+bonds+steam+ahead","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-credit-dollar-emerging-market-bonds-steam-ahead.html","enabled":true},{"name":"email","url":"?subject=Dollar emerging market bonds steam ahead&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-credit-dollar-emerging-market-bonds-steam-ahead.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dollar+emerging+market+bonds+steam+ahead http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-credit-dollar-emerging-market-bonds-steam-ahead.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}