Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 29, 2016

UK short sellers retreat despite Brexit vote

UK stocks are facing uncertainty as the country ponders its relationship with the EU, but the number of bets against UK stocks has actually fallen in every week since the June referendum was announced.

- Average short interest across FTSE 350 constituents has fallen by a tenth since February highs

- Covering driven by energy names, but shares with domestic exposure also see shorts retreat

- Whitbread has three times more short interest than at the start of the year

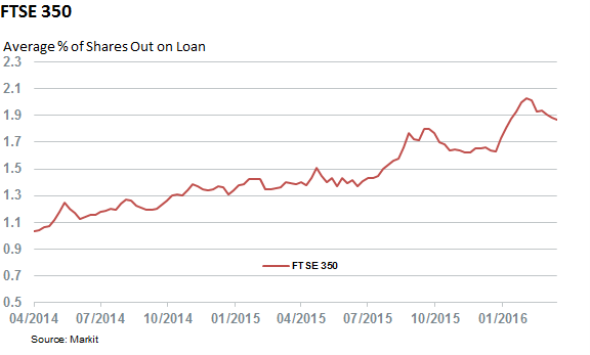

London mayor Boris Johnson's siding with the camp seeking to leave the European Union in the upcoming UK referendum saw the domestic markets reel with the uncertainty. Johnson's pro-"Brexit" announcement also marked the high water mark for investors betting against UK equities, as short selling across the constituents of the FTSE 350 reached a multi-year high. The market has since rallied from the concurrent lows; prompting investors betting against UK equities to pare back some of their positions.

Average shorting activity across FTSE 350 constituents reached a high of 2.06% of shares outstanding as of the middle of February, but the recent market rally has seen that number fall by a tenth despite to fall back below the 2% threshold. While bearish bets across the index's constituents is still elevated compared to where it stood a year ago, the fact that bears are retreating indicates that the market is either discounting the possibility of an "out" vote despite its early momentum or that a Brexit vote would not be as devastating as previously though for UK equities.

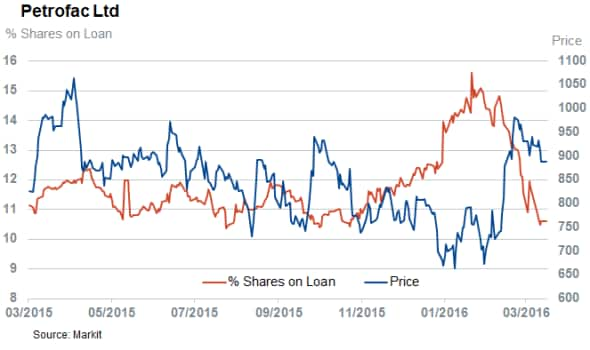

Recent polls seem to indicate that the former is most likely to be true but wider global forces may also be at play given that energy names have led the short covering in recent weeks. This covering, which has been prompted by the recent rally in oil price, and its impact on the most shorted section of the market has caught short sellers out. UK names have been no exception, as the energy constituents of the FTSE 350 have seen their short interest fall by 29% over the last month as their shares surged back from lows.

Two names driving this trend are Petrofac and Amec Foster Wheeler Plc, both of which have seen their shares recover by a fifth from February lows.

Shares with more solid domestic exposure, such as food retailers, have also seen covering, but to a much smaller extent than their energy peers.

In fact hospitality firms, whose board stated that an "out" vote would present a business risk for the firm, has seen its short interest remain stubbornly high. This indicates that a portion of bears remain content to stay the course with less than three months to go until the June 23rd vote. The firm now has 1.8% of its shares out on loan, up from 0.5% at the start of the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-uk-short-sellers-retreat-despite-brexit-vote.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-uk-short-sellers-retreat-despite-brexit-vote.html&text=UK+short+sellers+retreat+despite+Brexit+vote","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-uk-short-sellers-retreat-despite-brexit-vote.html","enabled":true},{"name":"email","url":"?subject=UK short sellers retreat despite Brexit vote&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-uk-short-sellers-retreat-despite-brexit-vote.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+short+sellers+retreat+despite+Brexit+vote http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29032016-equities-uk-short-sellers-retreat-despite-brexit-vote.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}